A massive Ethereum whale accumulation event is unfolding right under the market’s nose. Tom Lee’s Bitmine Immersion Technologies has added another 45,759 Ethereum over the past week, even as ETH slides toward $1,900. This isn’t retail buying—it’s strategic, institutional-sized accumulation from one of crypto’s most respected voices.

The Scale of This Ethereum Whale Accumulation

According to the company’s latest release, Bitmine now holds a staggering 4,371,497 ETH, acquired at an average price of $1,998. That represents 3.62% of the entire Ethereum supply—a jaw-dropping concentration. The firm also holds 193 Bitcoin, $670 million in cash, plus stakes in Beast Industries and Eightco Holdings totaling over $217 million.

Tom Lee called the pullback “attractive” based on Ethereum fundamentals, stating the company views ETH’s utility as “stronger than what its current price reflects.” This is classic bottom-fishing from someone who’s been right more often than wrong.

The “Alchemy of 5%” and Staking Yields

Bitmine is pursuing what it calls the “Alchemy of 5%” strategy—aiming to accumulate 5% of all Ethereum. They’ve already reached 72% of that target in just seven months.

The staking operation is equally impressive. With 3,040,483 ETH staked, Bitmine projects annualized rewards of $176–252 million based on current yields (~2.89%). The company is also building the Made in America Validator Network (MAVAN) , set to launch in Q1 2026, which will further deepen its ecosystem integration.

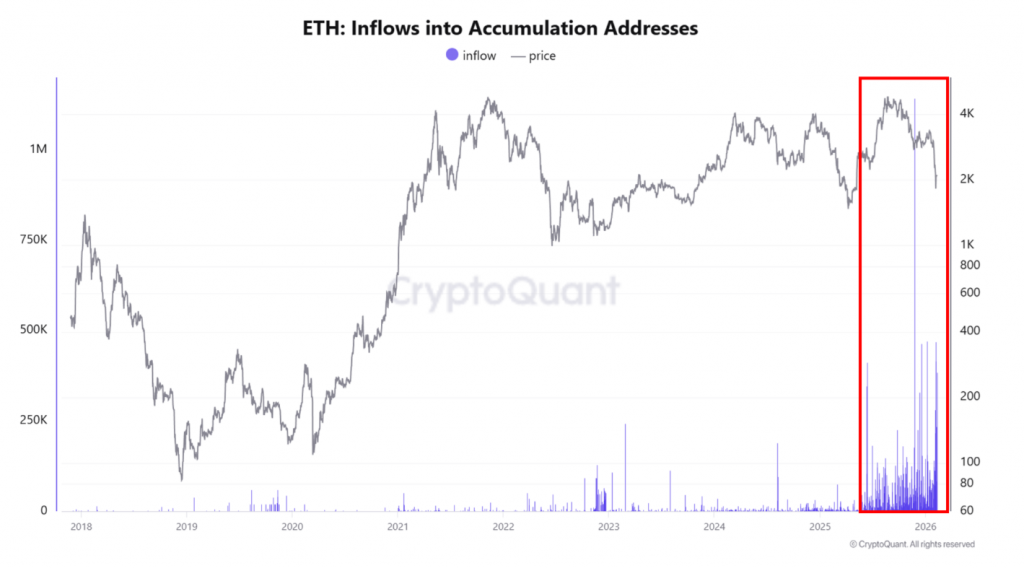

Whale Losses Signal Potential Bottom

CryptoQuant notes that Ethereum whales are currently holding losses similar to prior market bottoms. Critically, they have not taken profits this cycle and continue accumulating. Whales now hold their largest positions ever—a powerful contrarian signal that aligns with the current Ethereum whale accumulation trend.

