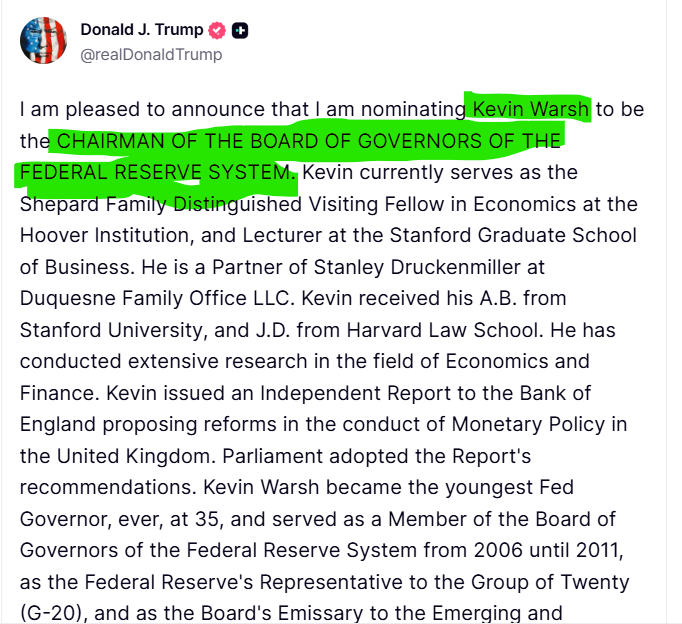

In a move poised to reshape the financial landscape, President Donald Trump has officially nominated former Fed Governor Kevin Warsh as FED chair. This decision, announced via Truth Social, signals a potential seismic shift for monetary policy and, crucially, for the crypto industry. With Jerome Powell’s term ending in May, Warsh’s perceived pro-crypto stance introduces a new variable into the market’s equation.

Why the Kevin Warsh Fed Chair Nomination Matters for Crypto

Kevin Warsh has publicly diverged from the current Fed’s often-ambiguous stance on digital assets. He has previously praised Bitcoin as a store of value comparable to gold and acknowledged its potential utility for policymakers. This perspective starkly contrasts with Chair Powell, who has consistently avoided deep commentary on crypto. Warsh’s nomination is therefore interpreted as a regulatory and philosophical win for the asset class, potentially fostering a more innovation-friendly environment at the highest levels of finance.

