In a monumental move that underscores a corporate flight from traditional finance, Tokyo-listed Metaplanet has announced a plan to raise $837 million through an international share sale—with nearly all proceeds dedicated to buying more Bitcoin. This aggressive expansion is a direct strategic hedge against Japan’s soaring national debt and persistently weak currency.

The Details of the Massive Bitcoin Bet

Metaplanet’s board has approved the issuance of up to 555 million new shares in an offering targeted exclusively at overseas investors. The plan is contingent on shareholder approval at an extraordinary meeting on September 1.

If approved, the company could deploy the entire ¥123.8 billion ($837 million) into Bitcoin between September and October. This would mark one of the largest single corporate acquisitions in Bitcoin’s history and a dramatic escalation of Metaplanet’s “Bitcoin-first” treasury strategy.

Why Metaplanet is Betting Big on Bitcoin

The company’s conviction stems from a fundamental loss of faith in Japan’s economic pillars. Its official statement explicitly cites three core reasons for the pivot:

- Elevated National Debt: Japan’s debt-to-GDP ratio is one of the highest in the world.

- Prolonged Negative Real Interest Rates: This erodes the value of cash and traditional bonds.

- Ongoing Depreciation of the Yen: The Japanese yen has significantly weakened against major currencies.

Metaplanet views Bitcoin as a superior store of value and a critical hedge against these systemic risks.

A Look at Their Already Massive Treasury

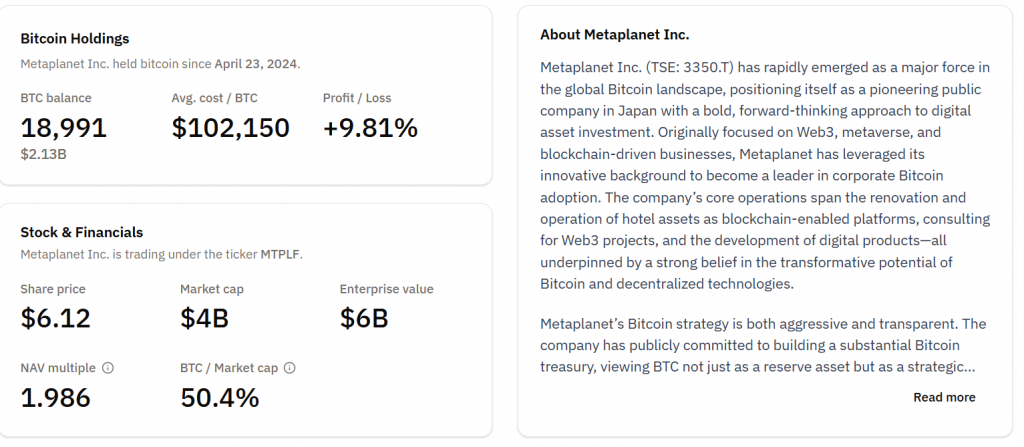

This isn’t a new strategy for Metaplanet; it’s a massive scaling of an existing one. The company is already Asia’s largest corporate Bitcoin holder.

- Current Holdings: 18,991 BTC (worth ~$2.12 billion)

- Recent Purchases: 775 BTC ($93M) and 103 BTC ($11.7M)

The firm has consistently used equity raises to rapidly amplify its BTC holdings, and this $837 million move is its most ambitious yet.

Protecting Shareholder Value

To ensure confidence in the new shares, major shareholders Simon Gerovich and MMXX Ventures Limited have agreed to a 60-day lock-up period, preventing them from selling existing shares. Metaplanet itself has also agreed not to issue any more shares during this time, preventing further dilution and protecting the value of the newly issued equity.

The Bottom Line

Metaplanet’s move is a powerful signal to the market. It represents a growing trend of corporations using Bitcoin as a strategic treasury asset to protect against sovereign currency devaluation and economic uncertainty. If successful, this will not only solidify Metaplanet’s position as a Bitcoin giant but could inspire a wave of similar strategies from other Asian firms.