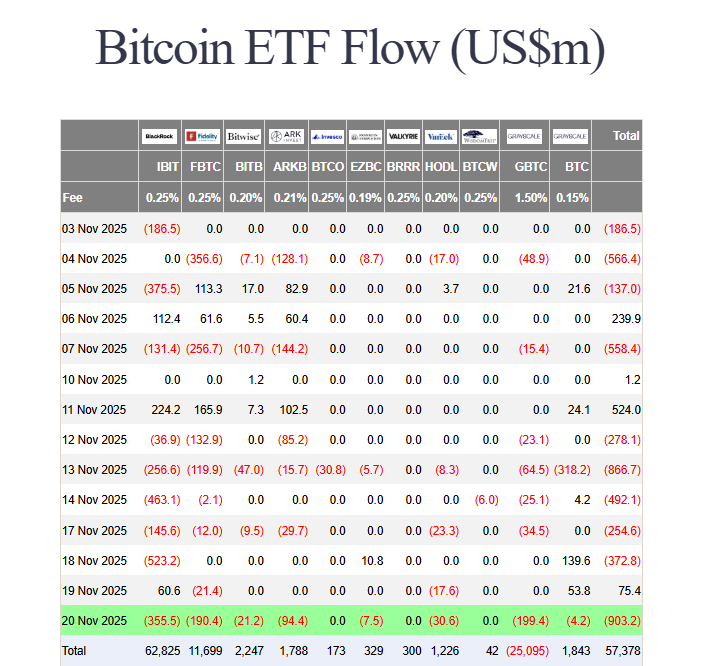

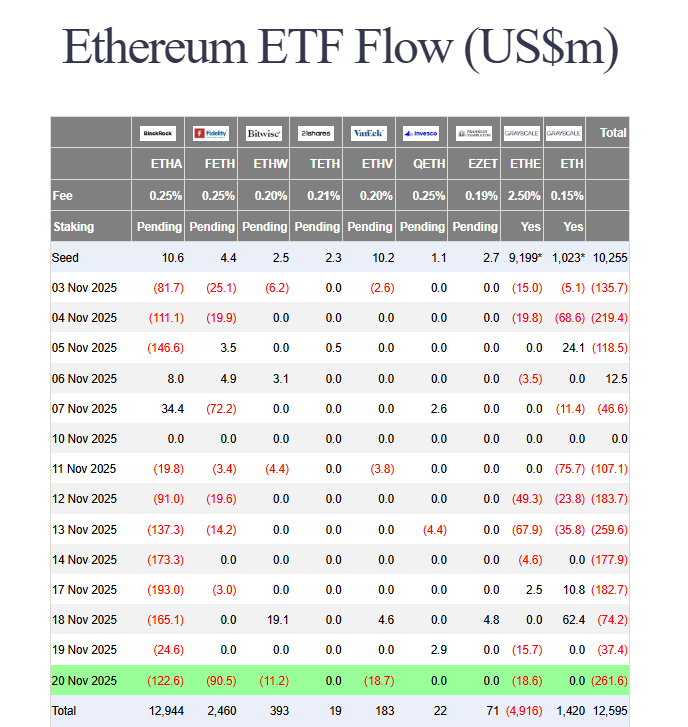

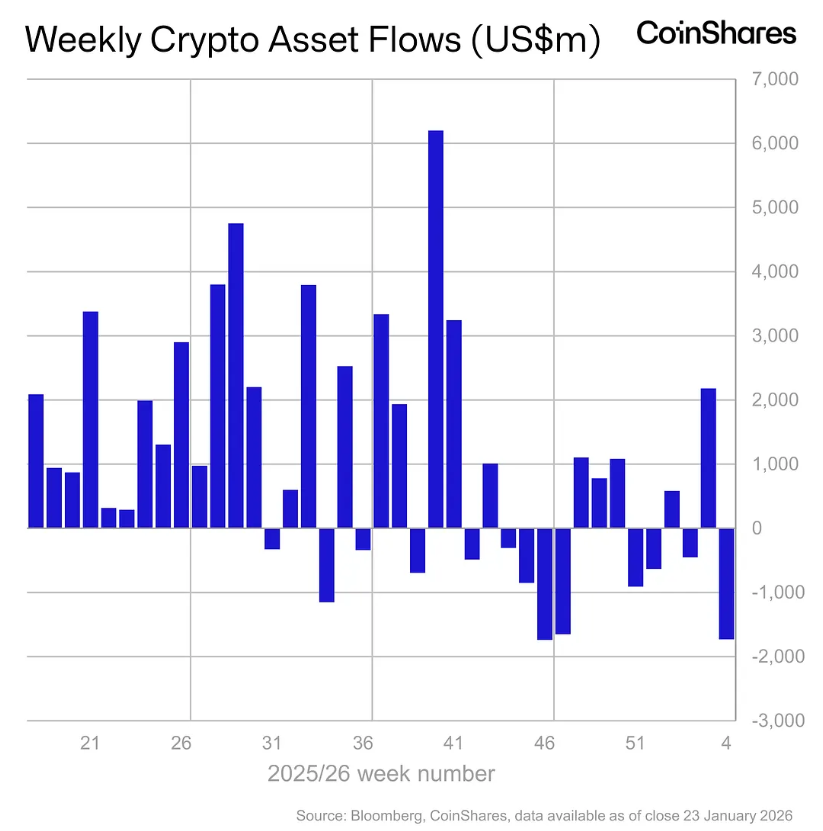

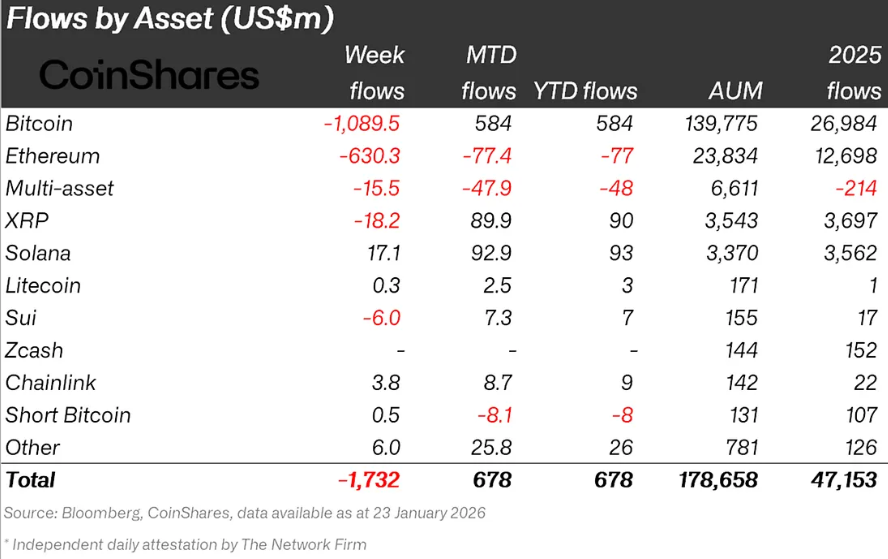

The institutional mood has turned sharply negative. After weeks of strong inflows, crypto exchange-traded products (ETPs) just suffered one of their worst weeks on record. A massive $1.73 billion flooded out of these funds, marking the largest weekly exodus since November 2025. This dramatic reversal reveals deep-seated fear is now overriding greed in the professional investment arena.

