Ethereum Price Rebound Ignites as Mega-Whale Defies ETF Outflows

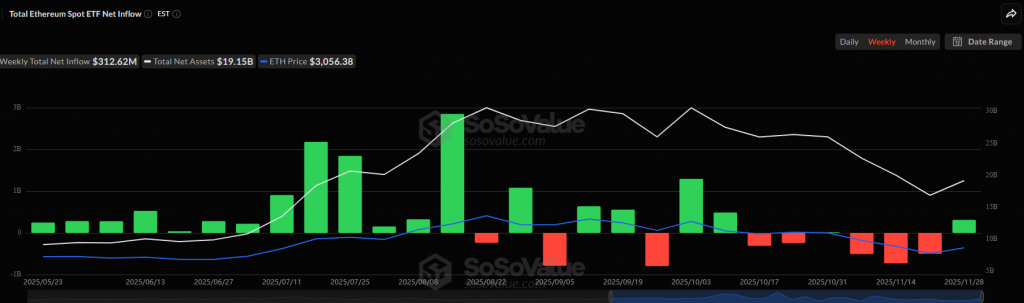

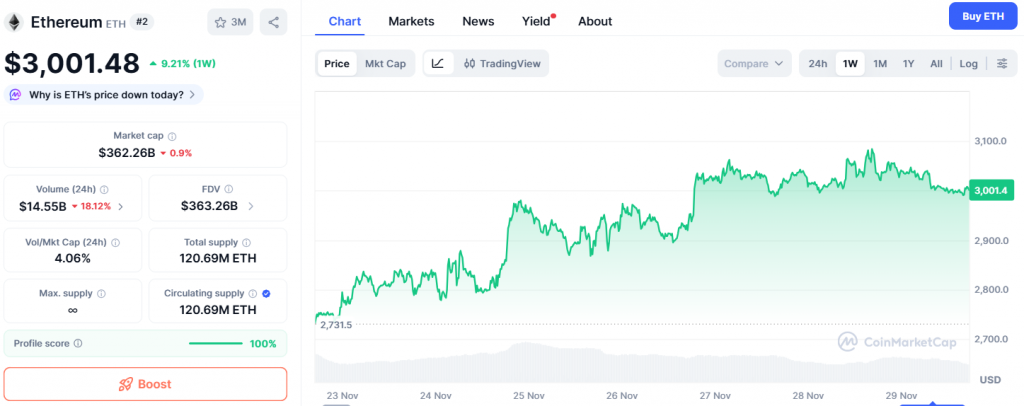

A resilient Ethereum price rebound is in motion, with ETH climbing back above $3,200 and shaking off post-FOMC volatility. This recovery is unfolding despite a surprising shift: spot Ethereum ETFs recorded their first daily net outflows this week. The bullish divergence between price action and institutional flows tells a compelling story—one dominated by a single, colossal whale whose accumulation might be more powerful than entire ETF books.

Technical Battleground: The $3,400 Breakout Line

The immediate chart narrative is clear. Ethereum is once again challenging the major resistance wall at $3,400. A decisive daily close above this level is the critical technical trigger that analysts say could open a clear path toward $3,700 – $3,800. Failure here, however, risks a retest of the $3,000 foundational support. This juncture is amplified by BitMine Chairman Tom Lee’s ultra-bullish stance, arguing that ETH at $3,000 is “largely undervalued” and forecasting a potential mega-rally to $22,000 if historical ratios to Bitcoin reassert themselves.

Whale vs. ETF: A Tale of Two Institutions

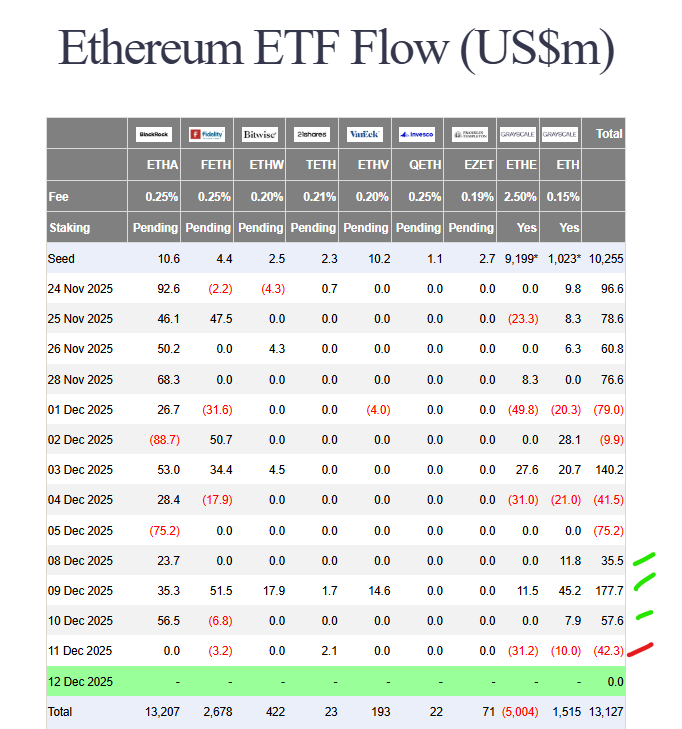

While ETF data showed $42.3 million in net outflows on Thursday, led by Grayscale’s products, on-chain activity revealed a staggering counter-force. The BitcoinOG whale “1011short” now holds a position of 150,466 ETH (worth ~$491M) and has placed limit orders to buy another 40,000 ETH between $3,030 and $3,258. This isn’t just holding; it’s aggressive, targeted accumulation into weakness. It demonstrates that for some sophisticated players, this dip is a strategic gift, outweighing the short-term flow trends from the broader ETF complex.

Historical Precedent: On-Chain Data Hints at a Major Bottom

Critical on-chain analysis supports the bullish case. CryptoQuant shows Ethereum’s price is trading near the realized price of whales holding over 100K ETH. Historically, this has been a rare and powerful signal. In the past five years, ETH has only traded near this metric 4 times, and each instance preceded a massive bounce. This pattern suggests the current zone represents a high-conviction accumulation area for the largest and most informed entities in the market.

My Thoughts

This is a masterclass in reading beyond headline flow data. The ETF outflows likely represent short-term tactical moves or profit-taking, but the whale’s half-billion-dollar bet represents a long-term structural view. When price holds firm despite apparent selling pressure, it often means stronger hands are absorbing the supply. The convergence of the key technical level ($3,400), the historical on-chain signal, and insane whale conviction creates a potent setup. If Ethereum Price rebound conquers $3,400, the short squeeze could be explosive.