Fed Rate Cut Odds Skyrocket to 85%, Fueling Bitcoin Rally to $89K

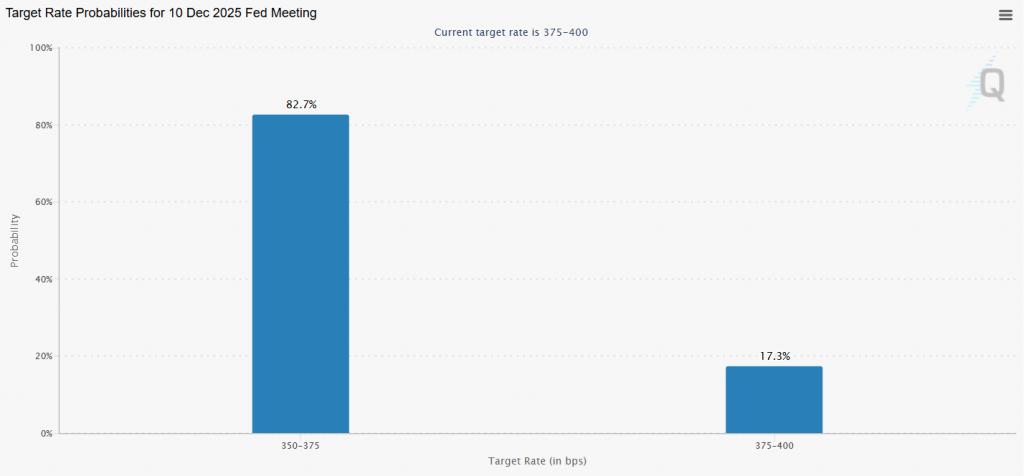

The macro stars are aligning for a massive crypto rally. Fed rate cut odds for a December rate reduction have surged to a stunning 85%, according to the latest CME FedWatch data. This marks a dramatic reversal from just weeks ago when probabilities languished near 30%. The soaring Fed rate cut odds have already acted as rocket fuel for Bitcoin, propelling it from last week’s low of $81,000 to a high near $89,000. For crypto investors, this signals that the era of cheap money may be returning sooner than anyone expected.

Fed rate cut odds Source : CMEWhat’s Driving the Insane Fed Rate Cut Odds?

Two key factors are pushing the Fed toward another cut: a softening labor market and supportive commentary from Powell’s inner circle. The latest PPI inflation data, while mixed, confirmed that the weakening job market is becoming the central bank’s primary concern. U.S. private payrolls have shown a significant deterioration, declining by an average of 13,500 weekly in recent weeks. More importantly, key Fed allies are publicly making the case for easing. San Francisco Fed President Mary Daly explicitly supports a December cut, citing that a labor-market decline is “harder to contain than a rise in inflation.” New York Fed President John Williams has also signaled room for another near-term cut.

Bitcoin’s Proven Reaction to Fed Cuts

History provides a compelling blueprint for what happens next. Bitcoin famously surged to new all-time highs just before the Fed’s previous rate cuts in September and October. The market is clearly anticipating a repeat performance. This relationship exists because lower interest rates increase the appeal of risk-on, non-yielding assets like Bitcoin. They also weaken the U.S. dollar, making dollar-denominated cryptocurrencies cheaper for international investors. With Fed Chair Powell having no public speeches scheduled before the December 10 FOMC meeting, the narrative is being set by his dovish colleagues, creating a powerful, uncontested bullish narrative.

My Thoughts

This is the ultimate macro tailwind. An 85% probability is as close to a guarantee as you get in economics. The market is now pricing in this liquidity injection, and Bitcoin is leading the charge. I expect this momentum to build throughout November, potentially pushing BTC past $90,000 before the actual decision. For altcoins, this creates a rising tide that could lift all boats, especially those with strong institutional ETF narratives like SOL and XRP. The stage is set for a powerful year-end rally.