Breaking Down the Massive Crypto ETP Outflows

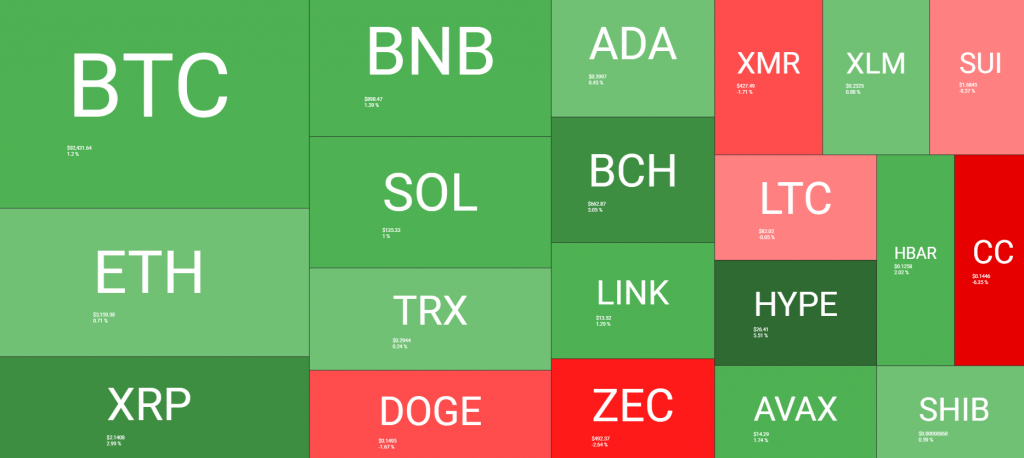

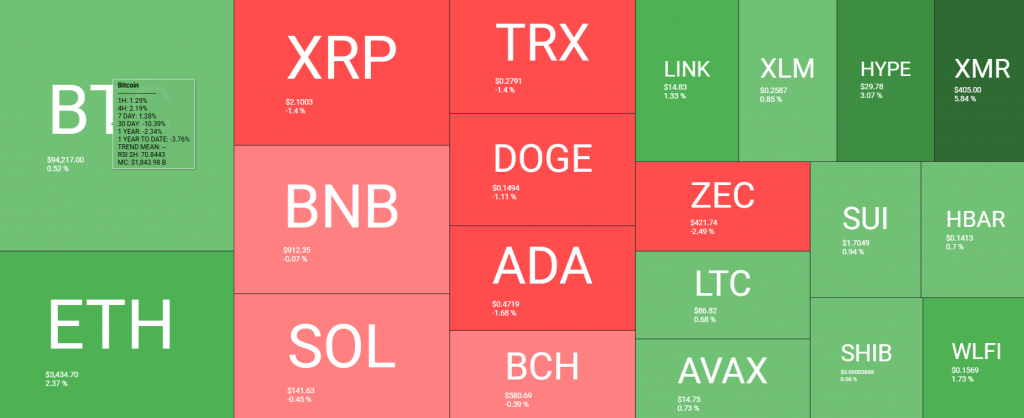

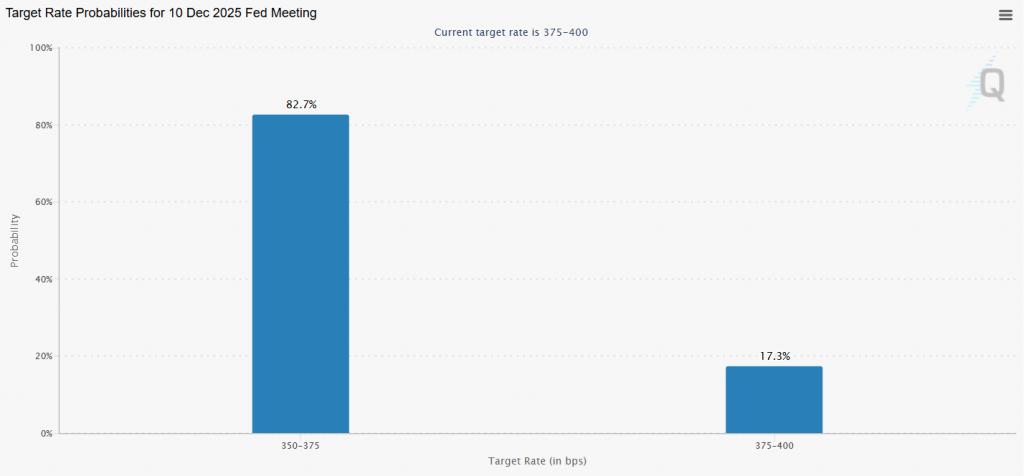

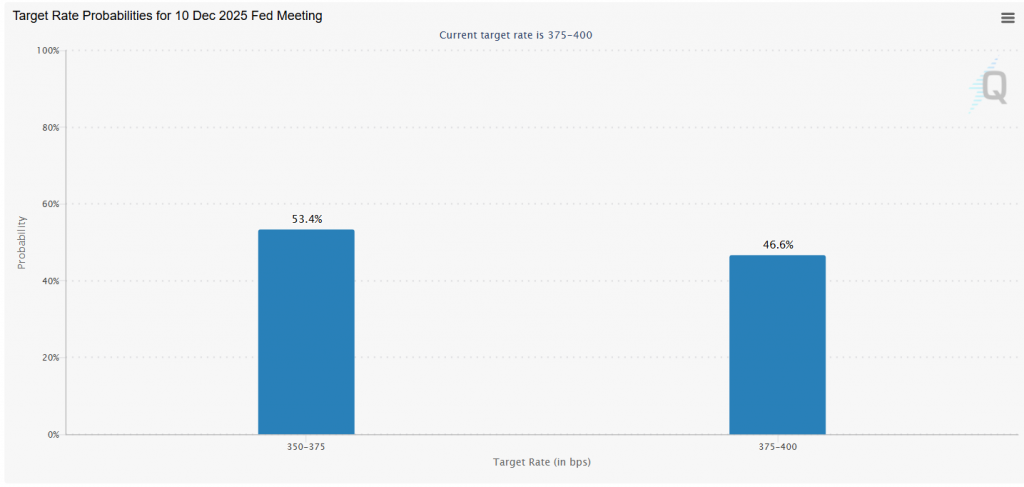

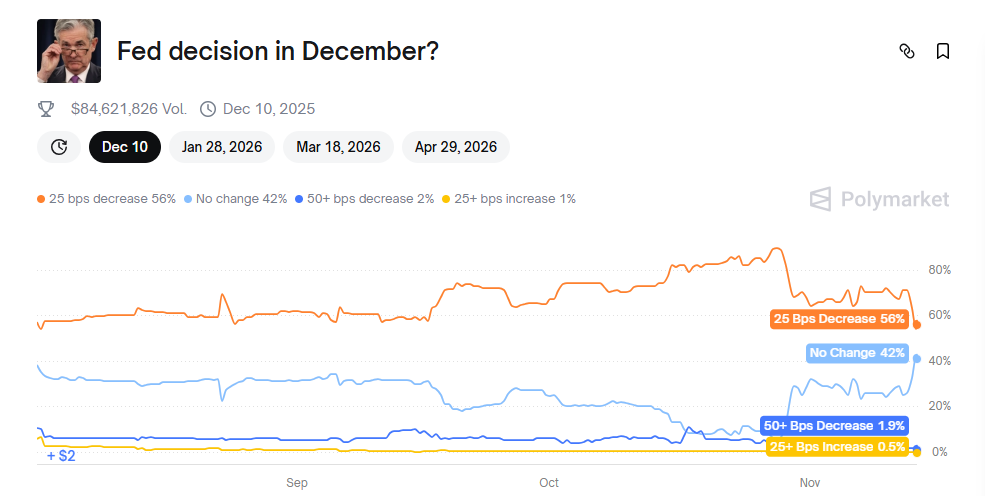

The selling was heavily concentrated. Bitcoin (BTC) and Ether (ETH) products alone saw a combined $1.72 billion in outflows. This suggests institutions are rapidly de-risking their core holdings amid a “sideways” market and fading hopes for near-term rate cuts. James Butterfill of CoinShares pinpointed the cause: “Dwindling expectations for interest rate cuts, negative price momentum and disappointment that digital assets have not participated in the debasement trade yet have likely fuelled these outflows.”

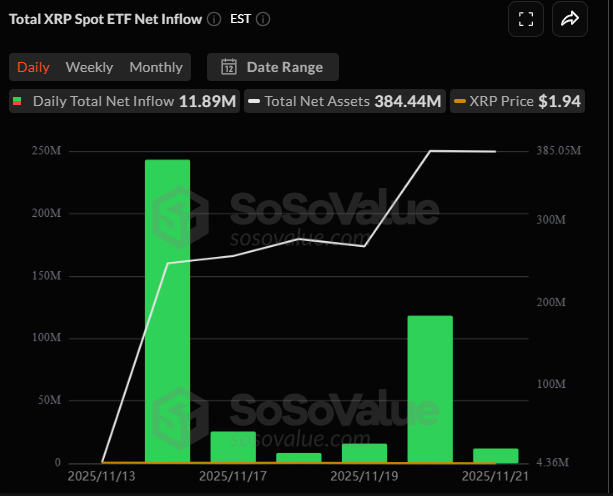

Interestingly, the bearish sentiment wasn’t universal. Solana (SOL) ETPs defied the trend, attracting $17.1 million in inflows. Chainlink (LINK) products also saw minor positive flows. This indicates a potential rotation within the digital asset space, as some investors seek alpha in select altcoins while fleeing the mega-caps.

