The institutional love affair with crypto’s giants is facing a serious test. For the second consecutive day, Bitcoin and Ethereum ETFs are witnessing massive ETF outflows, creating intense selling pressure. This wave of redemptions has pushed Bitcoin below the critical $110,000 level and Ethereum back under $4,000, breaking key psychological supports and unsettling the market.

A Deep Dive into the Major ETF Outflows

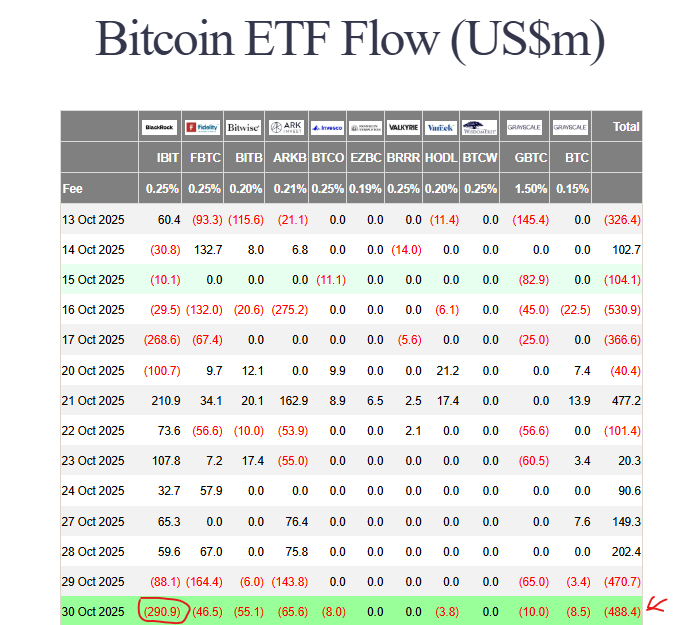

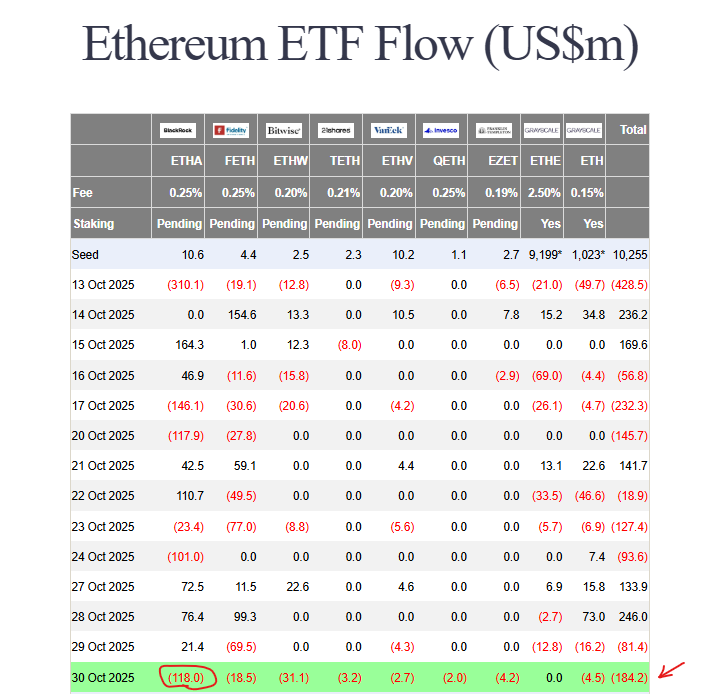

The numbers are stark and widespread. On October 30, Bitcoin ETFs saw a net outflow of $488 million. The bleeding was led by industry titans, with BlackRock’s IBIT and Ark’s ARKB seeing outflows of over $290 million and $65 million, respectively. The story was equally grim for Ethereum. Its ETFs posted $184 million in net outflows, with BlackRock’s ETHA fund alone shedding $118 million. Consequently, the weekly flows for both assets have now swung into negative territory, completely erasing the positive momentum from earlier in the week.

Solana and HBAR ETFs Defy the Gloom

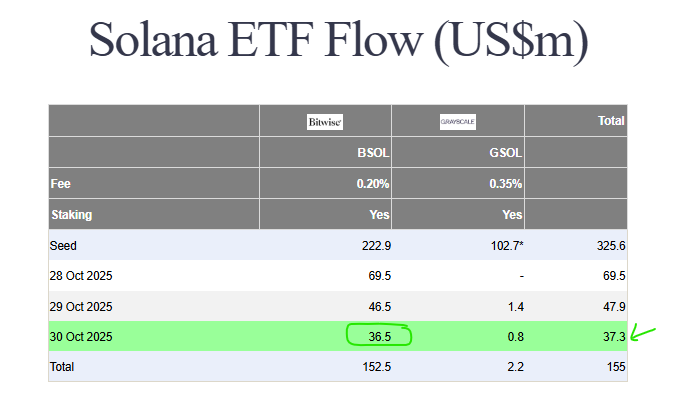

However, it’s not all doom and gloom. While the giants struggle, a new cohort of altcoin ETFs is boldly bucking the trend. The recently launched Spot Solana ETF (BSOL) continues its impressive run, pulling in over $36 million in a single day. Its cumulative inflows have now reached a stunning $155 million in just three days.

Similarly, the new HBAR ETF attracted nearly $30 million, demonstrating strong initial demand. Even the Litecoin ETF is holding in positive territory. This divergence clearly shows that institutional capital is still flowing, but it’s now rotating into newer, high-potential assets.

What This Rotation Means for the Market

This split in performance tells a crucial story about current market sentiment. The significant ETF outflows from Bitcoin and Ethereum suggest a phase of profit-taking and risk management from larger institutions. Meanwhile, the steady inflows into Solana and HBAR products highlight a hunt for alpha and diversification beyond the two largest cryptocurrencies. This isn’t a full-scale institutional exit; it’s a strategic repositioning.

My Thoughts

This is a healthy, albeit painful, market cleanse. The outflows from BTC and ETH are likely a combination of profit-taking and position squaring amid global macro uncertainty. The robust demand for Solana and HBAR ETFs is incredibly bullish for the altcoin sector, proving that institutional pipelines are now open beyond the big two. This rotation could fuel the next leg of the altcoin season.