History has been made in corporate treasury management. Michael Saylor’s Strategy Bitcoin purchase has been completed for the 100th time since adopting the asset as its primary reserve on August 10, 2020. The milestone acquisition adds 592 BTC for $39.8 million at an average price of $67,286 per coin. This marks the company’s ninth consecutive weekly purchase, demonstrating unwavering conviction even as Bitcoin struggles below $67,000.

The Strategy Bitcoin Purchase: 100 and Counting

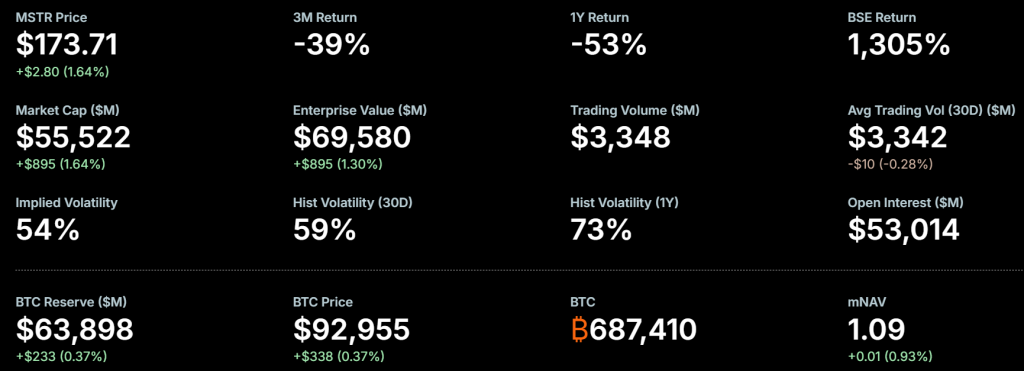

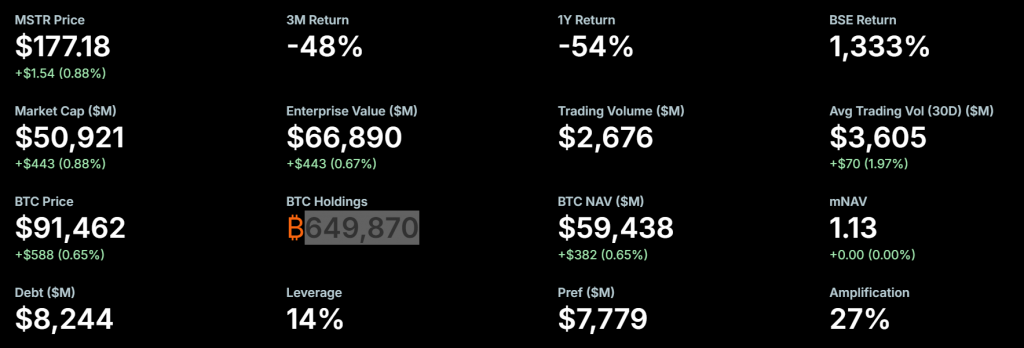

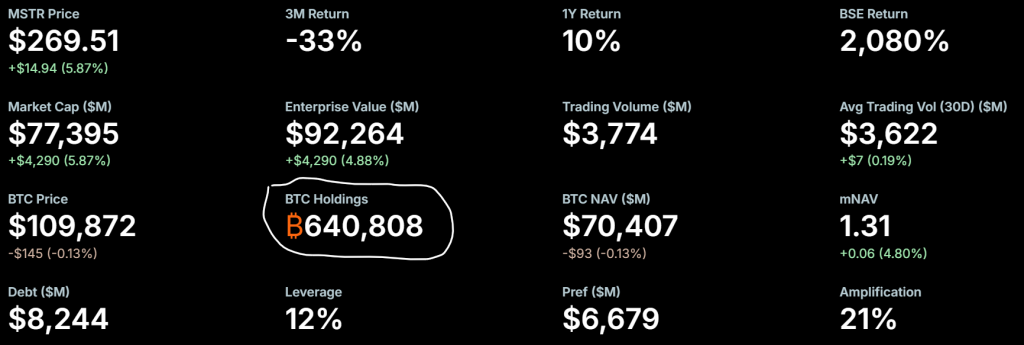

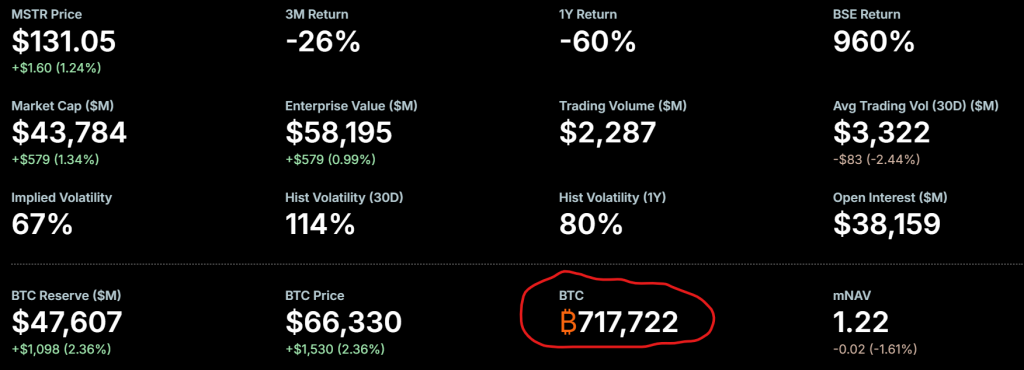

According to the SEC filing, Strategy funded this latest buy through the sale of 297,940 MSTR shares, generating $39.7 million in net proceeds. Total holdings now stand at 717,722 BTC, acquired for approximately $54.56 billion at an average cost basis of $76,020 per Bitcoin.

Saylor teased the historic purchase with his customary Sunday X post, sharing the company’s Bitcoin tracker with the caption: “The Orange Century.” The message was unmistakable—100 purchases and counting.

Market Context: Accumulation Amidst Weakness

The milestone arrives during a difficult period for Bitcoin. The leading crypto fell from $68,000 over the weekend to as low as $65,000 today, reflecting weak momentum and lackluster demand. Strategy’s average cost basis now sits significantly above spot price, placing the entire treasury position underwater on paper.

The stock market has taken notice. MSTR shares trade near $128, down over 2% from last week’s close, demonstrating the tight correlation between Bitcoin’s performance and the company’s equity valuation.

The Strategy Treasury: By the Numbers

- First purchase: August 10, 2020 – 21,454 BTC for $250M

- Latest purchase: February 23, 2026 – 592 BTC for $39.8M

- Total holdings: 717,722 BTC

- Total cost: $54.56 billion

- Average entry: $76,020 per BTC

- Rank: Largest corporate Bitcoin treasury (2nd place Mara Holdings: 53,250 BTC)

My Thoughts

A Strategy Bitcoin purchase on its own is no longer news—it’s a weekly ritual. But the 100th purchase is different. It’s a testament to unwavering discipline through multiple cycles, crashes, and criticisms.

The math is brutal but irrelevant to the thesis. Strategy is underwater by roughly $9,000 per coin at current prices. Yet they keep buying. This isn’t performance-chasing; it’s identity. Strategy has transformed from a software company into a Bitcoin accumulation vehicle.

For the market, this provides a structural bid that compounds over time. Each purchase removes coins from circulation, and the 100th buy is a reminder that this program has no end date. The only question is whether the market eventually validates the thesis or tests it to destruction.

So far, Saylor’s conviction has been rewarded. This cycle will be the ultimate test.