The world’s largest corporate Bitcoin holder is at it again. Michael Saylor teased another Strategy Bitcoin purchase with his signature Sunday cryptic post—”99>98″— signaling the company is once again adding to its massive treasury. This comes despite the firm sitting on over $5.1 billion in unrealized losses. The market’s response? MSTR stock surged nearly 9% in after-hours trading, proving conviction still commands a premium.

Strategy’s Bitcoin Purchase Hint: The “99>98” Signal

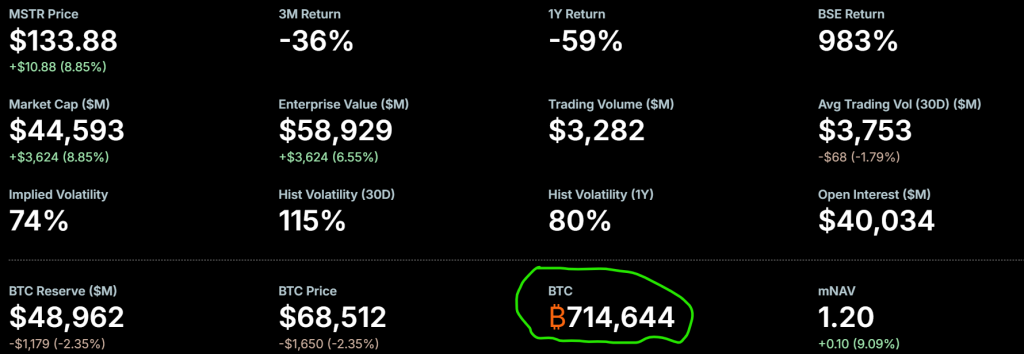

Saylor’s Sunday X post linking to the company’s Bitcoin tracker has become a weekly ritual for crypto traders. This week’s message follows the firm’s last disclosed purchase of 1,142 BTC for $90 million at an average $78,815 per coin. Total holdings now stand at 714,644 BTC, worth approximately $49.36 billion at current prices near $69,126.

Despite the paper loss, the message is crystal clear: Strategy is not selling. The company has repeatedly stated it will continue buying Bitcoin every quarter “indefinitely,” treating volatility as a feature, not a bug.

Technical Levels: $72K Resistance, $55K Bear Floor

Analysts are watching key levels as BTC holds weekend support. $72,000 is identified as major resistance. A clean break above could open the path toward $76,000–$80,000. Immediate support sits at $68,800, which aligns with a CME gap that may attract price action next week.

Derivatives data reveals significant asymmetry. A 10% BTC surge would liquidate ~$4.34B in shorts, while a 10% drop would wipe out ~$2.35B in longs. This imbalance suggests upside pressure is structurally stronger near term.

On the downside, CryptoQuant pegs realized price support at $55,000—the ultimate bear market floor based on historical cycles. A break below that could theoretically target $39,000, though that remains a low-probability extreme scenario.

My Thoughts

This is the purest expression of the Strategy Bitcoin purchase thesis: buy, hold, repeat. The $5.1B paper loss is noise to a firm measuring success in decades, not days.

What matters more is the structural bid this creates. Every week, regardless of price, Strategy is a buyer. Combined with the $55K realized support floor, the risk-reward skews heavily toward accumulation at current levels.

The short squeeze potential above $72K adds rocket fuel. If BTC reclaims that level, expect a violent cascade of covering that propels us toward the $80K region faster than most anticipate. This is still a bull market—just one that’s testing its strongest hands.