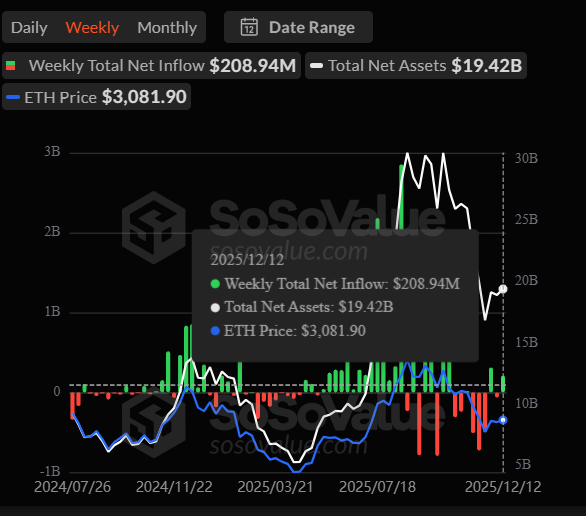

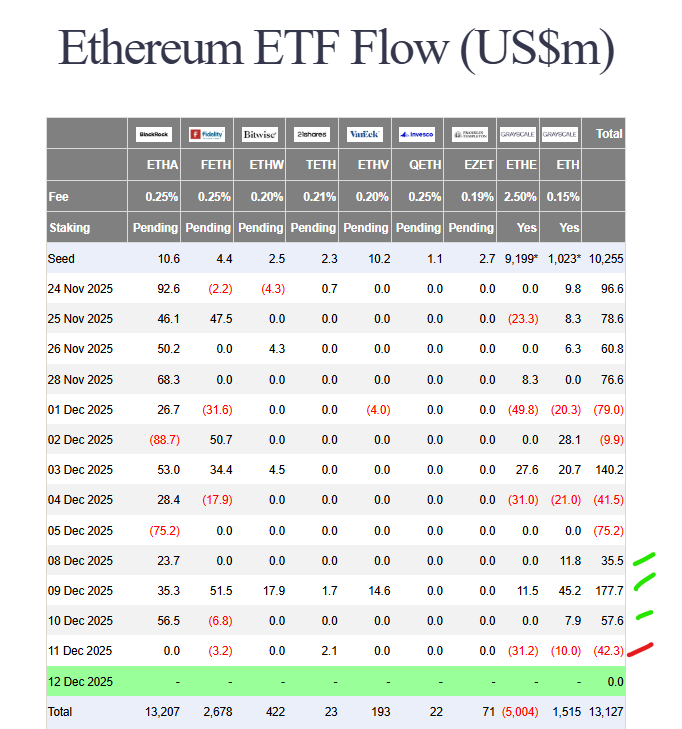

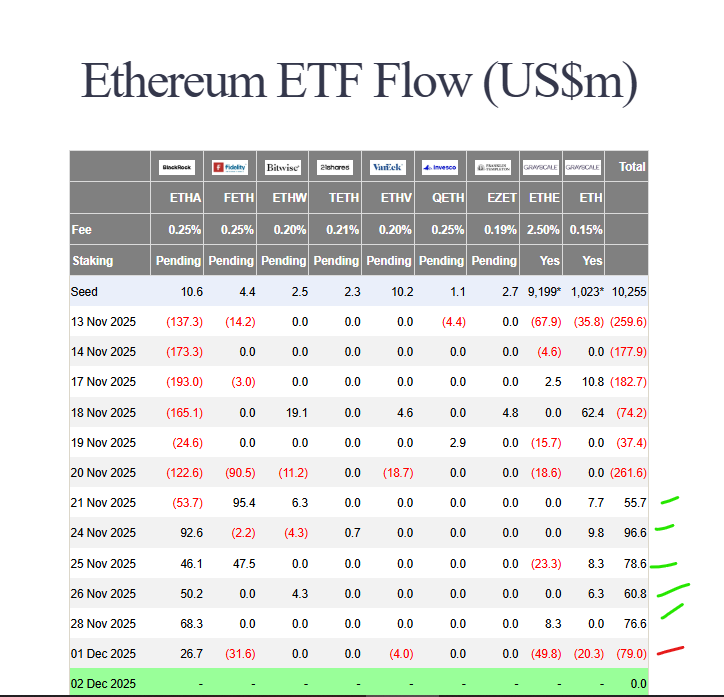

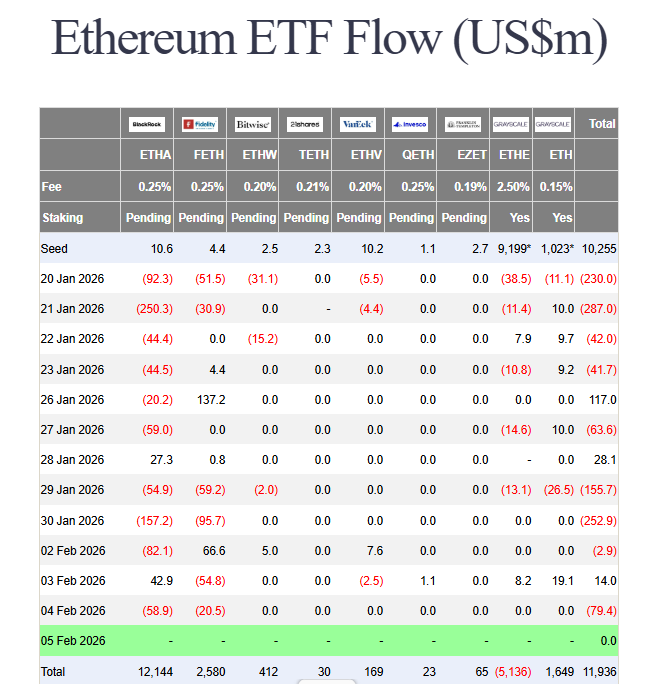

The Ethereum ecosystem is facing a convergence of selling pressure from its most prominent figures and its largest institutional vehicles. Co-founder Vitalik Buterin has sold 2,900 ETH ($6.6 million) over the past three days, according to on-chain data. This move coincides with another $79.5 million flowing out of spot Ethereum ETFs, deepening the bearish sentiment around the second-largest cryptocurrency.

