Bitcoin Price Crash Wipes Out $200B as Institutional Selling Accelerates

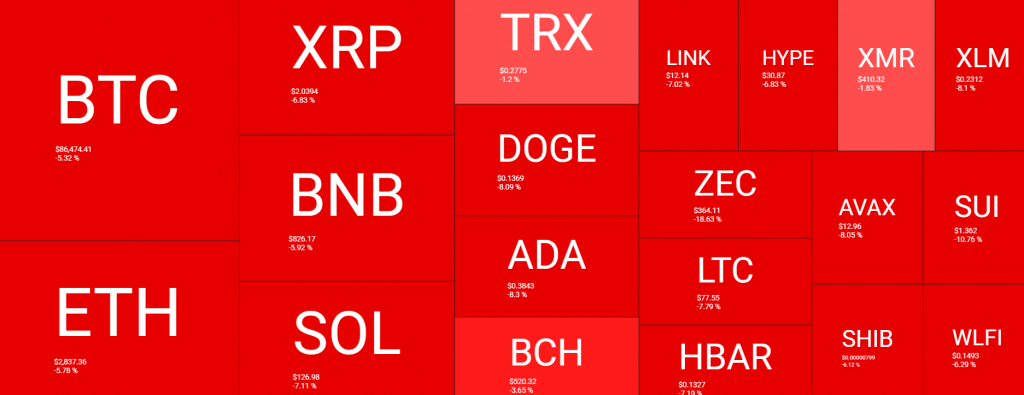

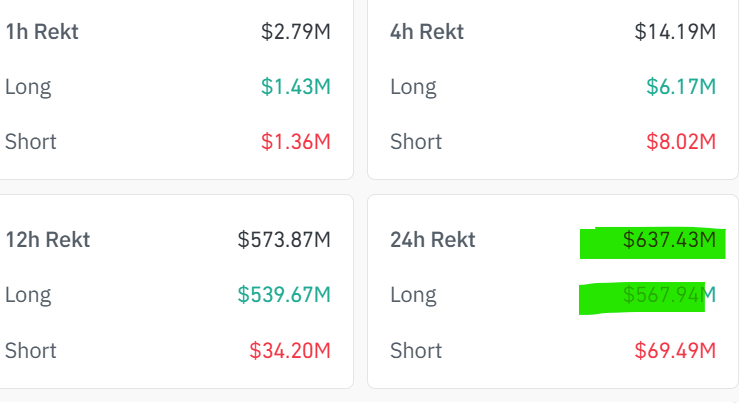

December opened with a brutal flash crash, as Bitcoin price plummeted over $5,000 in a matter of hours to fall to $86,000. This sudden collapse erased a staggering $200 billion from the total crypto market cap, sending shockwaves of panic and liquidating over $560 million in long positions. The sell-off wasn’t isolated to BTC; Ethereum and major altcoins fell 5-10% in unison. This severe Bitcoin price crash signals a dramatic shift in sentiment, flipping last week’s rebound optimism into outright fear and raising critical questions about the market’s near-term direction.

What’s Driving the Sudden Bitcoin Price Crash?

