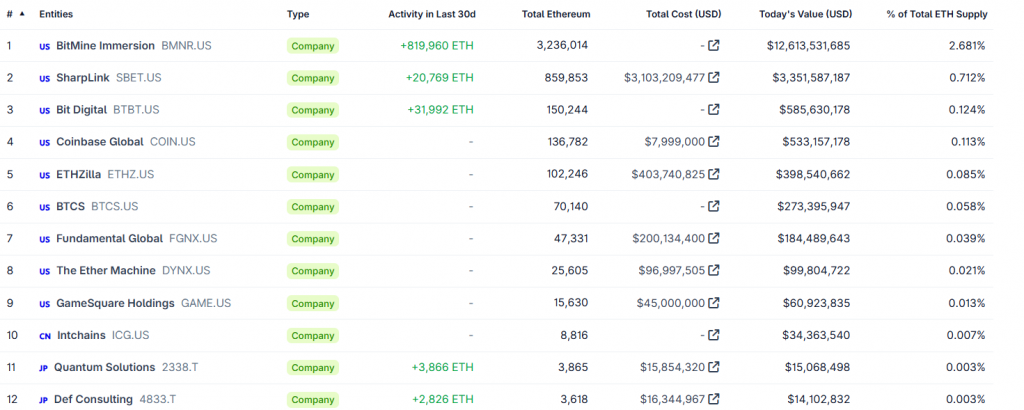

A Japanese company is making massive moves in crypto. Tokyo-listed Quantum Solutions has become Japan’s largest ETH treasury holder. The firm acquired 2,365 Ethereum in just seven days. This aggressive accumulation makes it the biggest corporate holder of ETH in the country and the 11th largest globally.

The buying spree was backed by serious institutional support. Quantum raised $180 million in a recent funding round. Notably, the round was led by Cathie Wood’s ARK Invest. This marks ARK’s first direct investment in Japan’s public markets. Two other major firms, Susquehanna International Group and Integrated Asset Management, also participated.

Strong Backing, Weak Stock Reaction

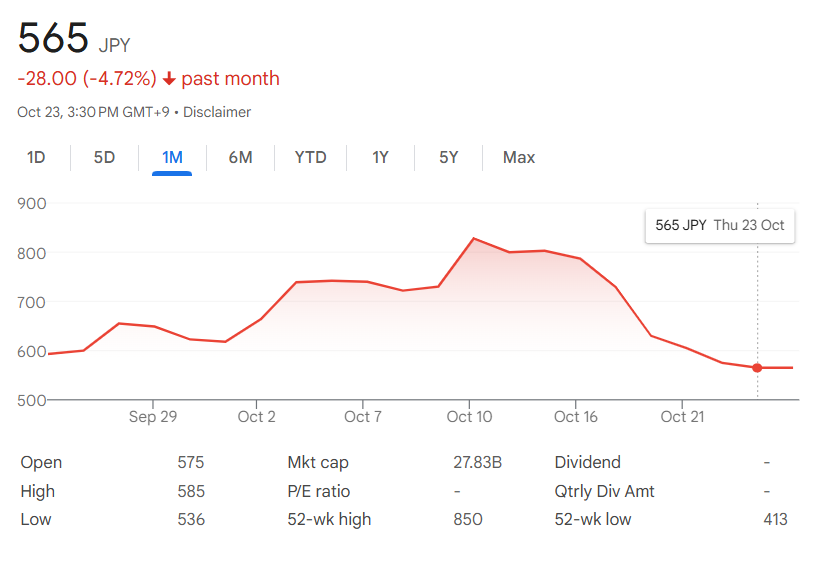

Despite this bullish fundamental news, the market reaction has been paradoxical. Quantum’s stock price continues to slide. It fell nearly 2% on the day of the announcement. Furthermore, it has lost over 28% of its value in the past five days.

This trend isn’t unique to Quantum. Many publicly-listed crypto treasury firms are seeing their valuations shrink. The initial hype around Digital Asset Treasuries (DATs) appears to be cooling. However, analysts believe underlying interest in Ethereum exposure remains strong. The stock decline is likely due to short-term profit-taking and volatility concerns.

My Thoughts

This highlights a fascinating divergence. Fundamentally, Quantum is executing a strong strategy, backed by top-tier investors. However, the stock market is punishing it in the short term. This creates a potential opportunity if you believe in the long-term ETH treasury thesis. The company is essentially trading at a discount to its crypto holdings. Once the broader market stabilizes, this aggressive accumulation could pay off handsomely.