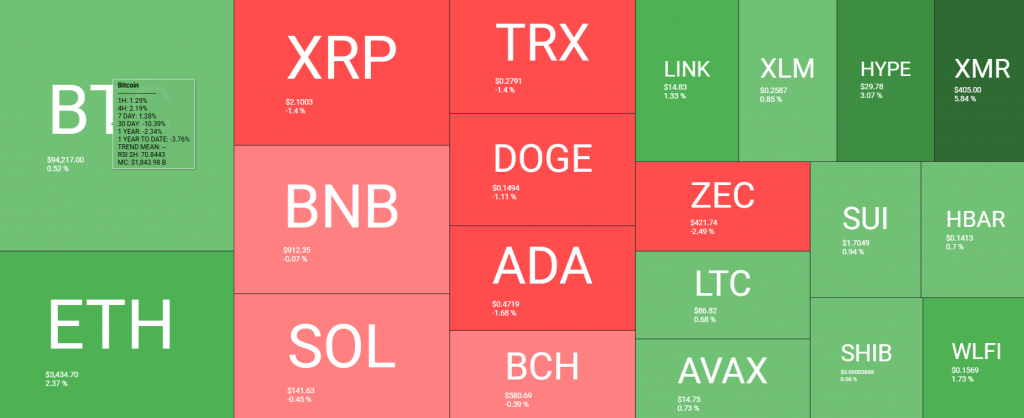

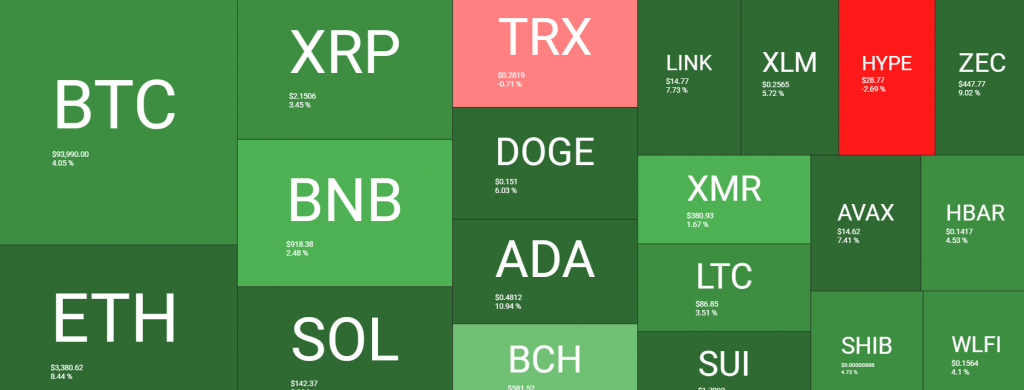

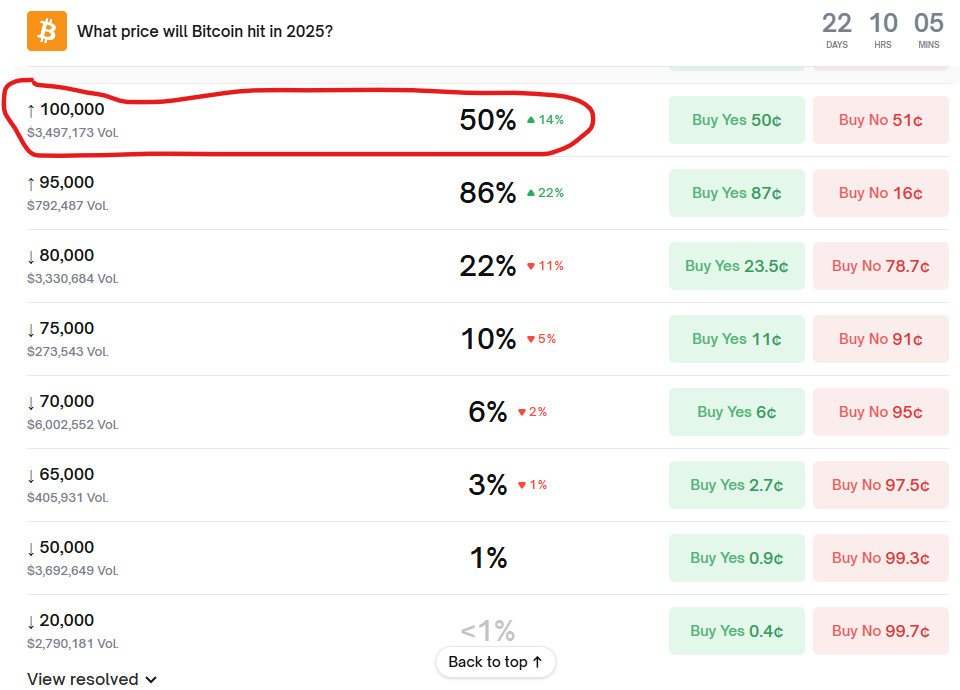

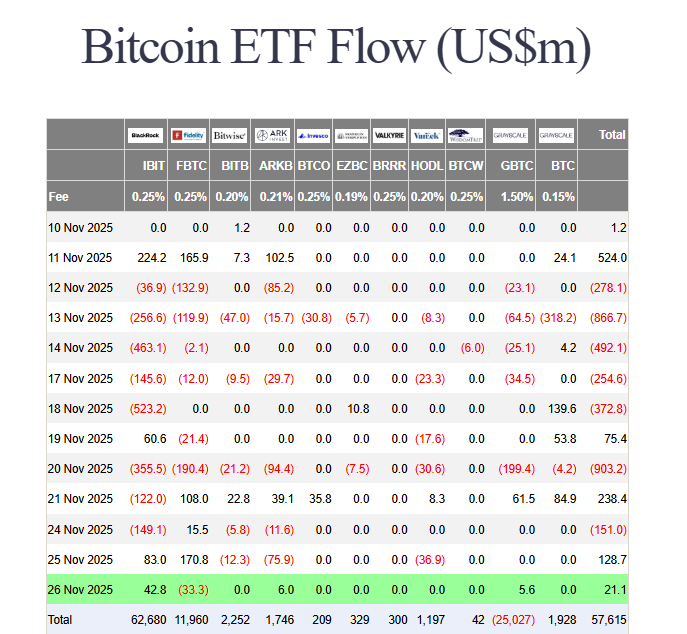

However, the immediate market reaction was muted. Bitcoin briefly touched $83,000 on the news before settling just below that level. The larger trend remains dominant, with BTC still down over 5% year-to-date after a sharp pullback from its January highs.