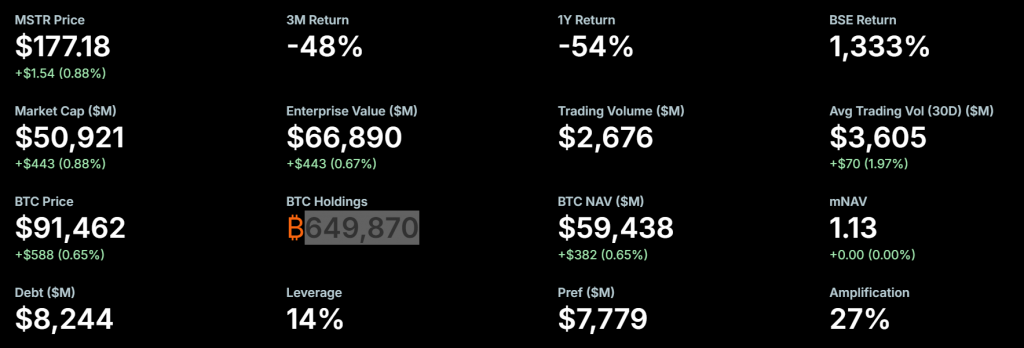

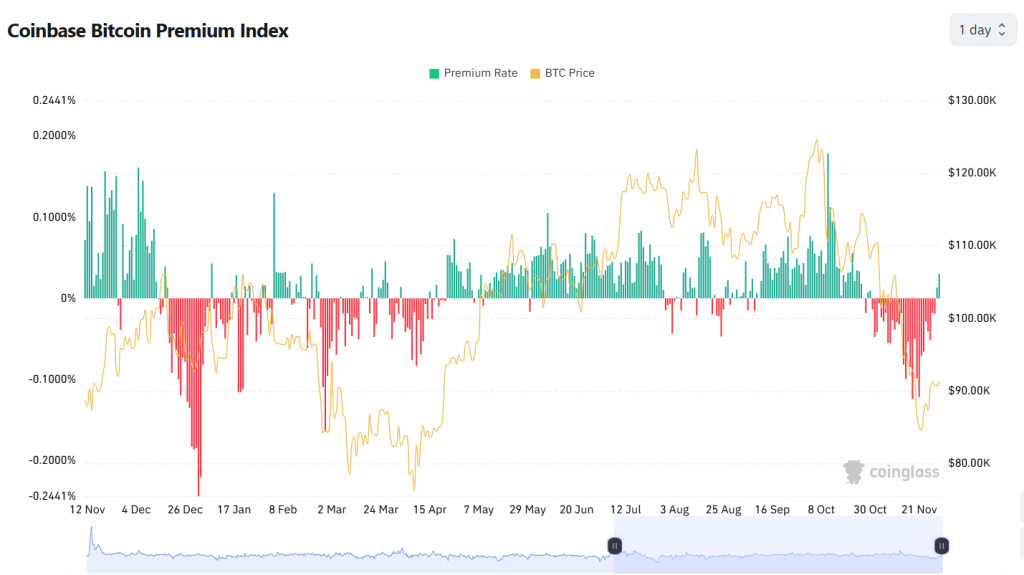

Multiple aggressive forces converged to trigger this sell-off. A significant catalyst was the unwinding of the Japanese Yen carry trade, prompted by a spike in Japan’s long-term bond yields, which pressured global risk assets. Simultaneously, on-chain data revealed massive institutional selling, with entities like Binance, Wintermute, and BlackRock reportedly offloading over $2.5 billion in Bitcoin within hours, fueling suspicions of coordinated action. This was compounded by persistent weakness in stablecoin giant Tether (USDT), which added to the liquidity fears. The backdrop of anxiety ahead of key U.S. economic data and Fed speeches created a perfect storm for a cascade of selling.

