Metaplanet, often called “Asia’s MicroStrategy,” is charging ahead with its Bitcoin-focused strategy. The company has just announced major expansion plans, including new subsidiaries in the United States and Japan, to grow its Bitcoin income generation business.

This bold move comes after the company successfully raised $1.4 billion to fund its aggressive Bitcoin acquisition strategy.

New Subsidiaries to Drive Growth

The company’s board of directors approved the establishment of several new entities on September 17. The most significant is a new U.S. subsidiary, Metaplanet Income Corp. This will be a wholly-owned unit of U.S.-based Metaplanet Holdings Inc. and is designed to supercharge its Bitcoin operations.

CEO Simon Gerovich commented on the expansion, stating that the Bitcoin income generation business has become the company’s “engine of growth.” He emphasized that the division is already cash flow positive, generating consistent revenue and net income to fund future initiatives.

In a strategic branding move for the Japanese market, the company also acquired the valuable domain “Bitcoin.jp.”

A Growing Bitcoin Treasury

Metaplanet continues to aggressively accumulate Bitcoin. Its most recent purchase added 1,009 BTC (worth $112 million) to its treasury. This brings its total holdings to a massive 20,136 BTC, valued at over $2.3 billion.

This strategy mirrors that of MicroStrategy, solidifying its reputation as a leading corporate advocate for Bitcoin.

Stock Price Faces Headwinds

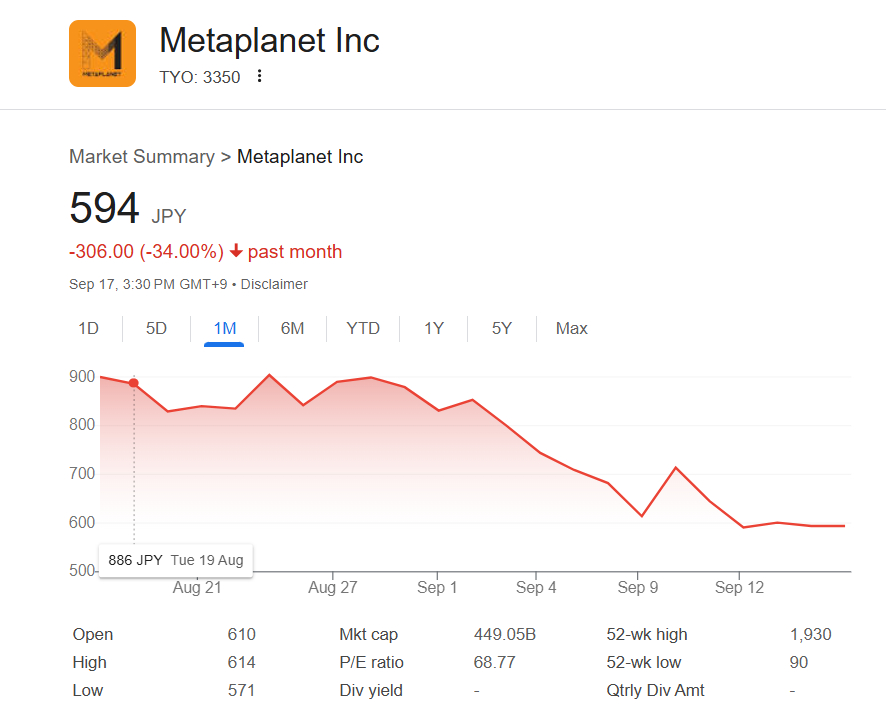

Despite these ambitious plans, Metaplanet’s stock price continues to face significant pressure. The stock fell 1.16% to 594 JPY following the announcements and is down a staggering 31% over the past month.

This decline has reduced its year-to-date (YTD) gain to 71%. Similarly, its U.S. ticker, MTPLF, has slipped nearly 30% in a month.

This sell-off occurs even as the company sells its equity holdings to raise more capital for Bitcoin purchases. Analysts note that major financial institutions like Morgan Stanley, UBS, Jefferies, and JPMorgan hold substantial short positions against the stock, contributing to the downward pressure.

Interestingly, this stock slump is happening while Bitcoin’s price has jumped over 6% in a week. Many investors anticipate further gains for BTC, especially if the Federal Reserve decides to cut interest rates.