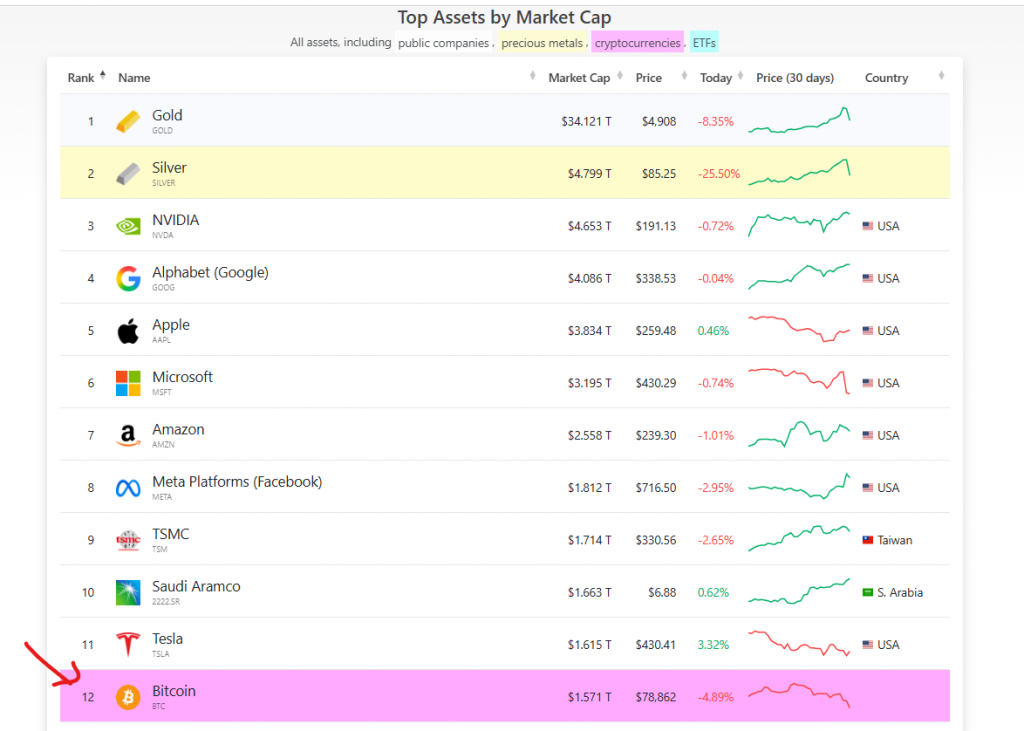

The crypto king has been dethroned, at least in the traditional rankings. Following a violent week of liquidations, Bitcoin has fallen out of the top 10 largest global assets by market capitalization. This stark Bitcoin market cap drop highlights the intense pressure facing digital assets as they wrestle with macro headwinds and a historic leverage flush.

Understanding the Bitcoin Market Cap Drop

Bitcoin’s valuation has slipped to approximately $1.571 trillion, placing it at 12th globally. It now sits just behind traditional titans like Saudi Aramco and Taiwan Semiconductor (TSMC). This is a dramatic shift from its peak near $2.5 trillion in October 2025, when price briefly soared above $126,000.

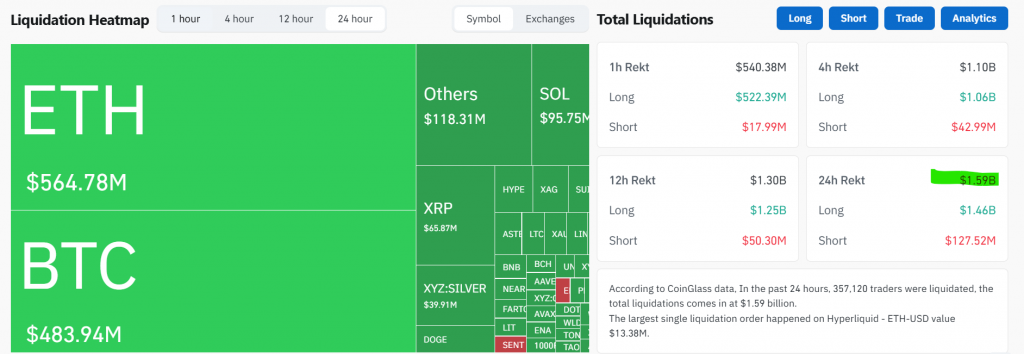

The catalyst was a brutal sell-off fueled by roughly $1.46 billion in long liquidations. This forced selling knocked Bitcoin from near $90,000 to below $79,000, erasing billions in value and investor sentiment almost overnight. Meanwhile, gold has surged to claim the undisputed top spot, underscoring a flight to traditional safe havens.

What This Means for the Crypto Cycle

This exit from the elite top 10 is more than symbolic; it reflects a tangible contraction in crypto’s relative standing within the global financial hierarchy. The move has reignited debates about whether this is a healthy correction or the start of a prolonged bear phase. The scale of the leverage washout suggests the market is purging excess, but the recovery path remains uncertain.

My Thoughts

This is a sobering moment for crypto maximalists, but not a surprising one. Extreme leverage had to unwind, and this is the result. However, falling out of the top 10 is a psychological blow that may actually help form a durable bottom. It shakes out weak hands and resets expectations. History shows that Bitcoin’s most powerful rallies begin when mainstream attention wanders. Use this period to accumulate strategically. The fundamentals of scarcity and adoption haven’t changed—only the noisy price action.