The Hyperliquid decentralized exchange launched its USDH stablecoin . USDH became the first spot quote asset that trades without whitelist restrictions adding a core component to the platform and pushing the next growth cycle in DeFi.

A Deeply Committed Launch

Native Markets, a core ecosystem participant, staked 200,000 HYPE tokens for three years. The lock up ties the firm’s returns to the network’s long term performance.

Native Markets pre minted 15 million USDH stablecoin to seed liquidity. The token holds cash and short-dated U.S. Treasuries as reserves. Yield from the reserves will buy back HYPE on a set schedule recycling value to token holders.

An Ecosystem Vote of Confidence

The launch followed a governance vote. Native Markets’ plan defeated rival proposals from Paxos besides Agora. HYPE holders cast the winning ballots signaling support for the new direction.

Launching into a Fierce Competitive Battle

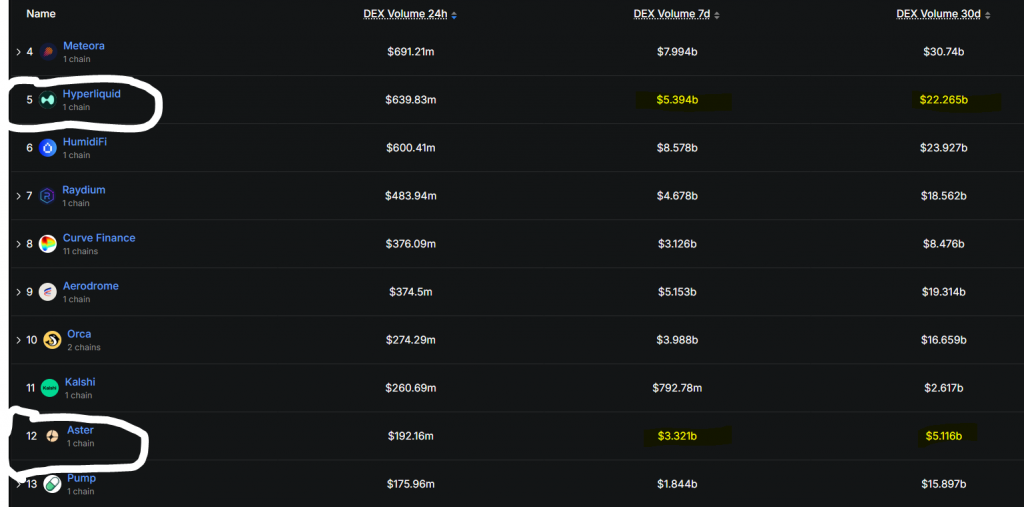

Hyperliquid released USDH while rival DEX Aster advertises support from Binance co founder Changpeng Zhao. Aster earned ten million dollars in twenty-four-hour revenue – Hyperliquid earned three million. Aster also routes deposits from Solana and other chains.

The Road Ahead for USDH Stablecoin

Despite the fierce competition, Hyperliquid is charging forward. The platform plans to deeply integrate USDH into its spot market and introduce USDH-margined perpetuals. The USDH stablecoin launch is more than just a new asset; it’s the core of Hyperliquid’s strategy to solidify its position as a dominant force in the future of decentralized finance.