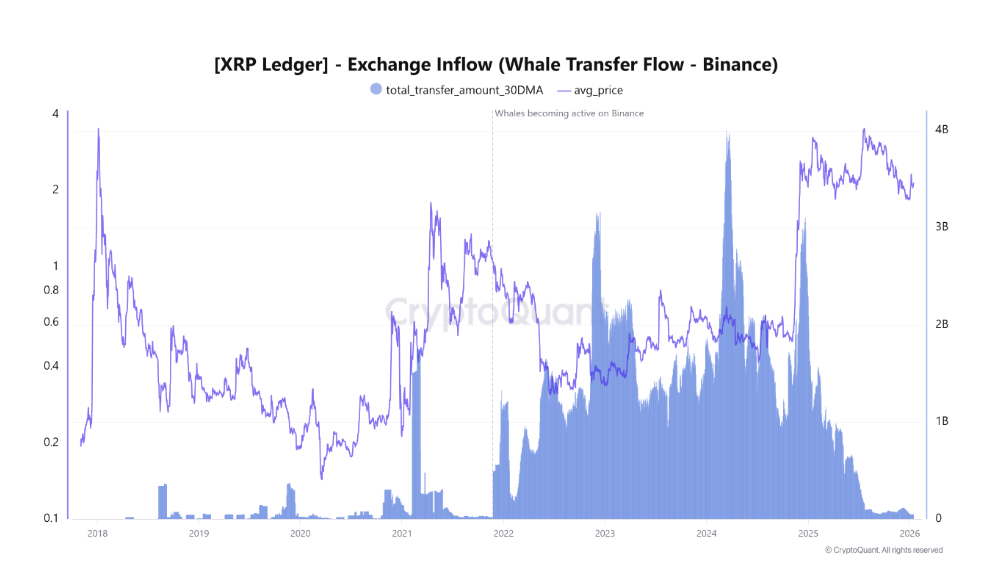

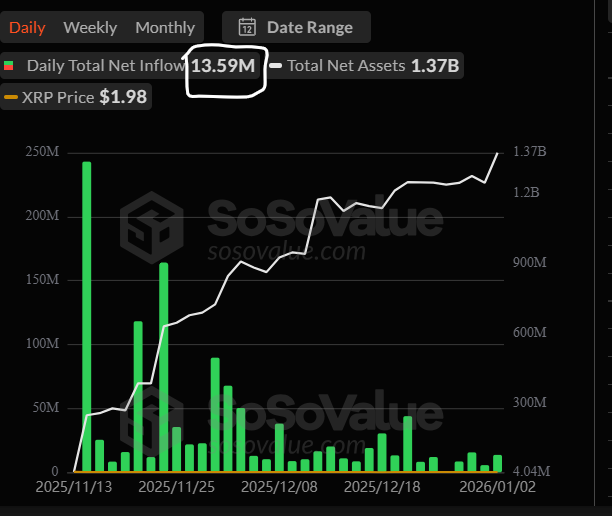

XRP is flashing a signal that seasoned traders love to see. Over the past 10 days, approximately 200 million XRP have exited Binance, one of the world’s largest crypto exchanges. At the same time, the exchange supply ratio has dropped from 0.027 to 0.025. Translation: a smaller percentage of the total XRP supply is now sitting on exchanges, meaning fewer tokens are immediately available to sell. This is textbook accumulation behavior.

The XRP Exchange Outflow Signal Decoded

Let’s break down what the charts show. The exchange supply ratio (the purple line) trends sharply downward in early February. This drop follows XRP’s brutal 40% year-to-date correction. Price (the black line) pulled back from recent highs during the same period.

When coins leave exchanges during a price correction, it typically signals one thing: investors are moving assets into private wallets for long-term holding, not short-term trading. It doesn’t guarantee an immediate rally, but it does suggest that sell-side pressure is diminishing.

Sentiment Divergence: XRP Stands Alone

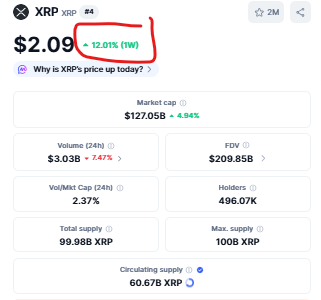

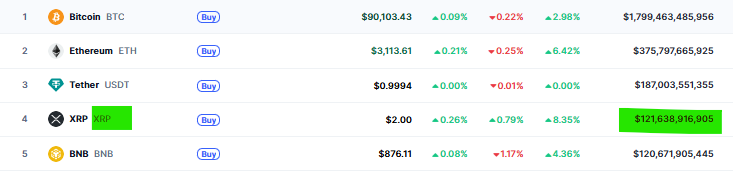

Here’s where it gets interesting. While the broader crypto market struggles for momentum, XRP sentiment has climbed to a five-week high. Social data shows bullish comments around Bitcoin and Ethereum have cooled, but XRP discussions are heating up. The catalyst? Recent partnership expansion announcements and growing community optimism.

Key XRP Price Levels to Watch Now

From a technical perspective, XRP bounced strongly from its February 6 low, rallying 30-35%. However, the move lacked continuation. Price failed to break above the February resistance zone and is now drifting back toward critical support between $1.19 and $1.36.

Here’s what matters now:

- Immediate support: $1.19–$1.36 zone. Holding here keeps the structure intact.

- Breakdown risk: A daily close below $1.19 opens the door to sub-$1 levels.

- Bullish trigger: Reclaiming $1.67 (recent swing high) would signal trend reversal.

Notably, recent rallies have formed three-wave structures—typically corrective. A durable uptrend requires a five-wave breakout with strong volume.

My Thoughts

The XRP exchange outflow data is genuinely bullish—not in a “pump tomorrow” way, but in a structural supply squeeze sense. When 200M coins leave Binance during a correction, it tells me that smart money is positioning, not panicking.

The sentiment divergence is equally notable. While the market obsesses over Bitcoin’s macro drama, XRP is quietly building its own narrative around partnerships and utility. That’s often when the best setups form.

Technically, $1.20 is the line in the sand. Hold it, and this becomes a high-probability accumulation zone. Break it, and we revisit the 2024 lows. My bias? The outflow data suggests the former is more likely.