Fed Rate Cut Odds Hit 87.6% as Quantitative Tightening Ends, Fueling Crypto Hopes

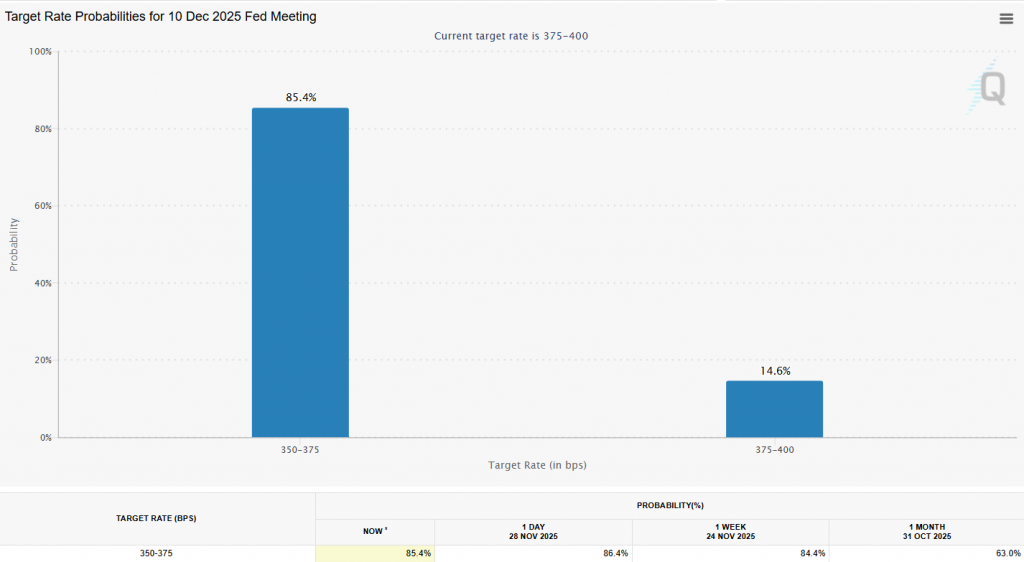

The macro tides are turning decisively in crypto’s favor. As Federal Reserve Chair Jerome Powell prepares to speak today, the market is already pricing in a near-certain December rate cut, with Fed rate cut odds soaring to 85.4%. This seismic shift in expectations comes on the very day the Fed officially ends its Quantitative Tightening (QT) program—a major liquidity drain that has constrained markets since 2022. The convergence of these two events could reopen the liquidity faucet for risk assets like Bitcoin and Ethereum, marking a pivotal inflection point after a brutal month of selling.

Why Ending QT is a Bigger Deal Than You Think

Today isn’t just about a speech; it’s about structural liquidity. For three years, the Fed has aggressively pulled $2 trillion out of the financial system by shrinking its balance sheet—the most aggressive tightening in history. Ending this QT program tonight means the relentless drain on market liquidity is officially over. For crypto, this is potential rocket fuel. While it doesn’t immediately trigger new money printing (Quantitative Easing), it removes a massive headwind. As commentator Milk Road noted, it’s “the week’s biggest catalyst.” More dollars staying in the system increases the capital available to flow into alternative assets.

Powell’s Speech and the Path to a December Cut

Chair Powell’s speech at 8 PM ET tonight falls within the Fed’s pre-meeting blackout period, meaning he won’t directly comment on monetary policy. However, the market has already received loud signals from his key allies. Fed Presidents John Williams and Mary Daly have publicly backed a December cut, causing Fed rate cut odds to skyrocket from 40% to their current 85.4% peak. The market is clearly listening, and Powell’s mere tone tonight could reinforce or soften this overwhelming expectation. Furthermore, the potential future appointment of rate-cut advocate Kevin Hassett as the next Fed Chair adds another long-term bullish layer to the narrative.

My Thoughts

The market is often perverse. Bitcoin’s sharp drop below $90k ahead of these bullish events feels like a final shakeout. Ending QT is the true stealth catalyst—it’s the essential first step before any new easing can begin. Combined with an almost guaranteed rate cut in two weeks, the macro setup for a ferocious year-end rally is falling into place. Smart money isn’t looking at today’s price; it’s positioning for the liquidity surge that starts now. This is the calm before the storm.