A major cloud of macroeconomic uncertainty is finally lifting! The U.S. Senate has taken a decisive step to ensure the government shutdown ends , voting 60-40 to advance a funding bill and break a weeks-long political stalemate.

Government Shutdown Ends: Senate Breakthrough Ignites Crypto Relief Rally

This procedural victory, known as invoking “cloture,” paves the way for a final vote and a full reopening of federal agencies as early as this week. For the crypto market, which has been starved for regulatory clarity and bruised by fear, this is the powerful catalyst it needed to spark a decisive relief rally.

The Path to Reopening: What Happens Next

The Senate’s breakthrough is the critical first step. A final vote, requiring only a simple majority, is expected as soon as Monday, November 10. Following that, the House of Representatives plans a swift “one-day-and-out” session to pass the bill, potentially reopening the government by November 12. This bipartisan cooperation doesn’t just fund the government; it signals a return to political normalcy. A calmer, functioning Washington D.C. is a net positive for all financial markets, reducing the systemic risk that has kept many institutional investors on the sidelines.

Instant Market Impact: Crypto Breathes a Sigh of Relief

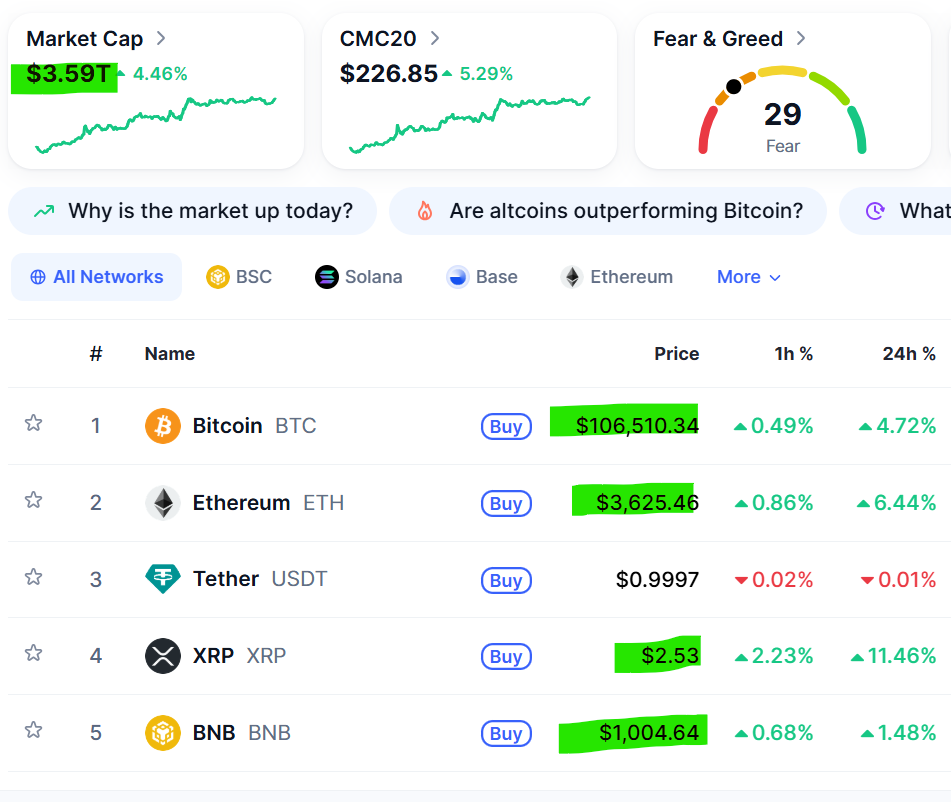

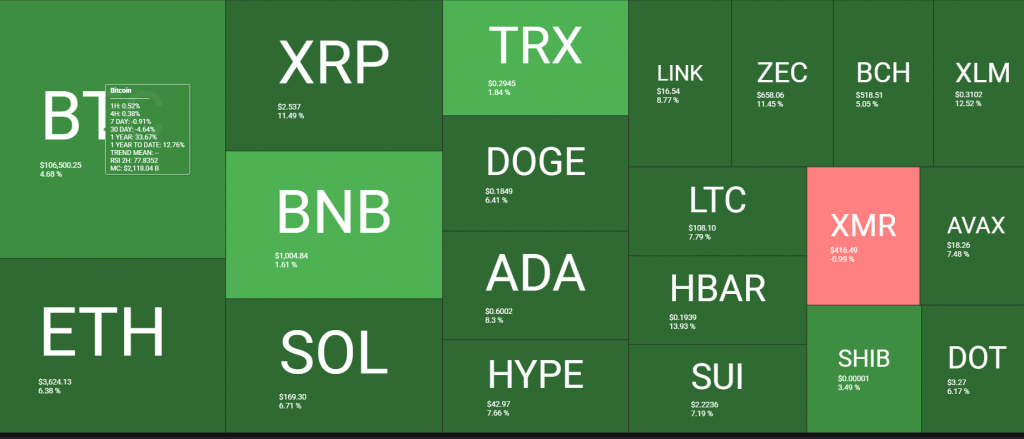

The market’s reaction was immediate and powerful. The mere prospect of the government shutdown ending injected a fresh wave of confidence into digital assets. The global crypto market cap jumped 4.46% to $3.59 trillion. Bitcoin, which had been struggling below $100,000, surged past $106,000. Ethereum reclaimed the $3,600 level. This bullish momentum proves that the underlying strength of the crypto market was being suppressed by political gridlock, not a lack of demand. With this overhang removed, assets are quickly repricing.

Why the Government Shutdown Ending is a Major Bullish Catalyst

The government shutdown ends a period of regulatory paralysis. Key agencies like the SEC and CFTC were operating with skeleton crews, bringing approvals and market oversight to a near-standstill. This created an environment of uncertainty that is toxic for institutional capital. A functioning government means these agencies can resume their work, potentially unlocking progress on pending ETF applications and providing the regulatory clarity the industry has been demanding. This opens the door for the next wave of institutional adoption.

My Thoughts

This is the macro all-clear signal we’ve been waiting for. The shutdown was an artificial anchor on market sentiment. Its resolution removes a major headwind and allows the market to focus on crypto’s powerfully bullish fundamentals again. I expect this rally to have legs, potentially pushing Bitcoin back toward the $115,000 resistance level as sidelined capital floods back in. The fear is over; it’s time for greed.