Bearish Pressure Mounts: Analyzing the Sharp Ethereum Price Drop

The dam has broken for Ethereum. A significant Ethereum price drop has pushed ETH below the critical $3,000 psychological support level, marking a 4.6% decline in 24 hours. This move is fueled by a sudden exodus of institutional capital and a bearish technical breakdown, raising concerns about the immediate bullish structure. Let’s unpack the catalysts behind this sell-off.

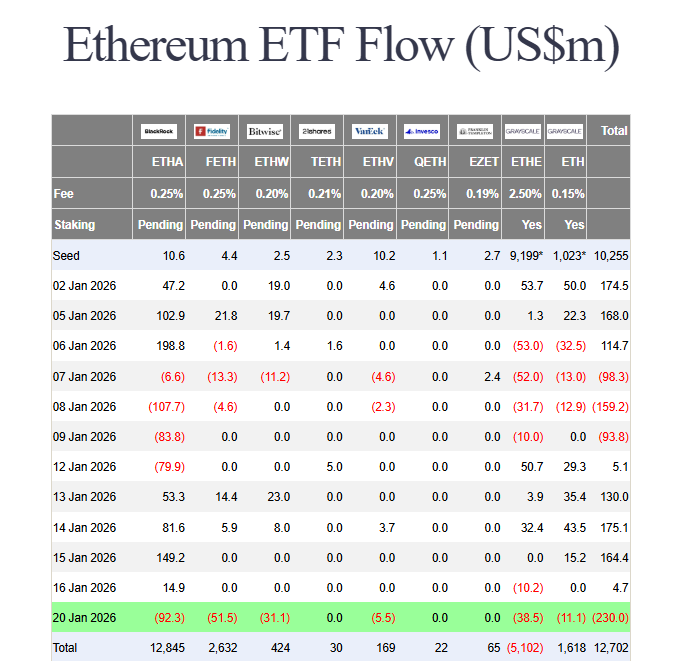

A primary driver is the stark reversal in ETF flows. After a five-day streak of inflows, U.S. spot Ethereum ETFs saw a massive $229.95 million net outflow in a single day. Heavyweights like BlackRock’s ETHA and Fidelity’s FETH led the redemptions. This sudden institutional pullback reduces immediate spot demand and shakes near-term trader confidence, directly contributing to the Ethereum price drop.

On-Chain Data vs. Price Action in the Ethereum Price Drop

Interestingly, on-chain data tells a more nuanced story. Despite the Ethereum price drop, exchange reserves have plunged to their lowest level since 2016, with balances on Binance continuing to fall. This indicates long-term holders are not rushing to sell their holdings onto exchanges. The selling appears concentrated among ETF traders and short-term derivatives players, not the core HODLer base.

Technically, the picture has weakened. ETH has decisively broken below its 20-day moving average, signaling fading short-term bullish control. Momentum is easing, with the RSI dipping into the low 40s. The next major support zone lies between $2,900 and $2,950. A failure to hold here could open the door to a deeper correction toward $2,750.

My Thoughts

This is a healthy, if painful, liquidity flush. The ETF outflow is concerning but likely represents short-term profit-taking and rotation, not a long-term exodus. The plummeting exchange reserves are the more important signal—they show the underlying supply is becoming scarcer. This Ethereum price drop feels like a final shakeout of weak hands before the next leg up, especially with the Dencun upgrade and ETF ecosystem still developing. Watch the $2,900 level closely; that’s the line between a dip and a deeper dive.