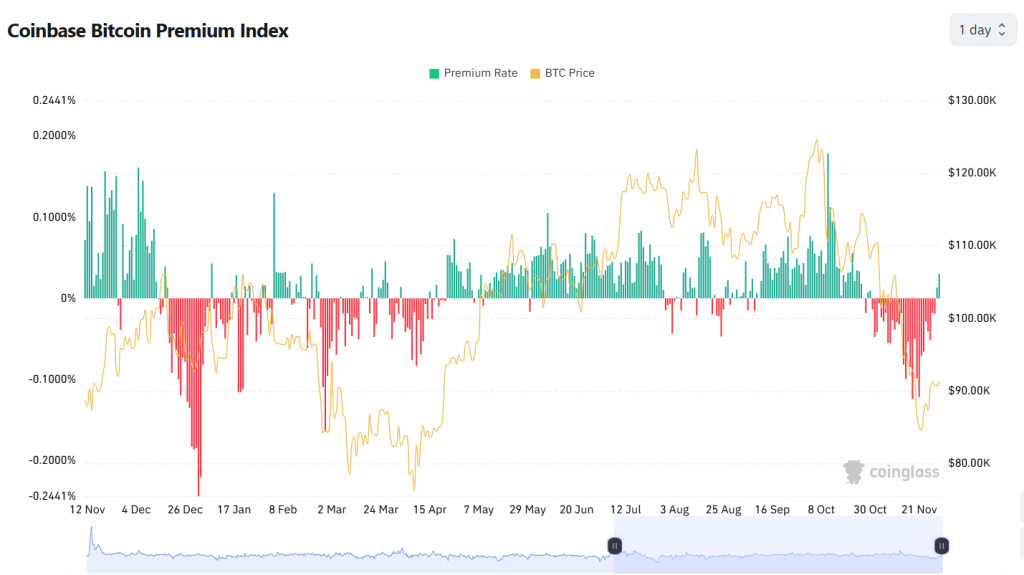

Coinbase Premium Index Flips Positive, Signaling US Institutional Demand is Back

A crucial gauge of American institutional sentiment has just flashed green for the first time in a month. The Coinbase Premium Index (CBPI), which tracks the price difference for Bitcoin on Coinbase versus the global average, has turned positive. This indicates that BTC is now trading at a premium on the US-based exchange, a strong signal that American investors are buying more aggressively than the rest of the world. This shift comes as Bitcoin stages a powerful rebound from its November 21 low below $81,000, now trading firmly above $91,000. When US capital flows in, it often leads the market.

What the Bullish Coinbase Premium Index Means

For beginners, the Coinbase Premium Index is a trusted barometer for US institutional activity. A positive reading means Bitcoin is more expensive on Coinbase, which is dominated by US institutional traders, than on other global exchanges. This is a classic sign that sophisticated American money is accumulating. Historically, a sustained positive Coinbase Premium Index has preceded significant rallies, as US institutional demand provides a powerful, fundamental bid underneath the market. This is a major psychological shift from the fear that dominated most of November.

Contrarian Bullishness Amidst Retail Uncertainty

This institutional accumulation is happening while retail sentiment remains mixed, creating a classic contrarian opportunity. Heavyweights like Binance founder Changpeng “CZ” Zhao and author Robert Kiyosaki are publicly calling this a prime buying opportunity, with Kiyosaki describing the market as entering a “quiet equilibrium.” Even the nation of El Salvador seized the dip, buying 1,100 BTC below $90,000. However, data from prediction platform Kalshi shows that many traders remain skeptical of Bitcoin reaching $100,000 this year. This divergence between institutional action and retail doubt often marks the early stages of a major move.

My Thoughts

This is the signal we’ve been waiting for. The flip in the Coinbase Premium Index isn’t just a technical blip; it’s a fundamental confirmation that US institutions are returning. They are using this period of “quiet equilibrium” to build positions before the next leg up. The combination of a positive CBPI, nation-state buying, and influential endorsements creates a powerfully bullish setup. I believe the path to $100,000 is now clearer than it has been in weeks. The weak hands have been shaken out, and the strong hands are now loading up.