The “Binance effect” is in full force once again! The world’s largest crypto exchange has announced its latest Binance listing, adding Lorenzo Protocol (BANK) and Meteora (MET) to its spot trading platform.

Binance Listing Ignites Frenzy: BANK Token Surges 90% in Minutes

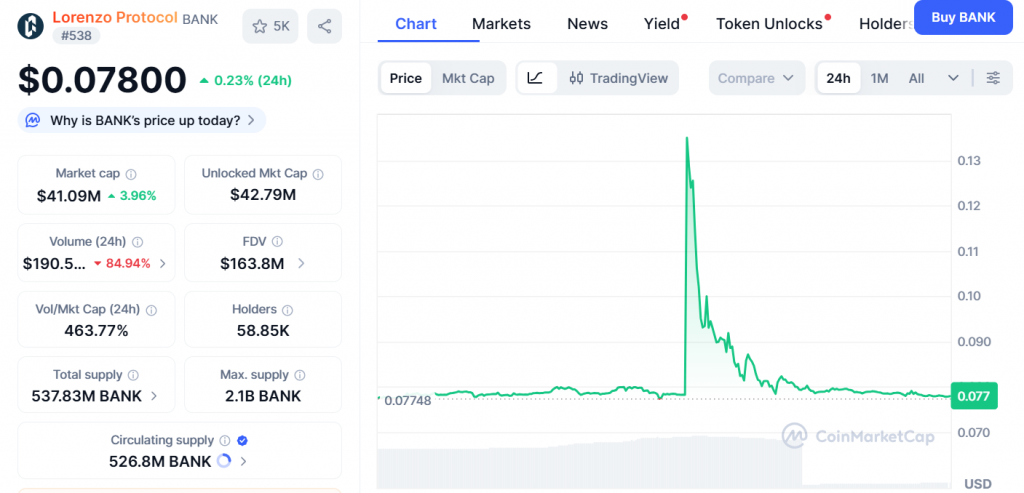

The announcement instantly sent BANK on a parabolic tear, rocketing over 90% from $0.07 to $0.13 before stabilizing around $0.070. This classic pre-listing pump demonstrates the immense power of a Binance endorsement, providing instant visibility and liquidity to emerging projects. Trading for both tokens begins November 13 at 2:00 PM UTC across USDT, USDC, and TRY pairs.

What You Need to Know About the New Binance Listing

This Binance listing follows a specific and strategic rollout. Deposits open an hour before trading begins, while withdrawals are delayed until November 14 to help prevent price manipulation at launch. Both tokens were previously available on Binance’s “Alpha Market,” a pre-listing pool for early access, but will be removed from that platform once spot trading goes live. Critically, both BANK and MET carry Binance’s “Seed Tag,” a warning label for investors. This tag signifies that the projects are innovative but carry higher volatility and risk due to their early-stage nature.

Diving into the Tokens: BANK and MET

So, what are these projects? Lorenzo Protocol (BANK) is an institutional-grade asset management platform built on the BNB Smart Chain. It offers users access to yield-generating strategies, liquid staking, and real-world asset (RWA) integration. Its 90% surge post-announcement has brought its market cap to $45 million.

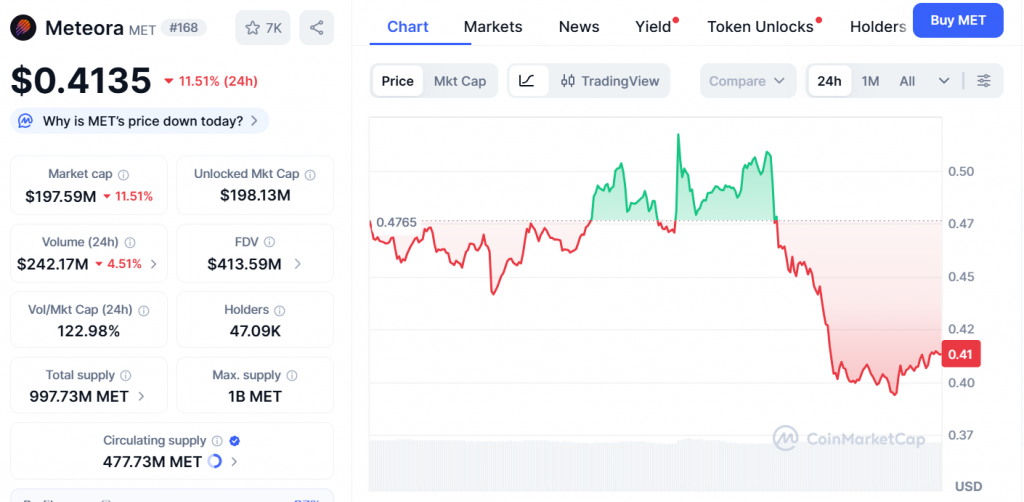

On the other hand, Meteora (MET) is a dynamic liquidity layer for DeFi on the Solana blockchain. Interestingly, it marks Binance’s first Solana-based listing in nearly six months. Despite the bullish news, MET’s price dipped 7%, trading near $0.49, though its 24-hour trading volume spiked 33%, indicating significant trader interest.

Trading Strategy and Market Impact

For traders, a Binance listing is one of the most predictable alpha events in crypto. The typical pattern involves a pre-announcement pump, followed by volatility at the open, and often a “sell the news” dip after trading begins. The “Seed Tag” is a crucial reminder to manage risk and position size appropriately. For the ecosystem, this dual listing reinforces Binance’s role as a kingmaker and highlights its continued focus on both the BNB Chain and Solana ecosystems.

My Thoughts

A Binance listing remains the single most impactful event for a low-cap token. The 90% move in BANK is a textbook example. While I expect volatility at the open, the long-term legitimacy this provides for both projects is invaluable. For MET, the initial dip could be a buying opportunity, especially given its status as Binance’s first SOL-based listing in six months. This is a strong signal that Binance is still actively curating talent from the Solana ecosystem.