Mainstream Breakthrough: Visa Crypto Cards Post 525% Spending Explosion

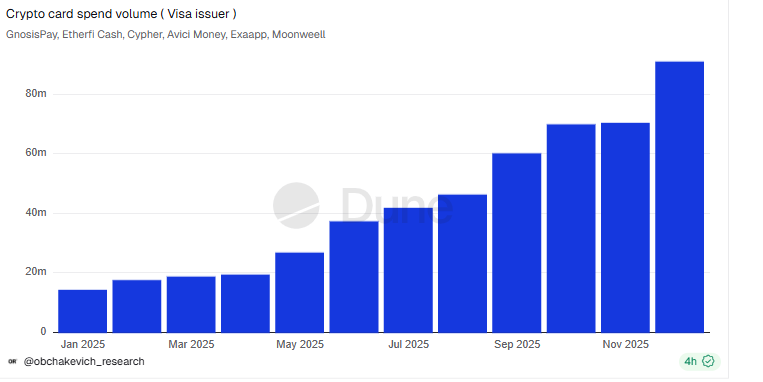

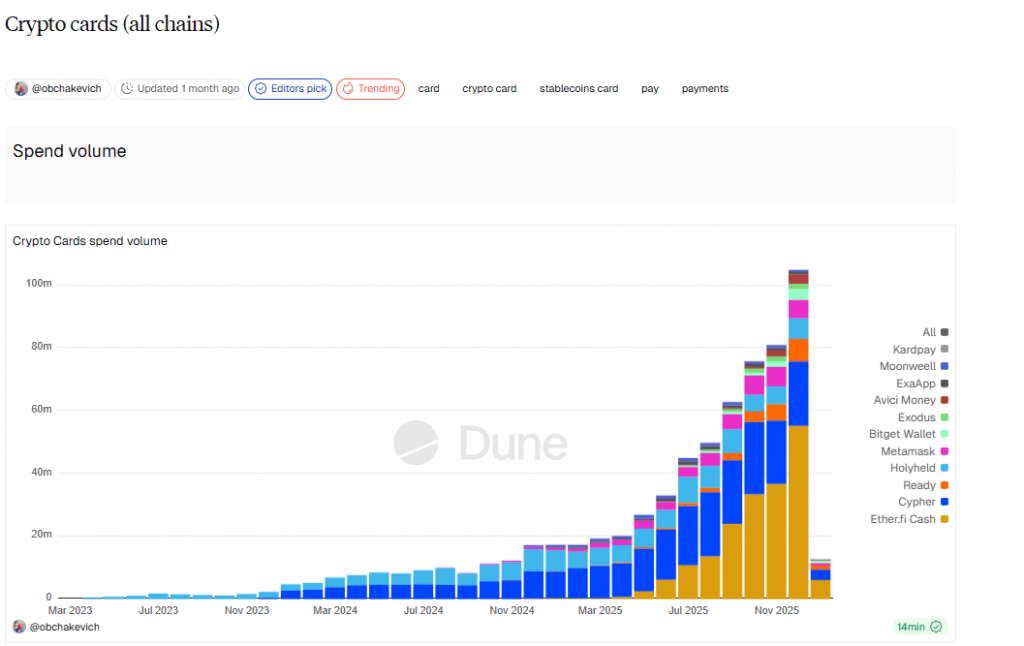

The narrative that crypto is only for speculation is officially dead. New data reveals an explosion in real-world usage, as Visa crypto cards saw a staggering 525% surge in net spending throughout 2025. Total spend across six key partner cards rocketed from $14.6 million in January to a massive $91.3 million by year’s end. This isn’t just growth; it’s a tidal shift toward everyday cryptocurrency utility.

Leading the charge was the card from EtherFi, a decentralized finance (DeFi) project, which alone facilitated $55.4 million in spending. Cypher followed with $20.5 million. This data clearly shows users are increasingly comfortable leveraging their crypto holdings for daily purchases, moving digital assets from exchange wallets directly into the real economy.

What’s Driving the Adoption of Visa Crypto Cards?

This parabolic growth signals a major maturation phase. As a Polygon researcher noted, “crypto is no longer just an experimental technology but a fully-fledged tool for everyday financial transactions.” The ease of use provided by these cards, which automatically convert crypto to fiat at point-of-sale, is removing a critical barrier to mass adoption.

Furthermore, Visa is doubling down on this success. The payments giant is aggressively expanding its stablecoin infrastructure across four blockchains and recently launched a dedicated stablecoin advisory team. This strategic focus ensures that the rails for Visa crypto cards will only become faster, cheaper, and more widespread in 2026, setting the stage for continued exponential adoption.

My Thoughts

This is a cornerstone moment for crypto adoption. When users willingly spend their ETH or stablecoins on groceries and gas, it creates a powerful, circular economy that strengthens the entire ecosystem. This data is a bullish signal for projects building at the intersection of DeFi and real-world finance (RWA). Visa’s deepening commitment indicates that traditional finance sees the future clearly: blockchain-based payments are inevitable. For crypto natives, this is proof that utility, not just speculation, will drive the next bull market.