In a stunning display of corporate conviction, Forward Industries Highest Solana Treasury Holder in the world has just announced a massive $1 billion share repurchase program through 2027. But that’s not the main event.

Forward Industries Doubles Down with $1B Buyback and Massive Solana Treasury

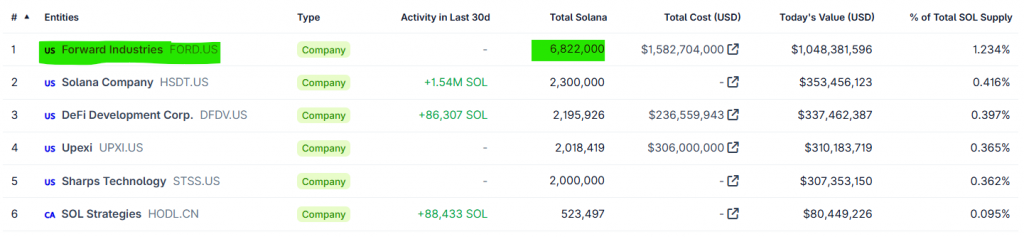

The real story is the company’s unprecedented commitment to Solana, as it now officially holds the world’s largest corporate Solana treasury—a staggering 6.8 million SOL tokens. This bold move solidifies its position as a leader in crypto-native corporate strategy, merging traditional finance with aggressive on-chain asset management.

The $1 Billion Buyback: What It Means for Shareholders

So, why does a $1 billion buyback matter? This authorization allows the company to repurchase its own shares from the market through 2027. This strategy is a classic signal of management’s belief that the stock is undervalued. By reducing the number of outstanding shares, it can directly boost earnings per share (EPS) and return value directly to investors. In this case, it’s also a strategic cushion. The announcement came alongside a 30% stock price plunge, suggesting the buyback is partly intended to stabilize the stock and demonstrate confidence during volatility.

Inside the World’s Leading Solana Treasury

Let’s talk about the colossal Solana treasury. Forward Industries pivoted hard into crypto, deploying over $1.5 billion to amass 6.8 million SOL. This isn’t just a static holding; it’s an actively generating asset. The stash is being staked, yielding approximately 7% annually. This means the treasury isn’t just appreciating with SOL’s price; it’s producing substantial yield revenue for the company and its shareholders. This strategic pivot, backed by heavyweights like Galaxy Digital and Multicoin Capital, is a masterclass in modern treasury management.

Market Reaction: Contrarian Opportunity or Red Flag?

The market’s initial reaction was brutally negative, with the stock tanking 30% on the news. This sell-off seems driven by concerns over potential share dilution from recent private placements, overshadowing the bullish buyback announcement. However, for crypto-native investors, this creates a fascinating contrarian setup. The company is using traditional finance tools (a buyback) to support its valuation while sitting on one of the most powerful crypto assets. This disconnect between short-term stock price and long-term crypto strategy could represent a prime accumulation opportunity.

My Thoughts

This is a landmark moment for corporate adoption. Forward Industries isn’t just dipping a toe in; it’s building its entire financial strategy around Solana. The buyback is a clever tool to manage traditional investor expectations while the Solana treasury does the heavy lifting for long-term growth. I believe the market is severely underestimating the compounding effect of a multi-billion dollar staked SOL position. This is a bellwether for other public companies watching the crypto space.