Institutional Players Driving the Sell-Off

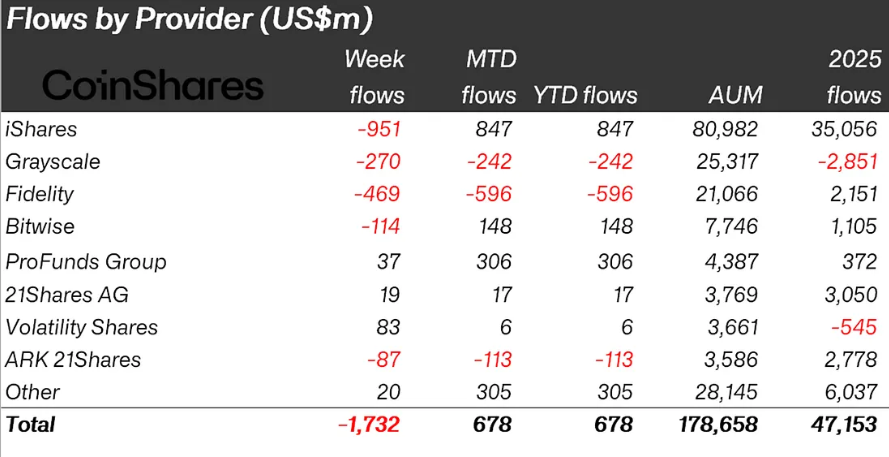

The outflows were led by the biggest names in traditional finance. BlackRock’s iShares ETFs bled $951 million, followed by Fidelity ($469M) and Grayscale ($270M). Geographically, the United States was the epicenter of the selling, accounting for $1.8 billion in outflows. Consequently, total assets under management (AUM) for crypto funds plunged from $193 billion to $178 billion in just one week.

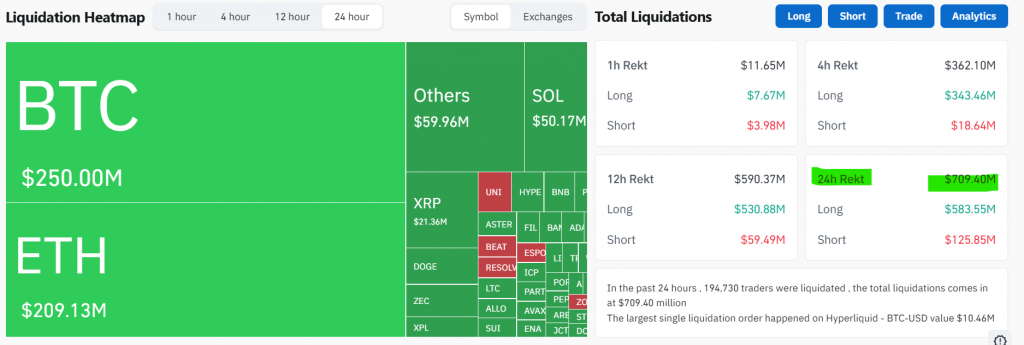

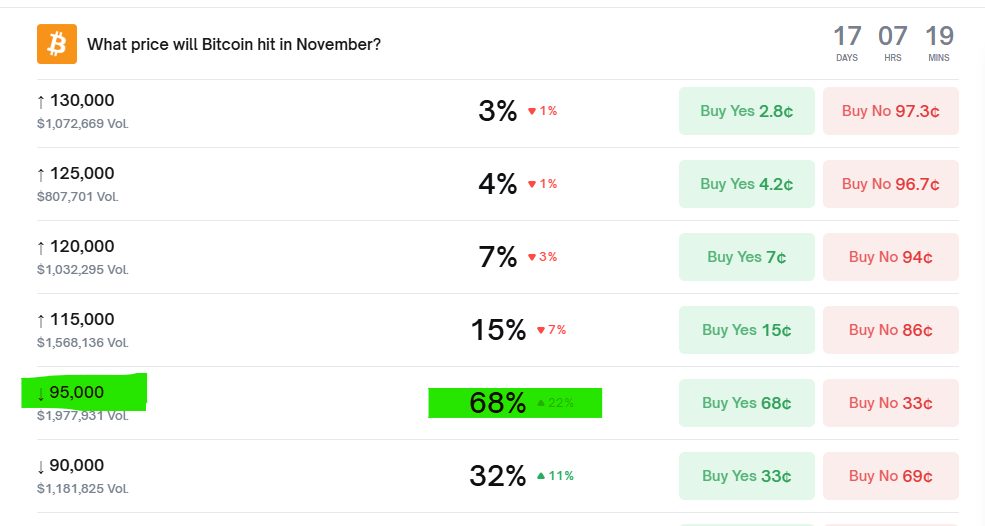

My Thoughts

This is a clear institutional risk-off signal. While retail can be fickle, these flows represent smart money positioning. The sheer scale suggests a deeper correction may be underway as liquidity tightens. However, the Solana inflows are a critical silver lining—they show capital isn’t leaving crypto entirely, but rotating. This is typical late-cycle behavior. For investors, this flush could create a stronger foundation for the next leg up, but caution is warranted until the outflow trend breaks.