My Thoughts

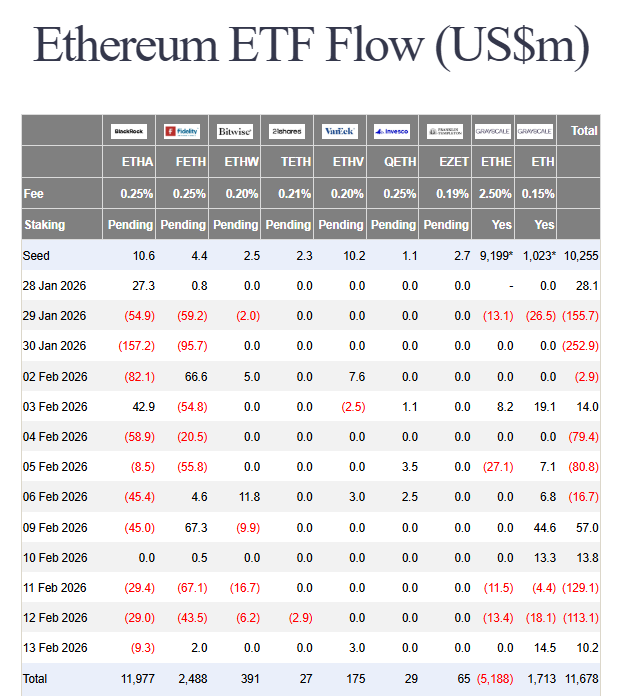

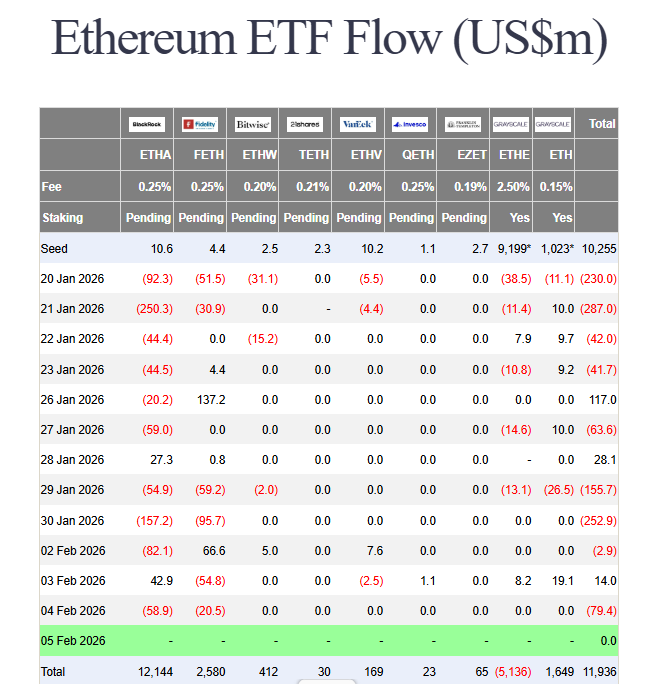

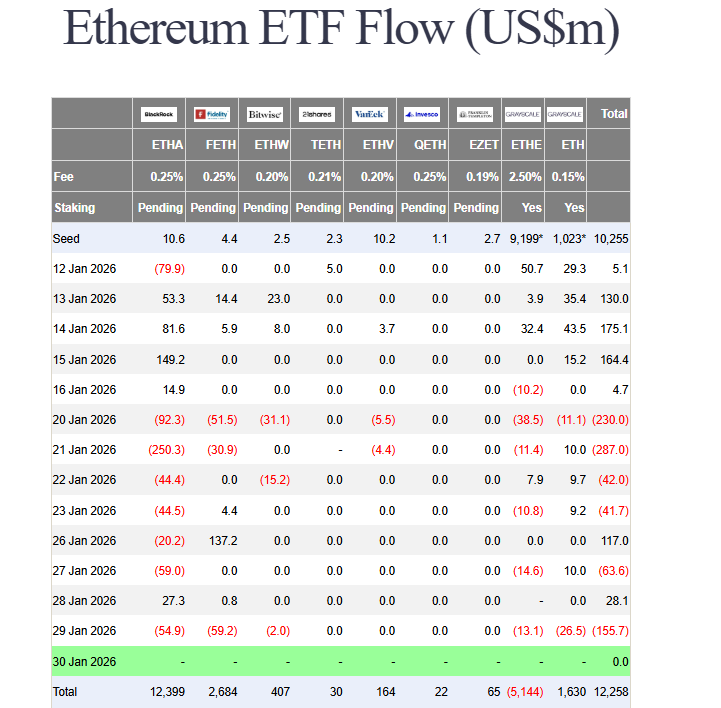

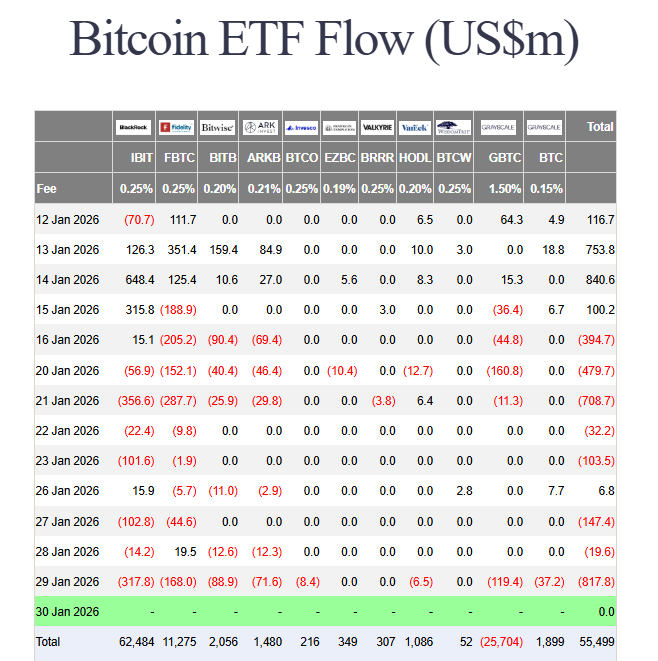

This is the loudest whisper in the market right now. While retail capitulates and ETFs bleed, Tom Lee’s Bitmine is executing one of the most aggressive Ethereum whale accumulation events in history.

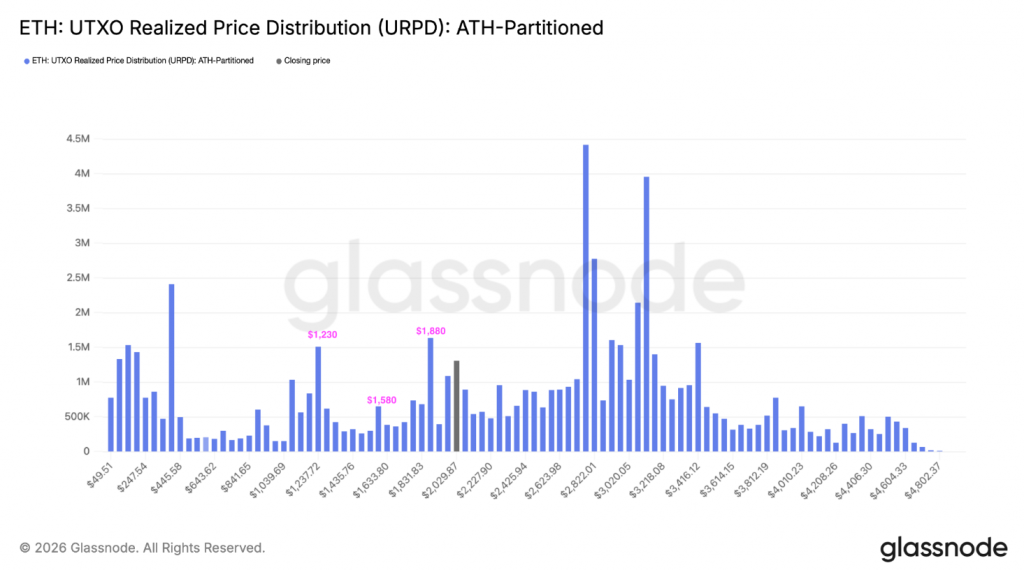

The $1,998 average entry is almost too perfect—it tells you they’re buying size right here, right now. The staking yield alone ($176M+) transforms this from a speculative bet into a revenue-generating machine.

For investors, this is a mirror test. Do you follow the whale or the crowd? The crowd is fearful. The whale is accumulating. History suggests one of them is wrong. I know which side I’m on.