The oracle of corporate Bitcoin has spoken again. Strategy’s Michael Saylor just dropped his signature “orange” signal, strongly hinting at another major Bitcoin acquisition in the coming week.

Saylor’s Orange Signal: Another Massive Bitcoin Acquisition Incoming

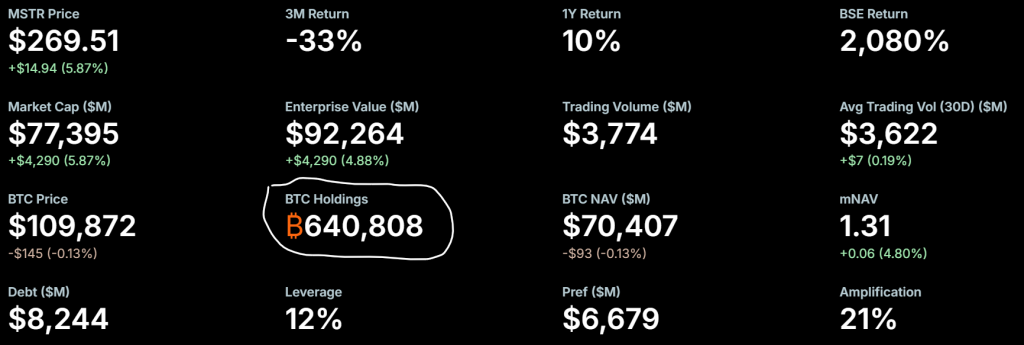

In a cryptic X post, Saylor shared his firm’s legendary portfolio chart—now holding 640,808 BTC worth a staggering $71 billion—with the caption “Orange is the color of November.” This isn’t just a color preference; it’s a proven alpha call. Historically, this exact signal has preceded each of Strategy’s 12 consecutive Bitcoin purchases. Get ready for number thirteen.

The Strategy Bitcoin Acquisition Juggernaut Marches On

Let’s put this potential purchase into perspective. Strategy’s current hoard was acquired at an average price of $74,302 per Bitcoin, representing an unrealized gain of over $23.6 billion—a 48% profit on their initial investment. The firm just added 390 BTC last Monday, demonstrating relentless accumulation regardless of price action. Saylor’s unwavering strategy reinforces Bitcoin’s “digital gold” narrative, treating it as the ultimate corporate treasury asset. Another purchase would further cement their dominance as the world’s largest corporate Bitcoin holder, a title they show no signs of relinquishing.

Macro Tailwinds: Trump’s Trade Deal Ignites Risk-On Sentiment

Meanwhile, a powerful macro catalyst is emerging that could supercharge Bitcoin’s momentum. President Donald Trump has announced a groundbreaking U.S.-China trade deal, signed during his Asia tour. The agreement includes tariff reductions, reopened agricultural markets, and pauses on rare earth material restrictions. This détente between economic superpowers immediately boosted global market confidence. Consequently, Bitcoin price reversed its recent losses, climbing back above $110,000 as risk assets rallied on the news.

The Perfect Storm for Bitcoin

This combination of institutional accumulation and positive macro developments creates an incredibly bullish setup. Saylor’s predictable Bitcoin acquisition strategy provides constant buy-side pressure, while Trump’s trade diplomacy reduces global economic uncertainty. For investors, this signals that both corporate and geopolitical forces are aligning in Bitcoin’s favor. As traditional markets stabilize, capital often flows into crypto, and Strategy’s impending purchase will only accelerate this trend.

KeMy Thoughts

When Saylor speaks, the market should listen. His consistent accumulation—through ups and downs—demonstrates a conviction that retail investors should emulate. Combined with improving macro conditions, this sets the stage for a violent move upward. I believe we’re witnessing the foundation being laid for Bitcoin’s next leg to $150,000. Don’t be caught on the sidelines.