Wall Street Expands: Morgan Stanley Bitcoin ETF Filing Unveiled

A major Wall Street player is officially entering the crypto ETF arena. Morgan Stanley has filed with the SEC to launch a spot Bitcoin ETF, alongside a separate Solana ETF. This pivotal move signals that institutional adoption is accelerating, not slowing, even as the broader market digests short-term flow fluctuations. The Morgan Stanley Bitcoin ETF filing proves that top-tier banks are now building the products to meet burgeoning client demand.

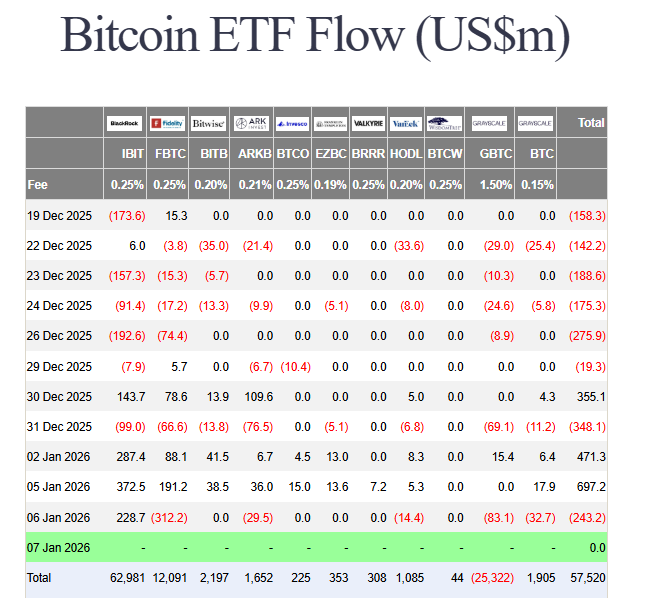

This strategic filing arrived on the same day U.S. spot Bitcoin ETFs recorded their first net outflow of 2026. While outflows from funds like Fidelity’s FBTC made headlines, BlackRock’s IBIT still saw inflows, showing a market in rotation, not retreat. The bigger story is the commitment from a wealth management titan, indicating a long-term institutional build-out that transcends daily flow volatility.

Spot Bitcoin ETFs recorded $243.2M in net outflows on Jan 6, but BlackRock bucked the trend, stacking Bitcoin with a massive $228.7M inflow—their third straight day!

What the Morgan Stanley Bitcoin ETF Filing Means for the Market

The Morgan Stanley Bitcoin ETF proposal follows the standard, successful model: a passive trust tracking Bitcoin’s spot price without leverage. This isn’t an experiment; it’s an execution of a proven blueprint. The simultaneous Solana ETF plan is even more notable, showing institutions are now comfortable extending regulated products beyond Bitcoin to other high-conviction assets.

This filing creates a powerful narrative. It confirms that the first wave of ETF approvals was just the beginning. Now, competitive pressure will push other major wirehouses and banks to launch their own funds, multiplying the on-ramps for traditional capital. This structural growth in accessibility dwarfs the importance of any single day’s outflow data.

My Thoughts

Ignore the daily outflow noise. The Morgan Stanley Bitcoin ETF filing is a seismic, long-term bullish signal. It represents the “institutionalization” phase of adoption, where major banks compete to provide crypto access to their vast client networks. This filing legitimizes the entire asset class further and ensures a sustained, structural demand source is being built. It’s a clear sign that the market is maturing, moving from speculative flows to strategic infrastructure development.