Fed Rate Cut Delivered as Expected, But “Stealth QE” Steals the Show

The third Fed rate cut of 2025 is now official, but the real market-moving news lies in an unannounced pivot toward liquidity injection. While the Federal Reserve lowered rates by 25 basis points as predicted, its simultaneous launch of a $40 billion Treasury bill purchase program represents a “stealth” form of quantitative easing (QE) that could unleash a powerful wave of capital into risk assets like crypto.

The Decision: A Hawkish-Dovish Tightrope

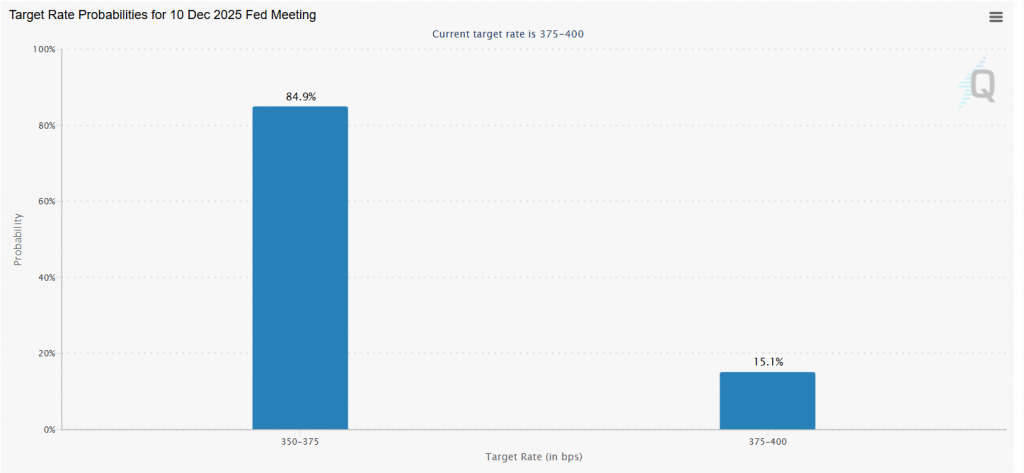

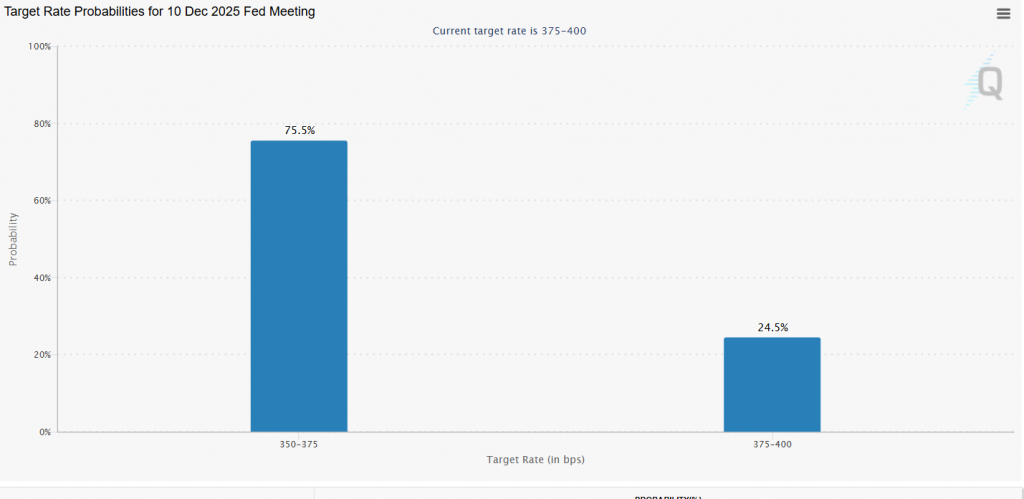

The FOMC voted 9-3 to cut the target range to 3.50%-3.75%, aligning with the 90% probability priced in by markets. However, the dissenting votes reveal underlying tension: two members wanted no cut, while one advocated for a more aggressive 50 bps reduction. This split sets the stage for Fed Chair Jerome Powell’s press conference, where he must balance acknowledging softening labor data (justifying cuts) against still-stubborn inflation above the 2% target. The committee’s median projection suggests only one more cut in 2026, signaling a cautious, data-dependent path ahead.

The Bigger Story: “Stealth QE” via $40B T-Bill Purchases

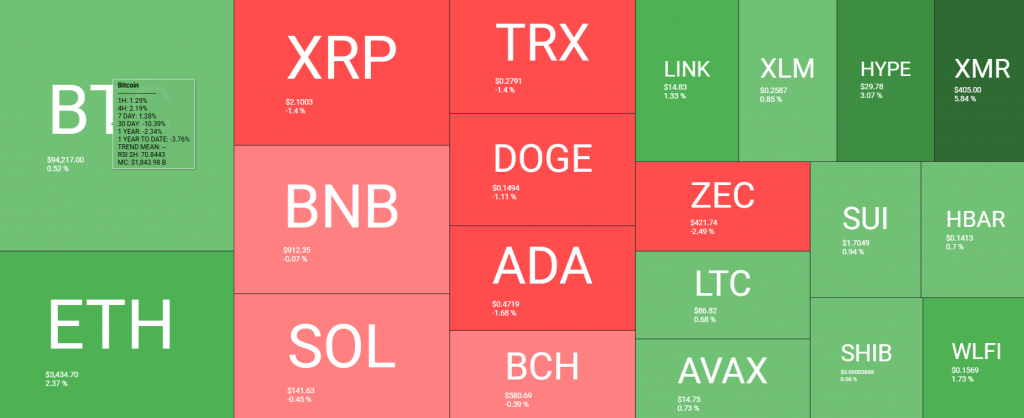

Beyond the rate cut, the Fed’s balance sheet move is crucial. Starting December 12, the central bank will purchase up to $40 billion in Treasury bills over 30 days. Experts are calling this “Reserve Management” that functions identically to QE—it directly injects liquidity into the financial system’s plumbing. For crypto, this is a fundamental bullish catalyst. More dollar liquidity historically weakens the currency and strengthens alternative, scarce assets like Bitcoin and Ethereum.

Market Impact: Short-Term Caution, Long-Term Tailwinds

Immediately, the market’s focus will parse Powell’s tone. A hawkish emphasis on inflation vigilance could cause short-term volatility. However, the structural reality is clear: the easing cycle is underway, and the Fed’s balance sheet is expanding again. This combination creates a powerful macro tailwind for crypto. The Fed rate cut lowers the opportunity cost of holding non-yielding assets, while the T-bill purchases add fresh dollars to the system seeking returns.

My Thoughts

The Fed is trying to have it both ways: a cautious, “hawkish cut” on rates while quietly turning the liquidity taps back on. For savvy crypto investors, the T-bill purchase is the true headline. It confirms that upward pressure on asset prices is an explicit policy outcome. While Powell may talk tough to manage inflation expectations, the Fed’s actions speak louder—liquidity is coming. This environment is ideal for Bitcoin’s “hard asset” narrative and should fuel the next leg of the institutional adoption cycle. Short-term noise, long-term signal: bullish.