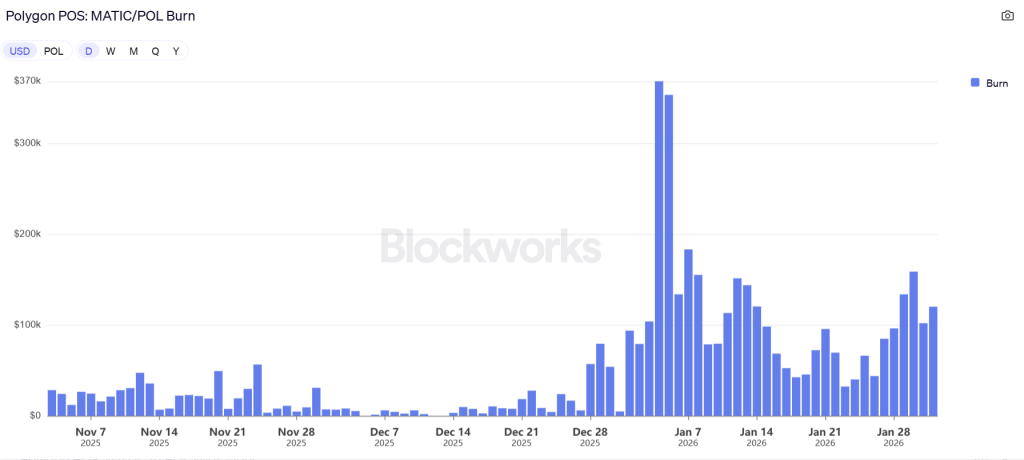

The Polygon ecosystem is firing on all cylinders, and its tokenomics are feeling the heat—in the best way possible. The network’s POL token burn mechanism has accelerated to record-breaking levels following its transition from MATIC. This surge is directly tied to skyrocketing activity across Polygon’s Layer 2 solutions, turning network usage into a powerful engine for programmed scarcity.

Record POL Token Burn Driven by Real Usage

The burn mechanism is simple in its brilliance: activity on the Polygon Proof-of-Stake (PoS) chain permanently removes POL from circulation. With the Layer 2 ecosystem now operating at high intensity, this deflationary process is hitting unprecedented speeds. Current trends suggest that if adoption continues, at least 3% of the total POL supply could be burned by the end of 2026.

This isn’t speculative reduction; it’s economic utility in action. The model directly ties the long-term value accrual of POL to the real-world usage of the network. Despite market volatility, user activity has stabilized at a robust 400,000 to 500,000 daily accounts, ensuring a consistent, usage-driven removal of tokens from the market.

Price Analysis: Deflation Meets Market Sentiment

Despite this powerfully bullish fundamental, the market reaction has been measured. POL price saw a moderate recovery, rising nearly 10% to the $0.11 range. However, technical indicators like the RSI have not yet confirmed a full trend reversal. The market cap sits around $1.19 billion, supported by a 20% bump in trading volume.

The key takeaway is one of patience. The impact of January’s $3 million burn is still small relative to daily trading flows. Experts agree that the deflationary pressure will become a dominant price driver as broader market sentiment improves, creating a potentially explosive setup for later in the cycle.

My Thoughts

This is tokenomics done right. Polygon is demonstrating that sustainable, utility-driven deflation is far more powerful than speculative hype. While the short-term price action is subdued, the foundation being laid is incredibly solid. As the cumulative effect of burns grows and the broader market enters a risk-on phase, POL is positioned for a revaluation. Investors should see this as a long-term accumulation signal; the network is quietly building value through use, not just promises.