BNB Price Analysis: All Eyes on a Critical Support Trendline

The pressure is mounting on BNB. Our latest BNB price analysis reveals the token is teetering on the edge of a crucial multi-month support trendline. A decisive break below this level could trigger a swift 15% nosedive toward $730. This comes amid a perfect storm of declining on-chain activity and leveraged unwinding, testing BNB’s resilience despite its strong long-term fundamentals.

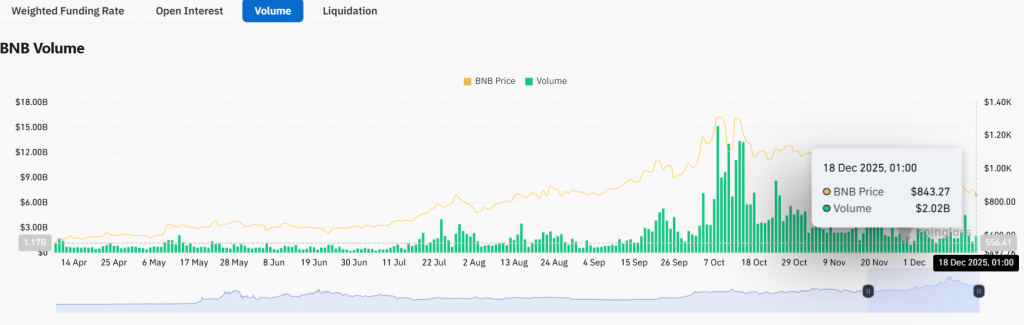

Bearish On-Chain and Derivatives Data Pile On

The numbers are telling a worrying short-term story. User activity on the BNB Chain has plummeted nearly 47% since October highs, with daily transactions falling to 16.6 million. This decline in network usage typically signals weakening demand for the native token.

Simultaneously, futures traders are fleeing. Open interest has collapsed from $2.97 billion in October to $1.27 billion—a massive 57% drop. This exodus of leveraged capital removes speculative support and adds persistent selling pressure. The technical picture confirms the weakness: BNB price has broken below the Supertrend indicator, and the MACD lines are now negative.

The Bullish Counter-Argument: Strong Fundamentals Remain

However, it’s not all doom and gloom. BNB’s fundamental backbone is strengthening. The network’s integration with BlackRock’s tokenized treasury fund is a monumental institutional endorsement. Furthermore, the protocol’s auto-burn mechanism continues to permanently reduce supply, building long-term scarcity.

This creates a fascinating divergence: weak short-term metrics vs. robust long-term value accrual. The market is currently voting with the short-term data.

The Line in the Sand: Key Support and Resistance

All roads lead to one trendline. This support, originating in April 2025, has fueled every major bounce this year. BNB is now just 2.7% away from breaking it.

- Bearish Scenario: A daily close below this trendline (near $820) projects a fall to the next major support at $729.3, a 15% decline.

- Bullish Scenario: To invalidate the downtrend, BNB must reclaim $927.5 (the 23.6% Fib level). This would signal a momentum shift and open the door for recovery.

My Thoughts

This BNB price analysis sets up a high-conviction trade. The convergence of weak on-chain data, bearish technicals, and fleeing leverage makes a breakdown the probable path. While the fundamentals are stellar, markets often punish assets before rewarding them. My strategy is to wait for a confirmed break below $820 before considering shorts or further downside. For long-term holders, a drop to $730 would represent a prime accumulation zone, but catching the falling knife now is risky. Patience is key.