Fed Rate Cut Odds Hold Firm at 87% After Powell’s “Silent” Speech, Bitcoin Bounces

In a classic case of “no news is good news,” Bitcoin found relief after Federal Reserve Chair Jerome Powell deliberately avoided all comments on the economy or monetary policy in his Stanford speech. With the Fed in its pre-meeting blackout period, Powell’s silence was expected, but it provided enough certainty for a 2% Bitcoin bounce above $87,000. Meanwhile, Fed rate cut odds continue to hover near an overwhelming 87%, fueled not by the Chair’s words, but by glaring economic weakness revealed in fresh data. The stage is now set for a pivotal December 10 decision.

Weak Economic Data Cement High Fed Rate Cut Odds

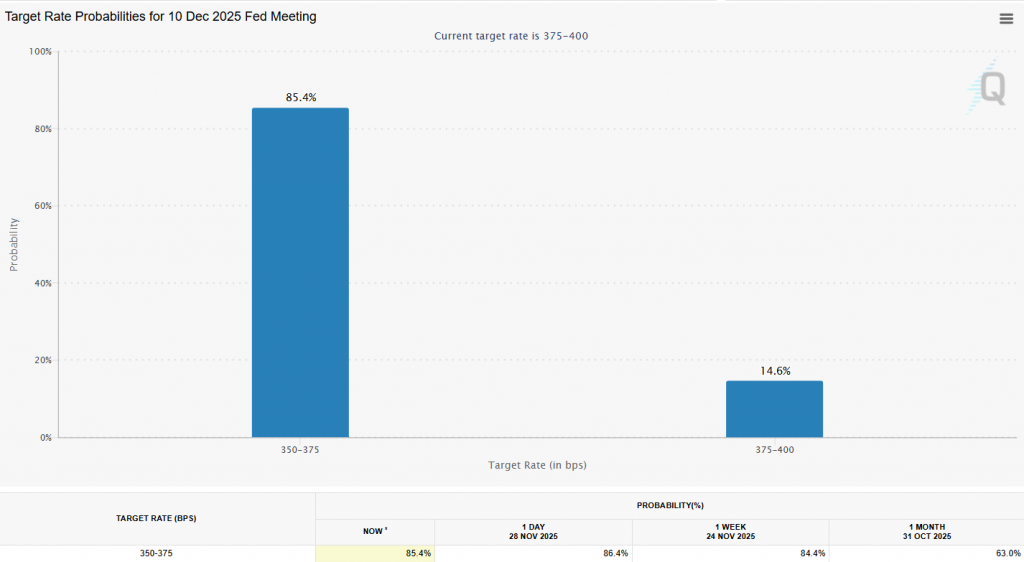

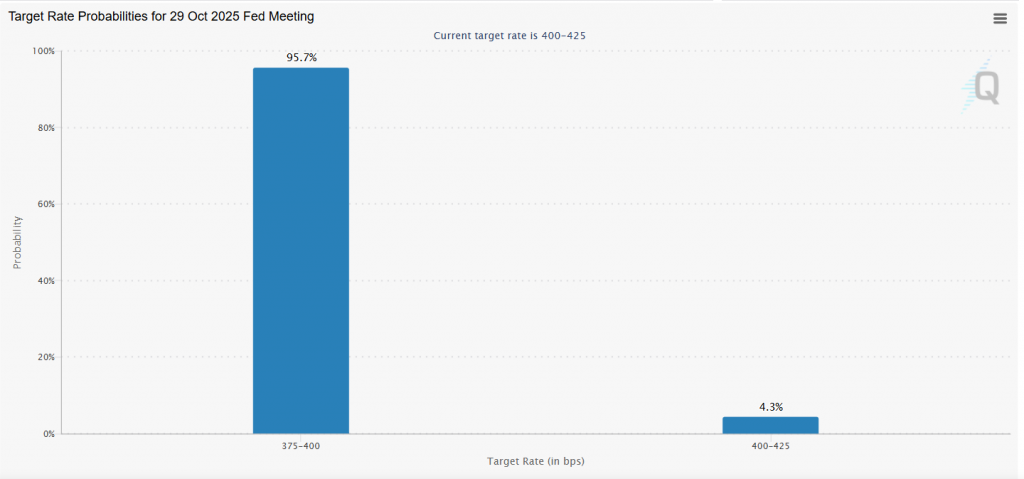

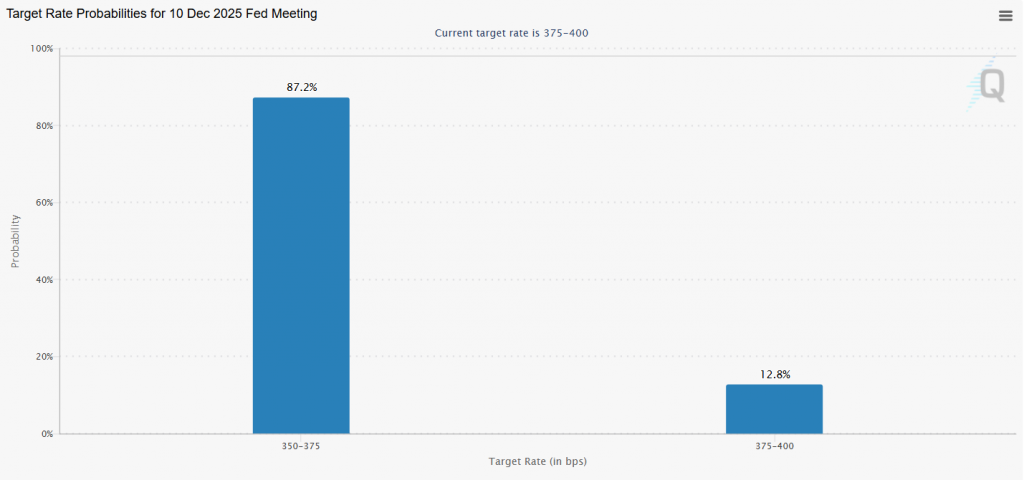

The real story isn’t Powell’s silence; it’s the screaming data. The latest ISM Manufacturing PMI came in at 48.2, marking the ninth straight month of contraction and sinking to a four-month low. This indicates slumping factory orders and rising prices—a direct result of tariffs. For the Fed, this weakens the argument for holding rates steady. Consequently, Fed rate cut odds have solidified near 87%, as the market views a deteriorating manufacturing sector as a clear signal for the central bank to provide stimulus. The potential future appointment of noted dove Kevin Hassett as the next Fed Chair only adds to the easing narrative.

Bitcoin’s Technical Rebound and Trader Sentiment

Bitcoin capitalized on the stable macro outlook, climbing to $86,970 with a daily high near $87,325. Trading volume remains elevated, showing tangible “buy-the-dip” interest. However, the derivatives market tells a more nuanced story. While total Bitcoin futures open interest rose slightly to $57.70 billion, activity was mixed across exchanges—CME saw an increase while Binance and Bybit saw declines. This suggests institutional players on regulated venues may be leading this cautious rebound. As trader Joe Saluzzi noted, the conditions support an uptrend, possibly “more of a grind up to the end of the year.”

My Thoughts

The market is trading the certainty of a narrative. Powell’s silence was a gift—it removed potential hawkish surprises. With Fed rate cut odds this high, the market is essentially pricing in the easing already. This creates a “sell the rumor, buy the news” risk for next week, but the path of least resistance until then is up. The combination of weak data and a dovish Fed setup is the perfect recipe for a crypto liquidity surge. Bitcoin is likely coiling for a significant move post-FOMC.