Trump’s Fed Gambit Supercharges Fed Rate Cut Bets for 2026

A seismic political shift is about to hit monetary policy, and crypto traders are already positioning for the tidal wave of liquidity. Former President Donald Trump has declared that immediate rate cuts will be a non-negotiable requirement for the next Federal Reserve Chair, supercharging Fed rate cut bets for 2026 and setting the stage for a historic pivot that could unleash a torrent of capital into risk assets like Bitcoin and crypto.

The Political Catalyst: Trump’s “Litmus Test” for the Next Fed Chair

In a clear signal of his intentions, Trump stated that any candidate to replace Jerome Powell must be ready to cut rates immediately. His reported favorite, former advisor Kevin Hassett, is a known rate-cut advocate who has already called for a 25-basis-point reduction. With Trump poised to nominate the next chair by early 2026 and potentially gain greater influence over the FOMC, the market is pricing in a profound shift from a data-dependent Fed to a politically-influenced, dovish one. This isn’t just speculation; it’s a looming structural change.

The Market Reaction: Traders Bet on an Aggressive Cutting Cycle

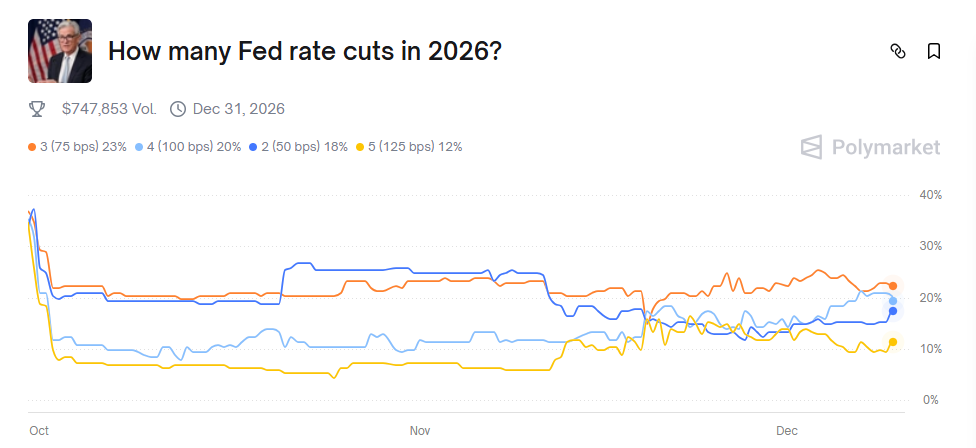

The prediction markets are exploding with activity. Polymarket data reveals traders are actively betting on the scope of the 2026 easing cycle:

- 23% chance of three 25-bps cuts

- 20% chance of four cuts (100 bps total)

- 12% chance of five cuts

This shows a strong consensus that a Trump-influenced Fed will be significantly more aggressive than the current leadership. While Powell will oversee the first few meetings of 2026, the expectation is for a rapid handover to a new, dovish chair who will accelerate the pace.

The Crypto Impact: Positioning for the “Trump Put”

For crypto, this is the ultimate macro tailwind. Lower interest rates weaken the dollar and make non-yielding, scarce assets like Bitcoin exponentially more attractive. The surge in Fed rate cut bets represents the market front-running a massive liquidity injection. This potential “Trump Put” could create a policy backdrop reminiscent of 2020-2021, where relentless monetary support fueled historic bull runs. Institutional capital will likely rotate into crypto in anticipation.

My Thoughts

This fundamentally changes the 2026 macro gameboard. We are potentially moving from a Fed fighting inflation to one actively pressured to stimulate. The sheer certainty of a more dovish chair is causing the market to reprice long-term liquidity conditions now. For crypto natives, this is a clear signal to accumulate. The coming months of political transition could create volatility, but the end destination is clear: a weaker dollar and stronger alternative assets. The smart money is already placing its Fed rate cut bets.