In a landmark interview, Strategy’s Michael Saylor delivered a message of historic conviction to a panicked market. Amid a brutal downturn and over $5.1 billion in unrealized losses, Saylor declared the company’s Bitcoin accumulation strategy is immutable: “We’re not going to be selling. We are going to be buying Bitcoin.” This isn’t just corporate optimism; it’s a strategic doctrine backed by an extreme financial fortress.

The $8,000 Litmus Test: Revealing the Ultimate Bitcoin Accumulation Strategy

Saylor doubled down on a stunning revelation first made by CEO Phong Le: Bitcoin would need to crash to $8,000 and stay there through 2032 before facing genuine liquidation risk. This isn’t a hypothetical; it’s a calculated disclosure of their financial runway. Saylor emphasized the company holds “decades of dividends” in Bitcoin and has 2.5 years of cash reserves for all obligations, with a net leverage ratio half that of an average investment-grade firm.

This framework reveals a Bitcoin accumulation strategy built for decades, not quarters. It’s designed to survive any conceivable winter, transforming current volatility into a strategic advantage.

Buying the Dip is Official Policy

The strategy is action, not just words. The company just reported buying 1,142 more BTC last week and will continue buying Bitcoin every single quarter going forward. Saylor framed volatility as the price of entry for assets that historically deliver “two to three times better returns” than gold, equities, or real estate over a multi-year horizon.

Market Impact and the Path Forward

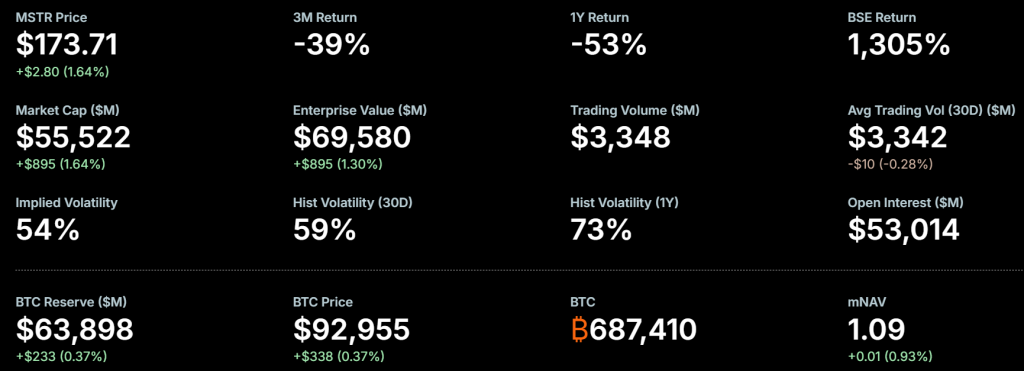

While MSTR stock has been whipsawed by BTC’s volatility—recently posting a 25% single-day gain after a severe drawdown—Saylor remains focused on the long-term ledger. He dismissed the notion of a $60,000 “miner cost” floor, arguing that institutional capital from banks and credit markets will ultimately drive price discovery far higher.

My Thoughts

Saylor isn’t just running a company; he’s orchestrating a masterclass in asymmetric betting. By publicly defining an $8,000 doomsday scenario, he makes the current ~$65,000 price look like a gift. This transparency is a psychological weapon against fear. For the market, it provides an unshakable pillar of demand. While traders focus on next week’s chart, Saylor is building a treasury for 2035. This is the ultimate contrarian signal to accumulate. When the largest, most sophisticated holder is this aggressively committed, your job as an investor is clear: align with the conviction, not the noise.