Ethereum Price Reversal: The Perfect Bullish Storm Is Forming

Beneath the surface of recent market turbulence, a powerful Ethereum price reversal is quietly brewing. A convergence of three explosive factors—a historic supply squeeze, the return of relentless institutional buying, and a classic bullish chart pattern—suggests Ethereum is consolidating for a potentially massive upward surge in the coming weeks. For savvy investors, this is the calm before the storm.

Factor 1: The Great Supply Squeeze

The most bullish fundamental signal is a staggering supply shock. The amount of ETH held on centralized exchanges has plummeted to a record-low 8.7%—the lowest level since the network’s launch. This supply is being pulled into three powerful sinks: staking, restaking protocols, and corporate treasuries like BitMine (which just bought another $73.2M worth). This drastic reduction in readily sellable ETH means that even modest demand can create disproportionate upward price pressure.

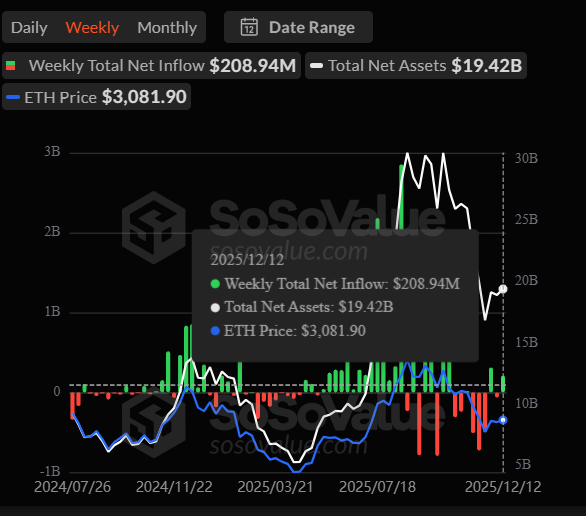

Factor 2: Institutional Demand Roars Back

After a brief pause, the smart money is flooding back in. U.S. spot Ethereum ETFs have snapped back with a vengeance, recording $209 million in net inflows over the past week. This proves that institutions view current prices as a strategic entry point, not an exit signal. This consistent, regulated buying provides a formidable floor and a catalyst for the next leg up.

Factor 3: The Technical Blueprint for a Breakout

The weekly chart reveals a textbook inverse head and shoulders pattern—one of the most reliable bullish reversal structures in technical analysis. Ethereum has also reclaimed the crucial 50-day moving average, and its RSI is curling upward from neutral territory, indicating building momentum. This alignment suggests the downtrend is exhausting itself and a new bullish phase is beginning.

The Roadmap: Targets and Key Levels

The immediate technical target for this Ethereum price reversal is $3,600, aligning with the key 61.8% Fibonacci retracement level. A break above this could unlock a much larger rally. On the downside, critical support to watch is $2,760; as long as ETH holds above this level, the bullish structure remains intact.

My Thoughts

This is the most compelling bullish setup ETH has seen in months. The supply drop is structural and irreversible in the short term, the ETF inflows are persistent, and the technical pattern is high-probability. When these three pillars align, the resulting move is typically explosive. While macro noise may cause short-term volatility, the underlying trajectory for Ethereum is now decisively pointing upward. The reversal isn’t just coming; it’s being built on-chain right now.