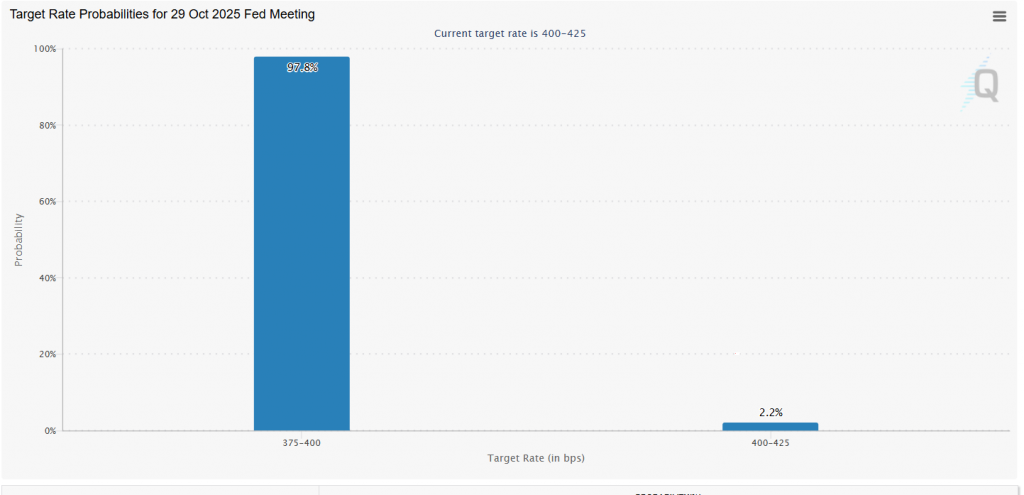

The financial world is holding its breath. Today’s Federal Reserve policy meeting is set to be a major catalyst, and Bitcoin traders are positioned for volatility. The market overwhelmingly expects a 25-basis-point Fed rate cut, which would lower rates to a target range of 3.75% to 4.00%. This decision is almost fully priced in, with probabilities sitting at a staggering 98%. Consequently, the cut itself is unlikely to be the main event.

Why Powell’s Words Will Move the Market

So, what should you be watching? The real market-moving potential lies entirely with Fed Chair Jerome Powell’s post-announcement commentary. While the rate cut is a done deal in the eyes of traders, Powell’s tone and guidance on the Fed’s future liquidity plans are what truly matter. Specifically, analysts will be scrutinizing any hints about when the Fed might end its quantitative tightening (QT) program. Furthermore, even whispers about a future return to quantitative easing (QE) could ignite a massive risk-on rally. This is the hidden alpha in today’s event.

A Telling Historical Pattern for Bitcoin

Interestingly, Bitcoin has developed a consistent reaction pattern to recent FOMC meetings. Analysis shows that BTC has tended to drop between 6% and 8% immediately following the last three Fed announcements. However, this short-term sell pressure has consistently been a buying opportunity. After each dip, Bitcoin proceeded to roar back, making new all-time highs before the next meeting. This same setup is forming now, with BTC hovering near $111,000 ahead of the decision.

The Bullish Setup for November

Therefore, if this pattern holds, we could see a familiar playbook unfold. A short-term dip following today’s news could be followed by a powerful recovery throughout November. In fact, with a Fed rate cut reinforcing a looser monetary policy environment, analysts are eyeing a potential run toward the $120,000 zone. The fundamentals for liquidity are improving, and history suggests any temporary weakness is likely to be met with fierce buying.

My Thoughts

The market is smartly looking beyond the cut itself. Powell’s guidance is the real trigger. A dovish tone that hints at more liquidity ahead could be rocket fuel, overpowering any short-term technical dip. The structural trend for Bitcoin remains fiercely bullish, and Fed policy is now aligning as a tailwind.