Ethereum Price Rally Explodes: ETH Surges 10% to $3,395 as Fed Catalyst Looms

A powerful Ethereum price rally is in full force, with ETH rocketing 10% to blast past $3,395. This explosive move shatters weeks of consolidation and arrives at the perfect moment: just hours before a highly anticipated Federal Reserve interest rate decision. The confluence of a bullish macro catalyst, a surging Bitcoin, and strong technicals has ignited a classic altcoin breakout.

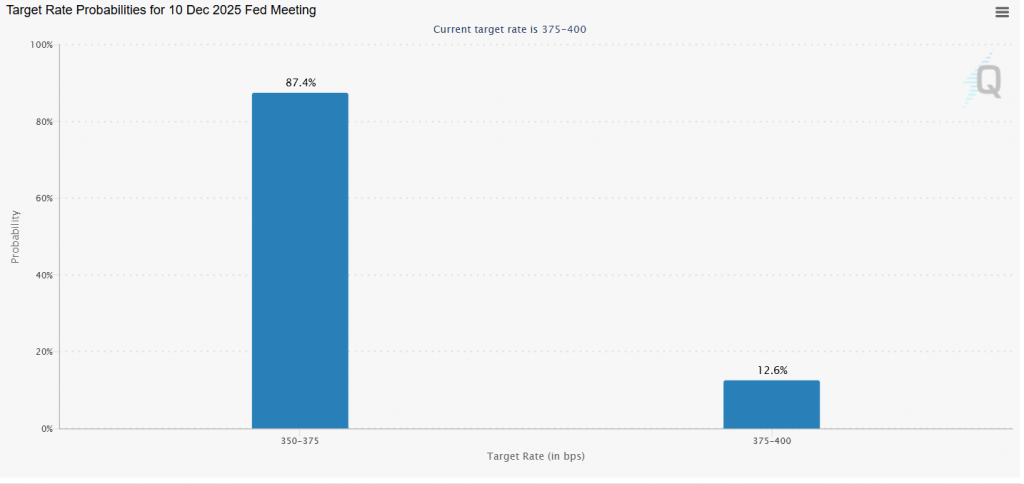

The Macro Rocket Fuel: An 89.6% Chance of a Fed Rate Cut

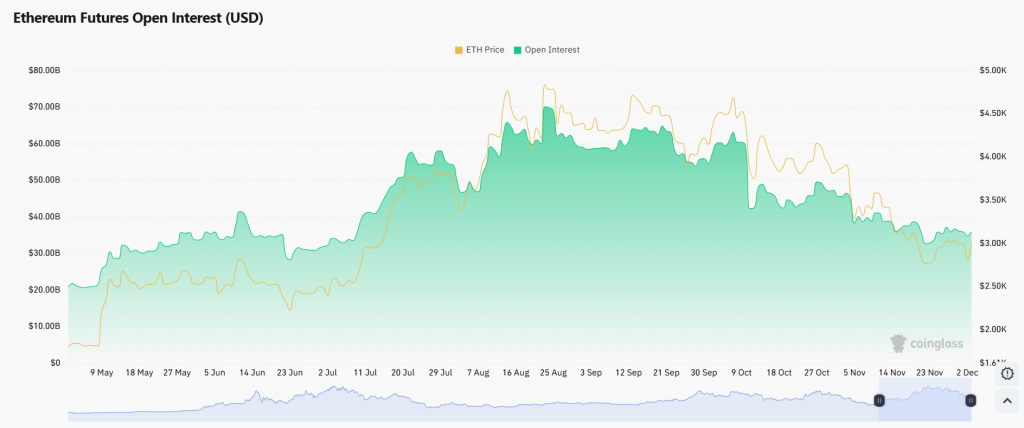

The primary engine for this surge is macroeconomic. Traders are pricing in an 87.5% probability that the Fed will cut rates by 25 basis points at tomorrow’s meeting. Lower rates weaken the U.S. dollar and act as a direct tailwind for liquidity-sensitive assets like Ethereum. The entire crypto market is rising in anticipation, with Bitcoin leading the charge above $94,000. This macro shift is providing the fundamental justification for a major breakout, pulling institutional and retail capital off the sidelines.

Technical Breakout Confirms the Bullish Momentum

The charts are displaying textbook bullish behavior. Ethereum has not only broken but shattered the key $3,300 resistance level on a powerful 4-hour candlestick. This is a clear technical victory for the bulls. The indicators support continued momentum: the MACD has executed a strong positive crossover, and the RSI, while high at 76, shows there’s still room for upward movement before becoming excessively overbought. The path is now clear for a test of the $3,500 resistance level.

Additional Tailwinds: A Rising Tide and Regulatory Progress

Ethereum isn’t moving alone. The rally is part of a broad-based market surge, with major altcoins like Solana and XRP also posting significant gains. Furthermore, the recent CFTC pilot program approving crypto assets like ETH for use as collateral in derivatives markets adds a layer of regulatory legitimacy and utility, boosting long-term institutional confidence.

My Thoughts

This is the breakout Ethereum holders have been waiting for. The alignment is perfect: a dovish macro catalyst is meeting a coiled technical spring. The Fed decision is the trigger, but the move is fueled by real buying pressure, as shown by the clean breakout candle. If the Fed delivers the expected cut and strikes a dovish tone, this Ethereum price rally could rapidly accelerate toward $3,500 and beyond, potentially leading the next phase of the altcoin season.