Monetary Policy Uncertainty and Market Expectations

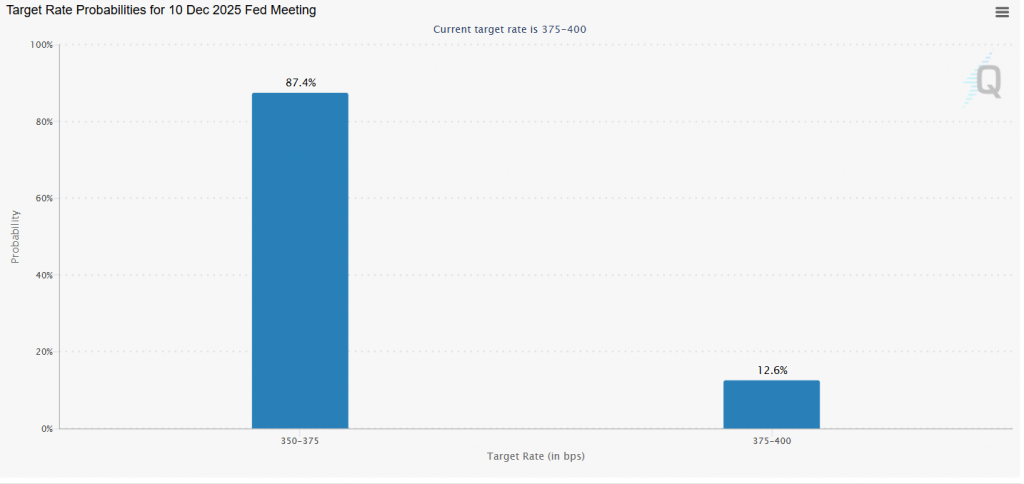

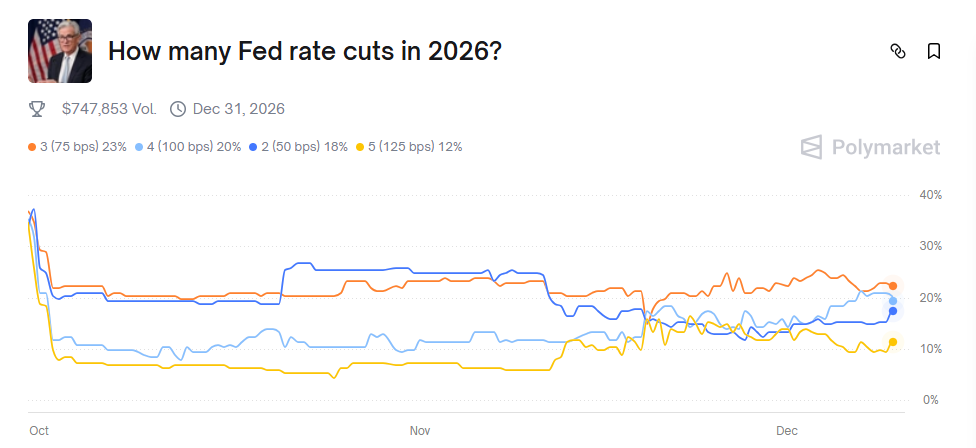

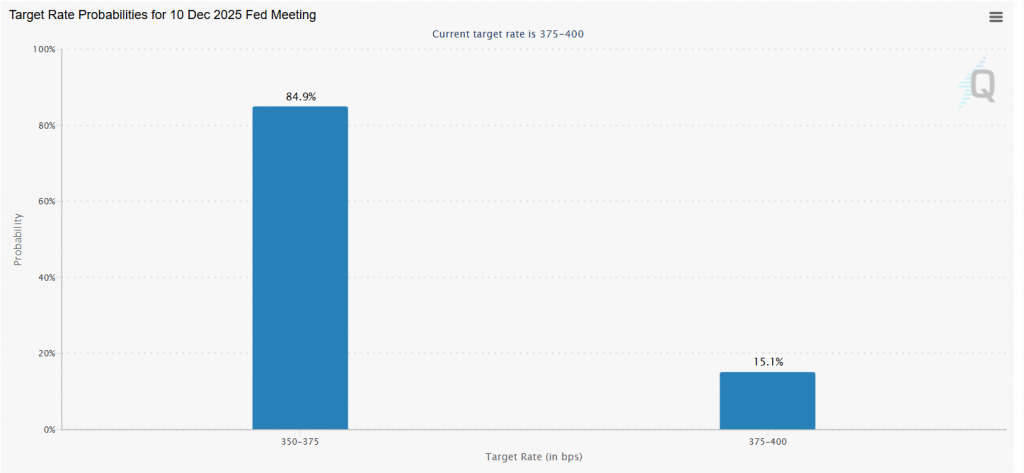

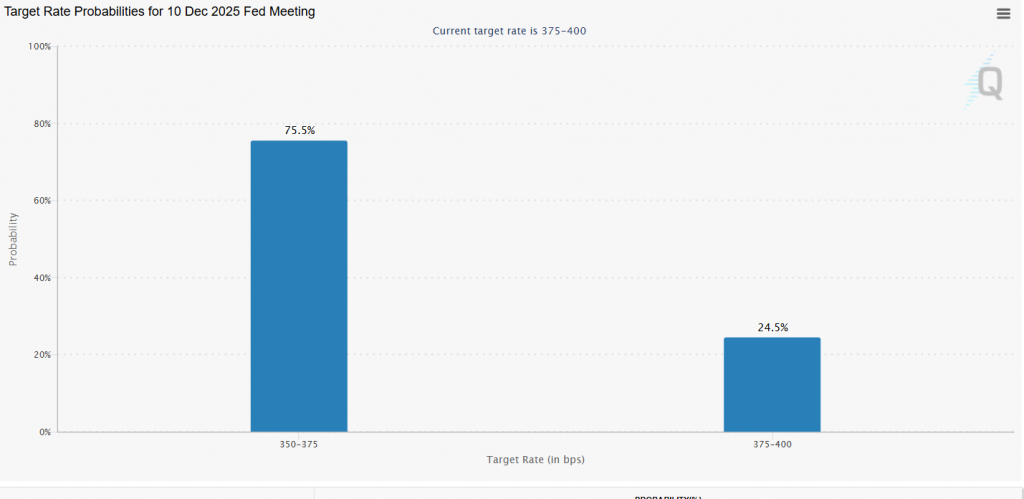

While crypto-friendly, Warsh’s monetary policy leanings introduce complexity. Traders on platforms like Polymarket are still pricing in three rate cuts for 2024, with the first expected at the June FOMC meeting—Warsh’s potential debut. Trump has publicly demanded immediate rate cuts, pressuring the incoming Chair.

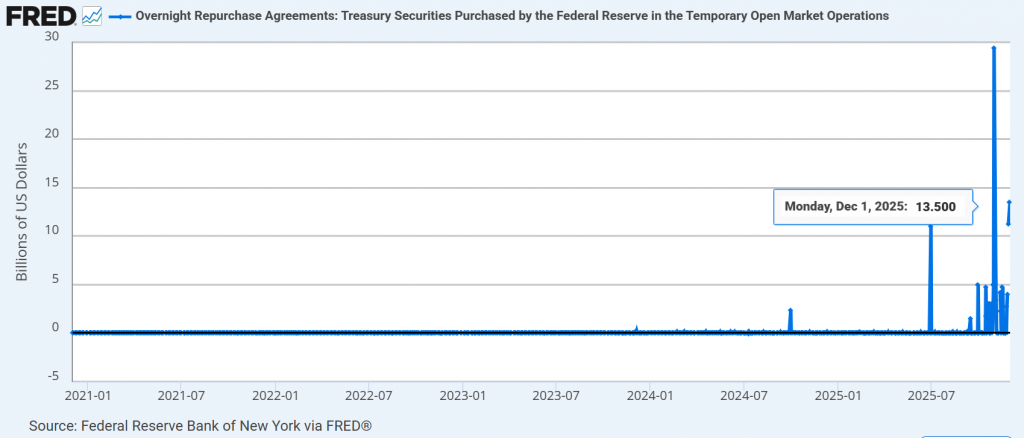

Yet, analysts note Warsh is historically considered more hawkish than other candidates and a proponent of a smaller Fed balance sheet. This suggests aggressive quantitative easing (QE) is unlikely, creating a potential tug-of-war between political pressure for easing and a more conservative approach to monetary expansion.

My Thoughts

This is a long-term structural bullish signal for crypto, but not a short-term trading catalyst. Warsh’s nomination reduces regulatory tail risk at the Fed and integrates crypto into mainstream macroeconomic discourse. However, his primary mandate will be battling inflation and managing the dollar, not boosting Bitcoin. The real impact will unfold over years through subtle shifts in tone, research, and openness to digital currency integration. For now, it’s a reason for cautious optimism within a still-fragile market.