Ethereum Breaks $3,000 as Historic Fusaka Upgrade Activates

Ethereum has powerfully reclaimed the $3,000 threshold, fueled by the successful activation of the long-anticipated Fusaka upgrade. This isn’t just a routine network update; it’s the foundational step toward Ethereum’s original sharding vision, finally delivering scalable data availability through PeerDAS. The market is celebrating, but derivatives traders are hinting at caution.

The Fusaka Upgrade: A Dream Realized Since 2015

Ethereum co-founder Vitalik Buterin declared this a historic moment, noting that sharding has been a core dream since the network’s inception. The star of the Fusaka upgrade is PeerDAS (Peer Data Availability Sampling). This tech allows the network to validate blocks without any single node processing all the data, a massive leap for scalability and security. Vitalik was transparent about remaining bottlenecks—like L1 throughput and the lack of a sharded mempool—but framed the next two years as a refinement period to scale L2s and, eventually, Ethereum L1 itself.

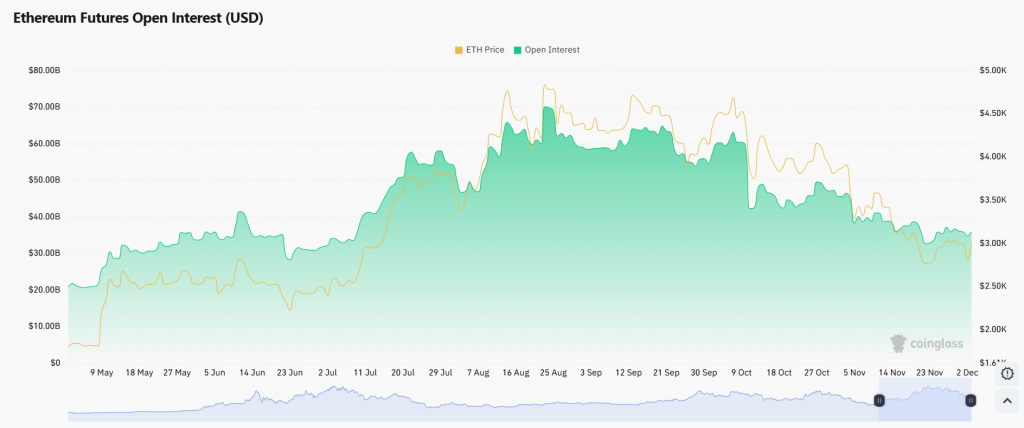

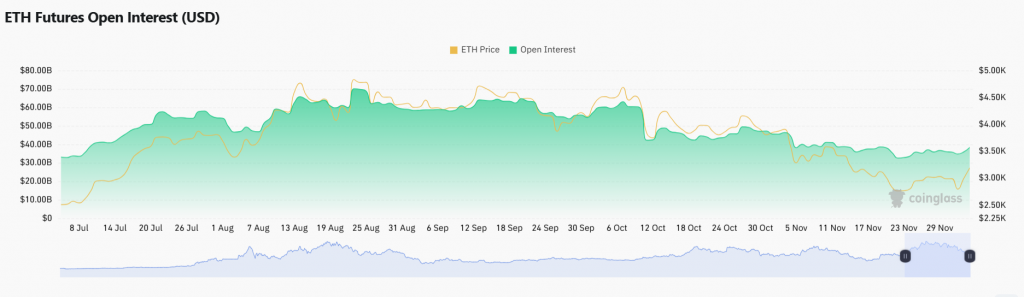

Trader Sentiment: Cautious Despite the Breakout

Interestingly, the spot price rally isn’t mirrored by rampant bullish leverage. Derivatives data reveals a cautious undertone. While trading volume rose, open interest barely budged, and the long/short ratio sits below 1. This means new futures positions are leaning short, suggesting traders are wary of a quick pullback. The market is respecting the technical breakthrough but betting on volatility rather than a straight moonshot.

ETH Price Forecast: Key Levels to Watch

Technically, Ethereum is now battling to convert the $3,125 level from resistance into support. A decisive close above this opens a clear path toward $3,160 and potentially $3,240. The RSI is in a healthy mid-range, indicating room to run without being overbought. Strong support now lies between $2,880 and $2,950. The balance of power will hinge on whether spot buying can overwhelm the skeptical futures market.

My Thoughts

Fusaka is monumental for Ethereum’s roadmap. This isn’t a speculative feature; it’s the essential infrastructure for L2s to become cheaper and more efficient, directly enabling the next wave of mass adoption. The cautious derivatives positioning is actually healthy—it prevents a leverage-driven bubble and sets up potential short squeezes on further positive momentum. The real price explosion will likely come as developers leverage PeerDAS to roll out tangible user benefits in the coming months.