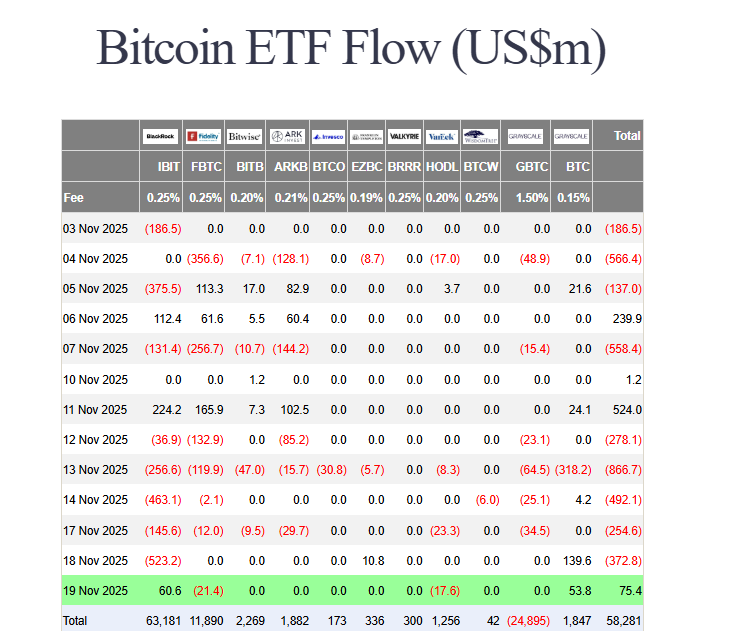

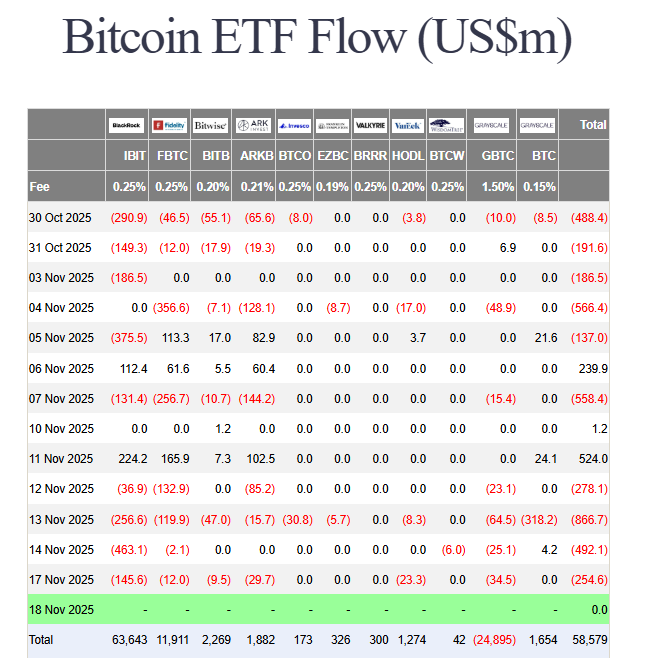

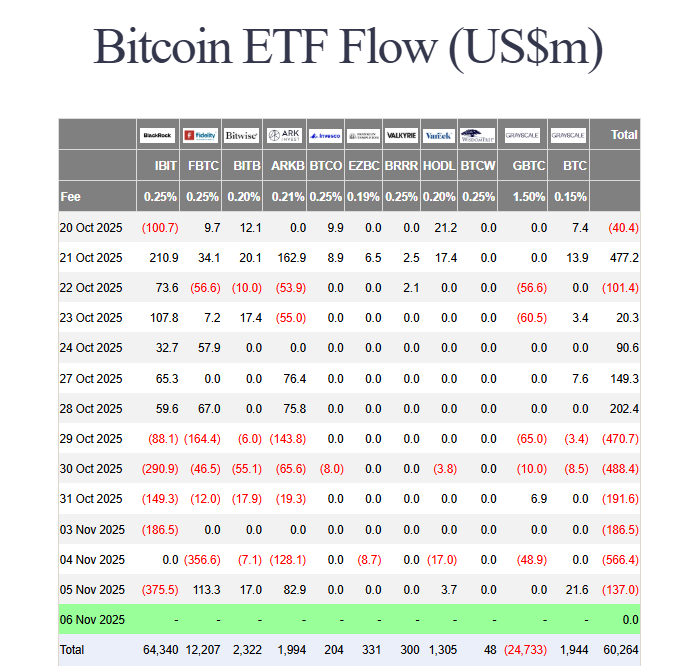

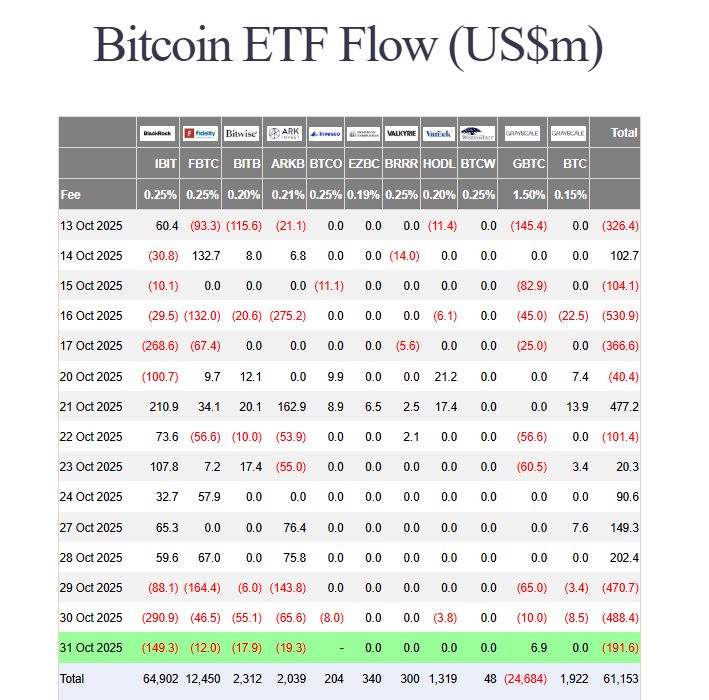

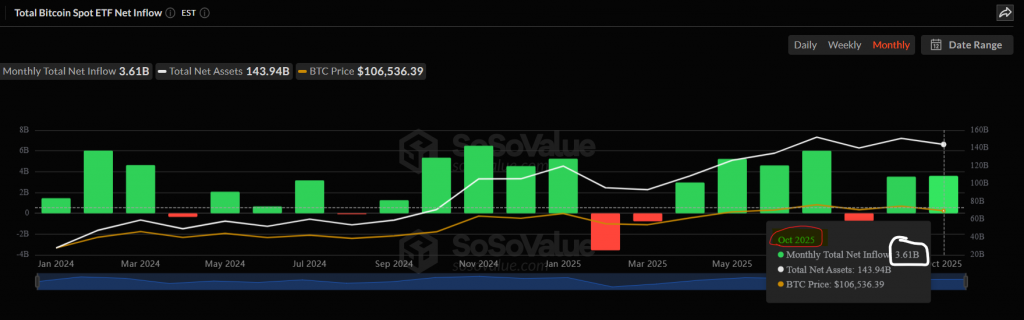

ETF Outflows and the Broken Support Level

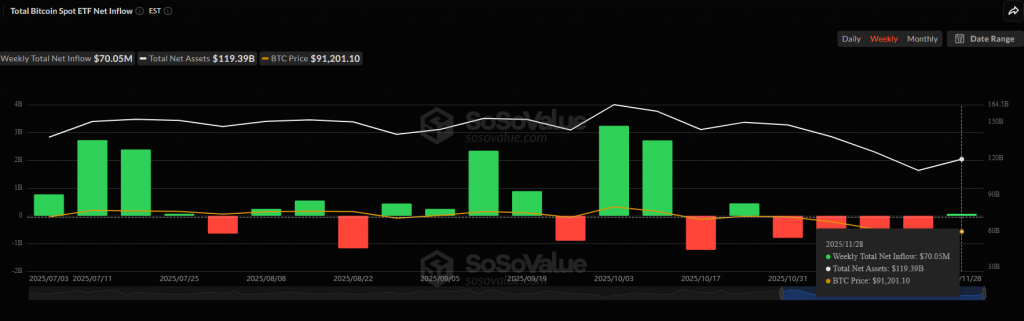

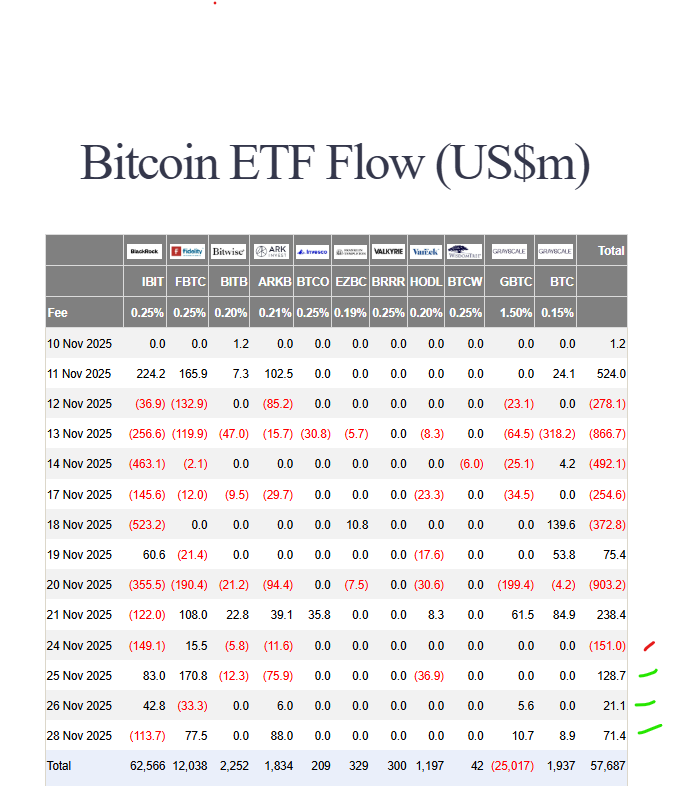

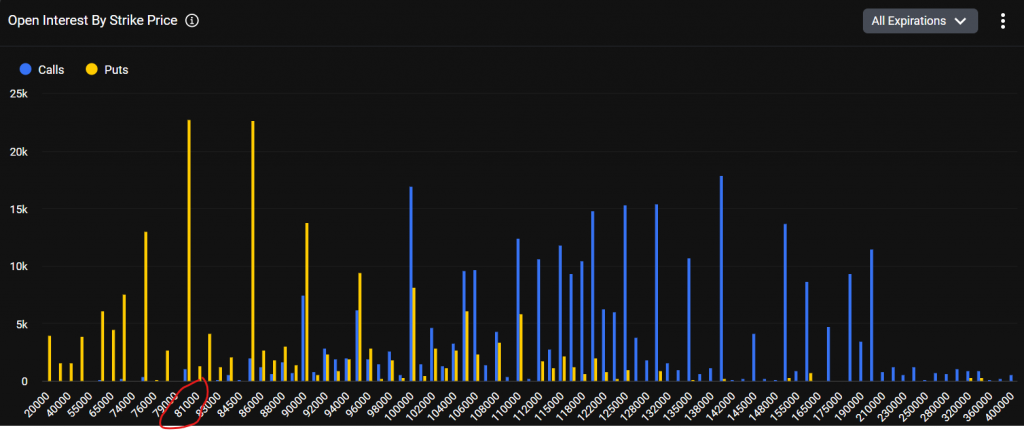

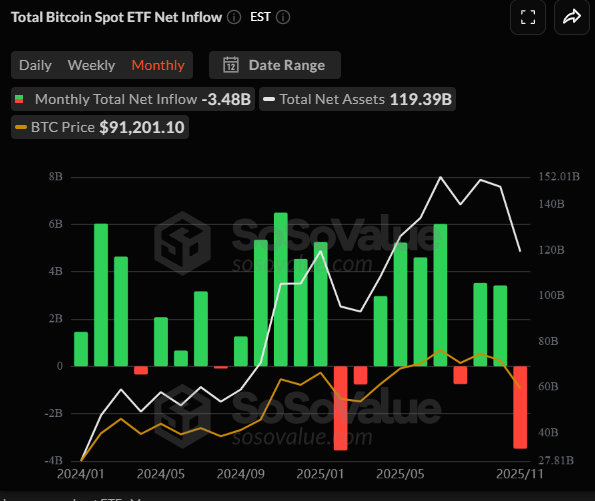

The institutional exodus is reflected in stark data. November witnessed a devastating $3.48 billion in net outflows from U.S. spot Bitcoin ETFs—their worst month on record. Spot Ethereum ETFs also saw their first major outflows of $1.42 billion. This Bitcoin price crash has invalidated the key $90,000 support level that bulls were defending. Technically, Bitcoin is now in a dangerous position. The MACD is trending downward, and the RSI is nearing oversold territory at 30. The next major support zone lies at $80,000, with a break below that potentially opening the door to $75,000 or even $70,000.

My Thoughts

This is a critical inflection point. The scale and speed of the sell-off, combined with the record ETF outflows, suggest this is more than a routine correction. It indicates a fundamental reassessment by large players. While the oversold RSI hints at a potential dead-cat bounce, the breakdown below $90K is technically damaging. The market needs to reclaim that level swiftly to restore any bullish structure. Until then, extreme caution is warranted. This move feels like a liquidity flush that could establish a lower trading range for the coming weeks.