Connecting the Dots: Founder Sales and Institutional Flight

Buterin’s recent transactions are part of a larger pattern of wallet activity, which experts often attribute to funding network projects. However, the timing exacerbates market fears. The sales align with significant institutional withdrawal, led by BlackRock’s and Fidelity’s Ethereum ETFs. This dual-layered selling—from a foundational figure and traditional finance—creates a powerful headwind for price recovery.

Furthermore, the selling isn’t isolated. Institutions like Trend Research are offloading holdings to cover losses, and even nation-states like Bhutan are moving Bitcoin holdings amid the downturn. The atmosphere is distinctly risk-off.

What’s Next for the Ethereum Price Outlook?

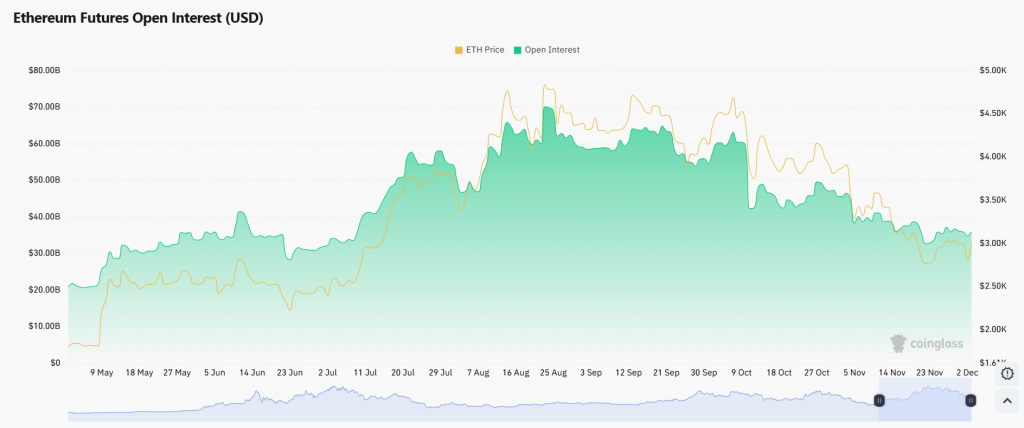

Currently, ETH is struggling to reclaim $2,100 after a severe drawdown, trading around $2,054. The Ethereum price outlook now hinges on a clash between negative momentum and future catalysts.

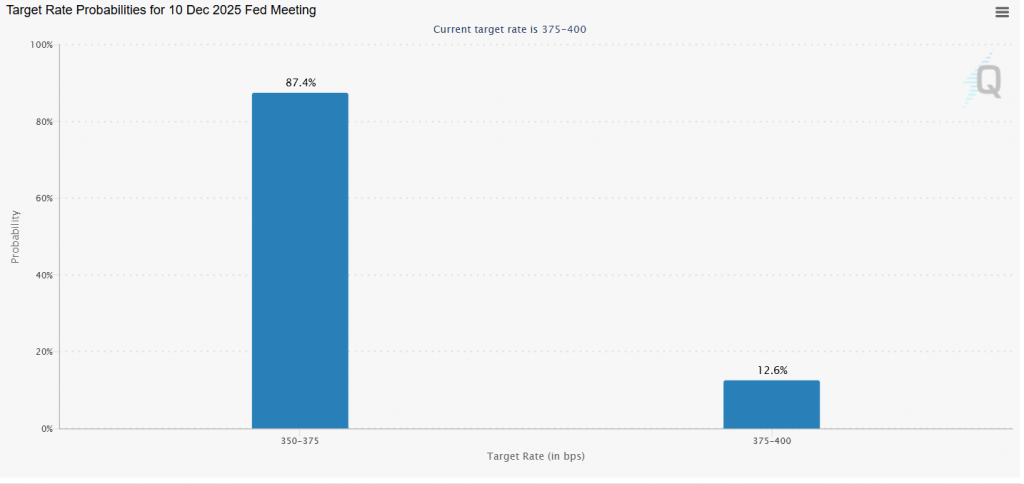

Bearish factors are clear: continued selling, Buterin’s public reconsideration of some Layer-2 networks, and weak ETF flows. The bullish case rests on the anticipated Fusaka upgrade and the potential for a broader macro shift. For a sustainable reversal, the market needs to see a stabilization in ETF flows and a clear narrative shift towards Ethereum’s upcoming technological improvements.

My Thoughts

This is a classic “weak hands vs. strong vision” moment. Buterin’s sales are likely for operational purposes, not a loss of faith, but the market perceives them bearishly. The current Ethereum price outlook is clouded by liquidity-driven selling, not a breakdown in fundamentals. For savvy investors, this panic creates opportunity. Once the ETF outflow trend exhausts itself and Fusaka development news ramps up, ETH could see a violent reversal. The time to watch is when selling no longer drives the price down—that’s the signal of a bottom.