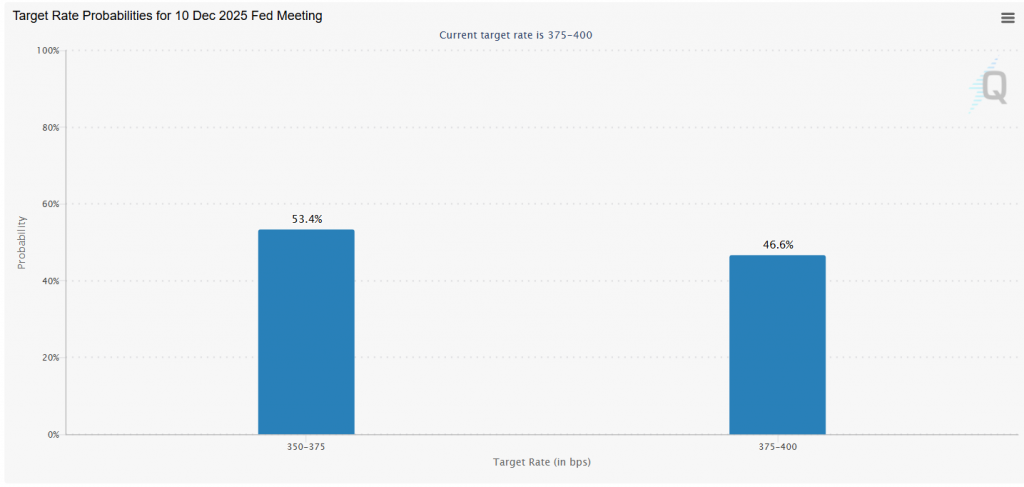

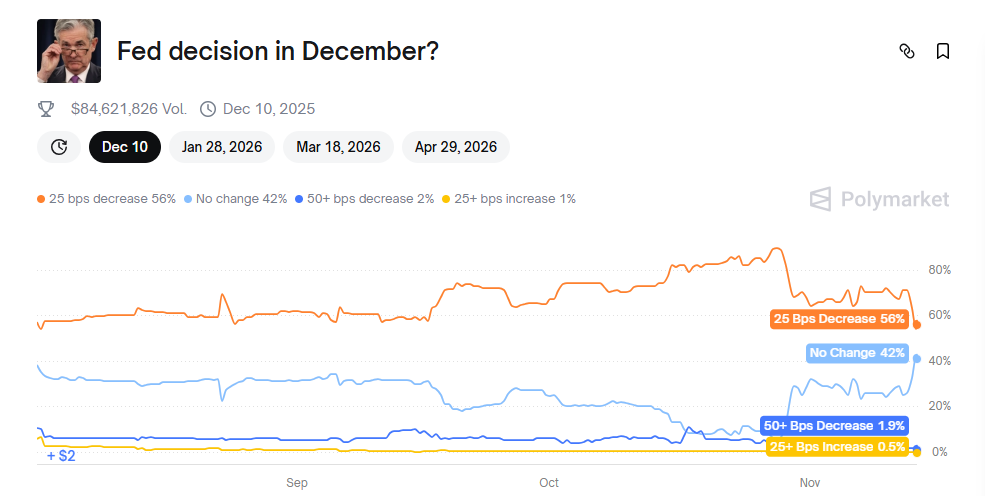

The wind is shifting for monetary policy, and it’s creating headwinds for crypto. The probability of a December Fed rate cut has plunged to just 53%, according to the CME FedWatch Tool, marking a new low after sitting as high as 70% last month.

December Fed Rate Cut Odds Plummet, Stalling Crypto Momentum

This growing uncertainty has put a lid on Bitcoin’s momentum, trapping the price in a tight range despite other positive catalysts like the ended government shutdown. With a 46% chance that rates hold steady, the market is now grappling with the possibility of only two rate cuts in 2025, leaving a key bullish macro driver in question.

Inflation Fears Drive the Fed’s Hawkish Pivot

So, why the sudden doubt? The narrative from Federal Reserve officials has turned decidedly more hawkish. Atlanta Fed President Raphael Bostic recently emphasized that inflation remains the “greater risk,” and he favors holding rates steady until there’s a clear path back to the 2% target. This sentiment is echoed by other key voices like John Williams and Austan Goolsbee, who have expressed concerns that inflation is stubbornly high. Their collective caution suggests the Fed is prioritizing its inflation fight over supporting the economy, making a December Fed rate cut far from a sure thing.

The Data Blackout Complicating the Picture

Making matters more complex is a significant data gap caused by the recent government shutdown. White House press secretary Karine Jean-Pierre indicated that key October data, including the Consumer Price Index (CPI) and jobs reports, may never be released. This leaves the Fed flying partially blind heading into its December meeting, likely encouraging a “wait-and-see” approach rather than an assertive rate cut. Without this critical inflation and employment data, the case for a preemptive cut is much harder to make.

Market Impact: Bitcoin’s Bullish Macro Backdrop Fades

The implications for crypto are direct. Bitcoin’s powerful rallies leading into the September and October cuts were fueled by the anticipation of looser monetary policy. Now, with the December Fed rate cut in serious doubt, that tailwind has vanished. This uncertainty is a primary reason BTC has struggled to break out of its consolidation, even with the resolution of the government shutdown. The market is stuck, waiting for the next clear signal from the Fed on the path of interest rates.

My Thoughts

While this delay is frustrating for bulls in the short term, it doesn’t break the long-term cycle. The Fed is still in a cutting cycle, just a slower one than the market hoped for. This pushes the timeline for the next major liquidity-driven rally further out, but it doesn’t cancel it. For now, crypto will need to find its footing based on its own organic catalysts—like ETF inflows and adoption trends—rather than relying on the Fed. Patience is key.