Ripple’s Singapore License Expansion Cements Its APAC Dominance as RLUSD Hits $1B

Ripple just secured a major regulatory victory that solidifies its position as a cornerstone of Asia’s digital finance landscape. The Monetary Authority of Singapore (MAS) has granted Ripple Markets APAC an expanded Major Payment Institution (MPI) license, broadening the scope of payment services the firm can offer. This Singapore license expansion isn’t just bureaucratic—it’s a powerful endorsement that allows Ripple to double down on its “regulation-first” approach in a region leading the world in real digital asset usage. This move comes with perfect timing, as Ripple’s native stablecoin, RLUSD, recently soared past the $1 billion market cap milestone.

What Ripple’s Singapore License Expansion Enables

Under the newly expanded MPI license, Ripple can “better support” the institutions driving Asia’s 70% year-over-year growth in on-chain activity. While the full details are confidential, this Singapore license expansion builds upon the firm’s existing 2023 license to offer digital payment token (DPT) services. In practice, this enhances Ripple’s ability to provide its global payout network—a sophisticated system that uses XRP and RLUSD for fast, cost-effective cross-border settlements. This network offers an end-to-end solution covering fund collection, holding, swapping, and payout, making it a turnkey option for traditional financial institutions looking to modernize.

RLUSD: The Stablecoin Engine Powering Growth

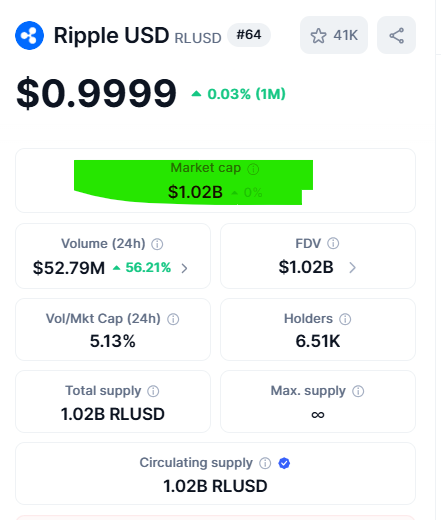

Parallel to its Singapore license expansion, Ripple’s stablecoin, RLUSD, is achieving breakout adoption. After surpassing $1 billion in market cap in early November, it now ranks as the 13th largest stablecoin globally. Its utility is expanding rapidly through key partnerships. Last month, Ripple collaborated with Mastercard, WebBank, and Gemini to pilot RLUSD for credit card settlements. Furthermore, plans are finalized for an early 2026 launch in Japan via its partnership with SBI Holdings. This growing stablecoin ecosystem provides the essential liquidity and stability for Ripple’s cross-border payment solutions, creating a powerful feedback loop of adoption and utility.

My Thoughts

This is a masterstroke in regulatory strategy. While other crypto firms fight ambiguous rules, Ripple is securing concrete licenses in the world’s most progressive financial hubs. The Singapore license expansion is a beacon for institutional confidence, proving that compliant crypto infrastructure is not only possible but actively being deployed. RLUSD hitting $1B market cap is just the beginning. As more institutions use Ripple’s network, demand for RLUSD and XRP will grow organically through utility, not speculation. This is how you build for the long term.