HBAR Price Decline Worsens, Breaking Critical Support Amid Ecosystem Stagnation

The HBAR price decline has intensified sharply, with Hedera’s token falling for six straight days to breach a crucial support level not seen since October. This breakdown below $0.1250—a level that held firm in April, June, and November—signals a disturbing shift in market structure and coincides with mounting evidence that the network’s ecosystem growth has stalled, creating a perfect storm of technical and fundamental weakness.

Technical Breakdown: Bears Seize Full Control

The charts show a clear and concerning capitulation. HBAR has now collapsed 63% from its September peak and trades below all major moving averages and the Supertrend indicator. The breakdown of the $0.1250 support confirms bears have overwhelming control. With the RSI and other momentum oscillators still pointing down, the path of least resistance is firmly bearish, targeting the next significant psychological level at $0.10. A break below this could trigger another wave of liquidations and steeper declines.

Fundamental Stagnation: An Ecosystem in Retreat

This HBAR price decline is rooted in troubling on-chain data. The ecosystem shows clear signs of contraction:

- No new dApps have launched in months.

- Total Value Locked (TVL) has crashed to $126M from a yearly high of $350M.

- Stablecoin supply has plummeted from $250M to just $74M, a stark contrast to the booming broader stablecoin market.

This data suggests developer activity and capital are exiting, not building, on Hedera.

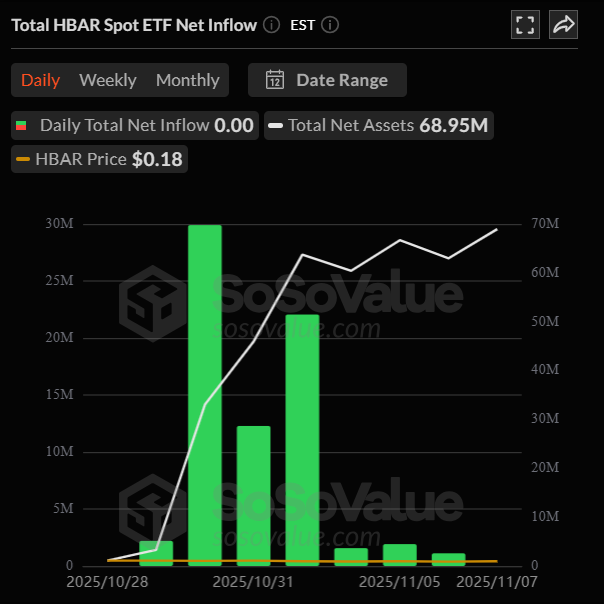

ETF Demand Fails to Materialize

The anticipated institutional catalyst has fizzled. The Canary Hedera ETF has seen zero inflows for three consecutive days, with assets stuck at $57M. This stagnation stands in stark contrast to the consistent inflows seen by Solana and XRP ETFs, indicating U.S. investors are currently bypassing HBAR for other altcoin opportunities.

My Thoughts

This is a severe but honest market repricing. The HBAR price decline reflects a reality where technical breakdowns and fundamental stagnation are reinforcing each other. The market is punishing the lack of ecosystem momentum. For a reversal, HBAR needs to reclaim $0.1250 as support and show a clear resurgence in developer activity and capital flows. Until then, this remains a “show me” story in a highly competitive layer-1 landscape. Patient accumulation may only make sense if clear signs of ecosystem revival emerge.