Another Jaw-Dropping Strategy Bitcoin Purchase: $980 Million Bet Against the Grain

In a staggering display of unwavering conviction, Michael Saylor’s Strategy has executed another monumental Strategy Bitcoin purchase, acquiring 10,645 BTC for approximately $980.3 million. This massive buy, funded by strategic equity sales, comes as the broader market trembles over potential macroeconomic headwinds, proving that for Saylor, fear is not a signal to sell—it’s a signal to double down.

The Numbers: Building an Unassailable Treasury

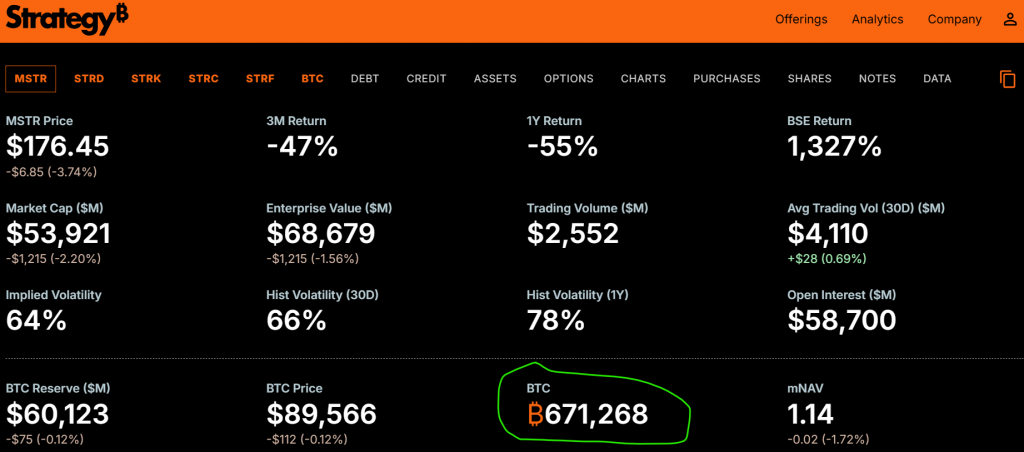

The latest Strategy Bitcoin purchase brings the company’s total holdings to a colossal 671,268 BTC, acquired at an average price of $74,972 per coin. With a year-to-date yield of 24.79%, the firm’s strategy of using proceeds from stock sales (MSTR, STRD, STRK) to perpetually grow its Bitcoin treasury remains relentless. This purchase even tops its $962 million buy from two weeks ago, signaling an accelerated accumulation pace despite rising market anxiety.

Timing: A Defiant Move Amid Macro Uncertainty

This purchase is particularly audacious given the current climate. The market is bracing for a potential Bank of Japan rate hike, an event that could tighten global liquidity and pressure risk assets like Bitcoin. Furthermore, Strategy itself faces a potential MSCI index exclusion due to its crypto-heavy treasury. Yet, Saylor’s firm is not merely holding; it’s aggressively buying the dip, treating macroeconomic fear as a discount opportunity rather than a threat.

Market Impact: Can Conviction Overcome Correlation?

While Strategy’s stock (MSTR) has fallen 24% in the last month alongside Bitcoin’s decline, this purchase is a long-term bet that their correlation will ultimately reward shareholders. The move sends a powerful message to the market: true believers see Bitcoin’s volatility as a feature, not a bug. It also soaks up nearly a billion dollars of sell-side liquidity, providing a tangible floor beneath the market.

My Thoughts

Saylor is playing a different game altogether. While traders fret over next week’s BOJ meeting, he’s executing a multi-year, capital-allocation masterplan. This Strategy Bitcoin purchase isn’t about timing the market; it’s about systematically transferring equity value into what he sees as a superior treasury asset. This consistent demand creates a structural bid underneath Bitcoin that no other public company can match. In a fearful market, this level of conviction is a lighthouse. It won’t stop short-term volatility, but it unequivocally signals where the smartest, most committed capital is flowing.