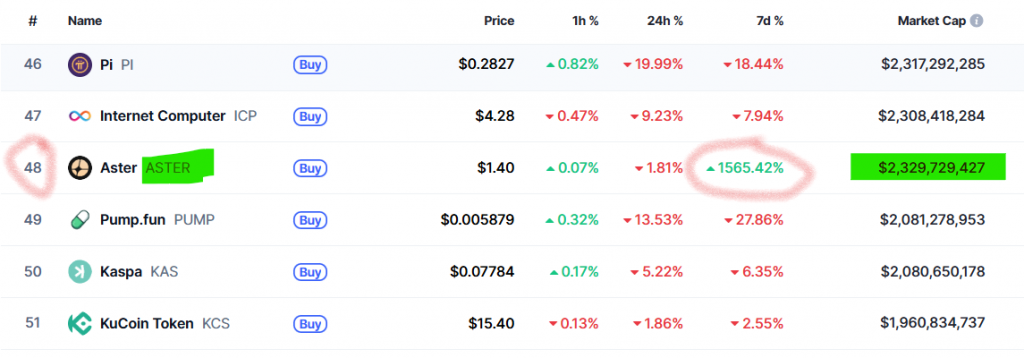

Aster DEX Roadmap Unveils Ambitious Path to Its Own Layer-1 Blockchain

The newly released Aster DEX roadmap charts an ambitious course through the first half of 2026, headlined by the launch of its own dedicated Layer-1 network, Aster Chain. This strategic shift from a standalone decentralized exchange to a full-fledged blockchain ecosystem signals a major expansion, with parallel development tracks targeting infrastructure, token utility, and community growth.

Infrastructure Track: Building the Foundation

The roadmap is structured across three simultaneous work streams. The Infrastructure track kicks off imminently with “Shield Mode” for private high-leverage trading and “Strategy Orders” using TWAP (Time-Weighted Average Price) for better execution in December 2025. This is quickly followed by upgrades to its real-world asset (RWA) and stock perpetual markets. The crown jewel, however, is Aster Chain. Its testnet is slated for late December 2025, with the mainnet Layer-1 launch targeting Q1 2026—a move poised to drastically reduce fees and increase scalability for the entire Aster ecosystem.

Token Utility & Ecosystem: Staking, Governance, and Smart Money

The utility of the native ASTER token is set for a massive upgrade. Q2 2026 is the focal point, introducing Aster Staking for APY rewards and Governance rights, empowering the community with direct protocol influence. Furthermore, the “Aster Smart Money” feature will allow users to copy-trade or mirror strategies from selected traders, integrating social trading directly onto the platform. Earlier in Q1, the team plans to launch “Aster Code” for developer integration and enhance fiat on-ramp/off-ramp support.

A Recap of Momentum and What It Means

This future vision builds on a solid 2025, which saw the merger of Astherus and ApolloX, the launch of multi-asset margin, a mobile app, and major CEX listings. The Aster DEX roadmap demonstrates a clear evolution from a derivatives DEX to a comprehensive, community-owned trading ecosystem.

My Thoughts

This is a savvy and necessary evolution. By launching its own Layer-1, Aster is directly tackling the high fees and network congestion that plague users on shared chains like Ethereum or Solana. This control over the underlying infrastructure allows for optimized performance and deeper integration of features like staking, governance, and copy-trading. It positions Aster not just as an app, but as a direct competitor to other trading-focused chains. If executed well, this roadmap could significantly increase protocol revenue and the fundamental value of the ASTER token.