Sei Network Gaming Explodes: 805K Daily Users and Counting

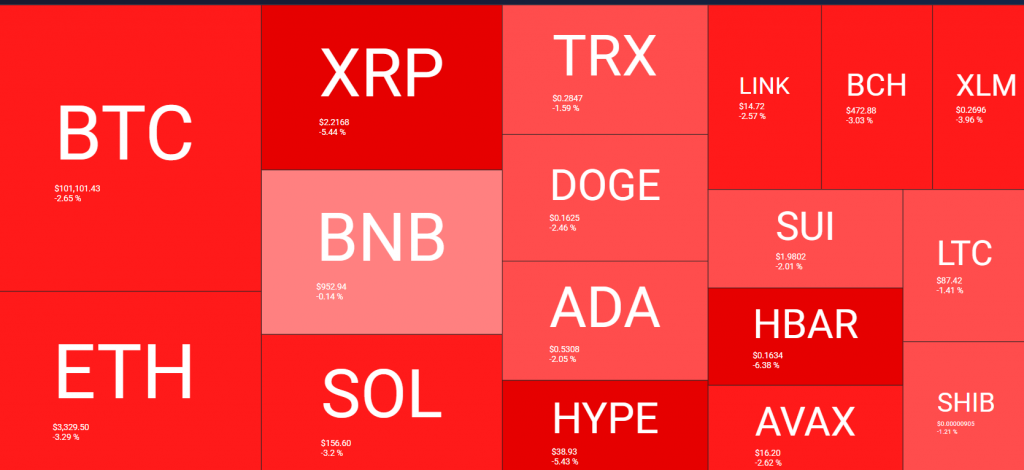

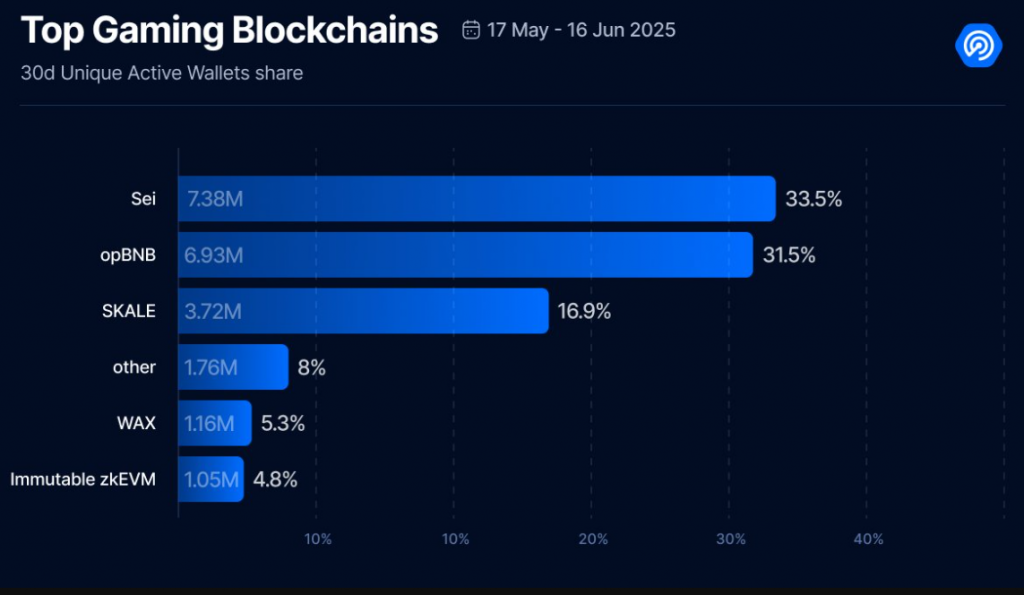

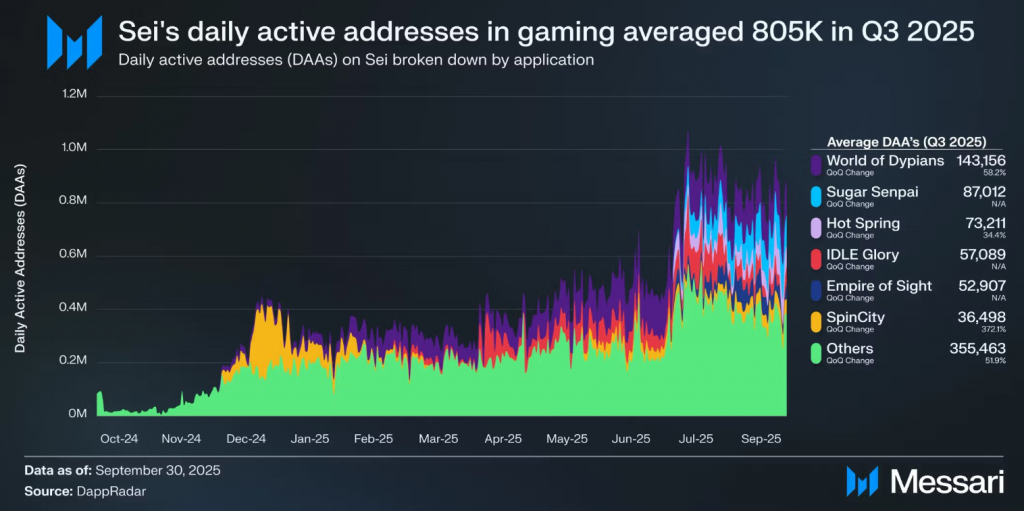

Move over, generalists—a specialized chain is stealing the spotlight. Sei Network gaming activity has exploded, reaching a staggering average of 805,000 daily active addresses (DAAs) in Q3 2025. This isn’t just growth; it’s dominance, positioning Sei as one of the strongest gaming blockchains of the year. According to a new Messari report, this represents a monumental 138% quarter-over-quarter surge, driven by sustained user adoption, not one-off spikes. The era of high-performance, gaming-focused Layer 1s is here, and Sei is leading the charge.

The Data That Validates a Gaming Juggernaut

The numbers speak for themselves. Sei’s 138% growth in gaming DAAs significantly outpaced most Layer 1 and Layer 2 competitors. For context, Solana-based games averaged around 200,000 DAAs in similar periods. This explosive growth is anchored by flagship titles like World of Dypians, which alone averaged 143,000 daily active addresses.

Furthermore, this isn’t a one-hit wonder. A diversified base of gaming applications contributed to steady engagement, showcasing ecosystem resilience. This distribution proves developers and gamers are actively choosing Sei for its tailored infrastructure—low latency and predictable fees that are non-negotiable for a smooth gaming experience.

Market Recognition and the Path Forward

The market reacted instantly to this fundamental proof. The $SEI token price jumped roughly 15% following the report’s release, a clear sign that investors reward tangible usage over empty hype. This performance cements Sei’s identity as a gaming-first blockchain in a landscape cluttered with DeFi-focused chains.

By prioritizing execution speed and user experience, Sei has carved out a defensible niche. If this adoption pace continues, Sei is poised to capture a massive share of the burgeoning on-chain gaming market well into 2026.

My Thoughts

This is a textbook case of a blockchain executing its niche to perfection. While others fight for DeFi TVL, Sei quietly built the best rails for gaming—and the users have arrived. This data is a powerful alpha signal: ecosystems with clear, measurable product-market fit are where the next bull market’s winners will emerge. For investors, Sei Network gaming activity is a key metric to watch. This isn’t just a good quarter; it’s the foundation of a new vertical leader.