Deflationary Powerhouse: BNB Burn Mechanism Executes $1.29 Billion Quarterly Burn

The numbers are simply staggering. BNB Chain has just executed its 34th quarterly token burn, permanently removing 1.37 million BNB from circulation—a jaw-dropping $1.29 billion in value incinerated. This event marks the first major supply shock of 2026 and showcases the relentless, automated deflationary power of the BNB burn mechanism. Each burn brings the network closer to its ultimate goal: a total supply of just 100 million BNB.

This isn’t a manual, speculative event; it’s a systematic process coded into the chain’s DNA. The tokens were sent to an unspendable “null” address on January 15, irrevocably reducing the circulating supply to 136.36 million BNB. The market’s initial reaction was muted, with price dipping slightly before recovering, but the long-term implications are profoundly bullish. Why? Because with no new BNB created, every burn increases the scarcity of every remaining token.

Understanding the Automated BNB Burn Mechanism

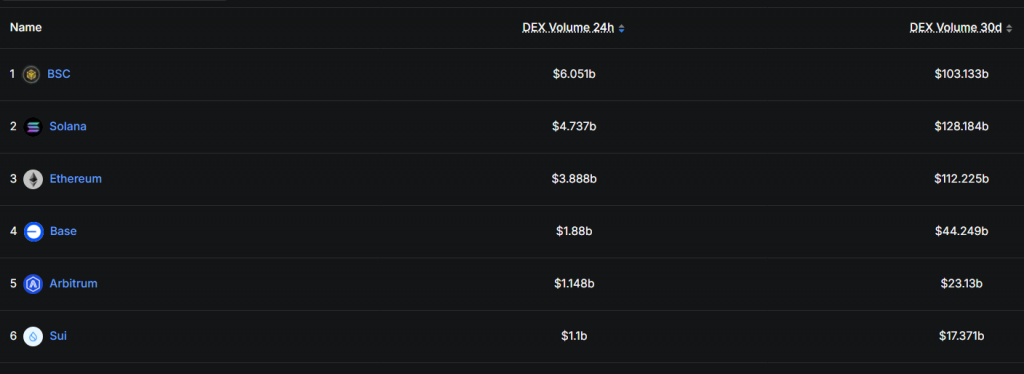

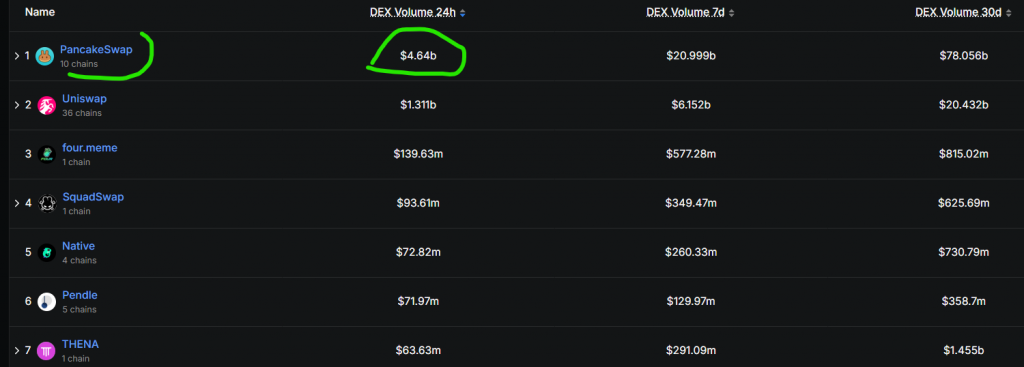

Let’s break down how this works. The BNB burn mechanism operates through two primary channels. First, the quarterly Auto-Burn, which calculates the amount to destroy based on BNB’s price and network activity. Second, a real-time gas fee burn that destroys a portion of every transaction fee. Combined, these systems ensure a constant, predictable reduction in supply.

This burn arrived hot on the heels of BNB Chain’s Fermi hard fork, which reduced block times to a lightning-fast 0.45 seconds. This upgrade likely contributed to the higher activity levels that influence the burn calculation. It’s a powerful synergy: a faster, more efficient network drives more usage, which in turn fuels a more aggressive deflationary schedule.

My Thoughts

This is textbook sound monetary policy executed on-chain. While short-term price action may be volatile, the long-term calculus is simple: rising demand + falling supply = price appreciation. The $1.29 billion burn represents a massive share buyback, but for a decentralized network. As adoption of BNB Smart Chain and opBNB grows, the burn rate could accelerate. In a market obsessed with narratives, BNB delivers a mathematically guaranteed scarcity story every quarter. It’s one of the strongest fundamental holds in crypto.