Traditional finance isn’t just dipping its toes into Solana—it’s diving headfirst. Morgan Stanley has significantly ramped up its Solana exposure, revealing holdings in both the Bitwise Solana Staking ETF (BSOL) and Solana Co. (HSDT) . This institutional vote of confidence arrives as Solana’s tokenized real-world asset (RWA) value smashes through $1.66 billion—a new all-time high.

Solana Institutional Adoption: Morgan Stanley & Goldman Lead the Charge

The SEC 13F filing tells a compelling story. Morgan Stanley holds 932,922 shares of BSOL, worth approximately $15.30 million. The firm also purchased 86,105 HSDT shares as of December 2025. This follows earlier reports that Morgan Stanley filed for its own Solana ETF and plans to offer SOL trading on its E*Trade platform in 2026.

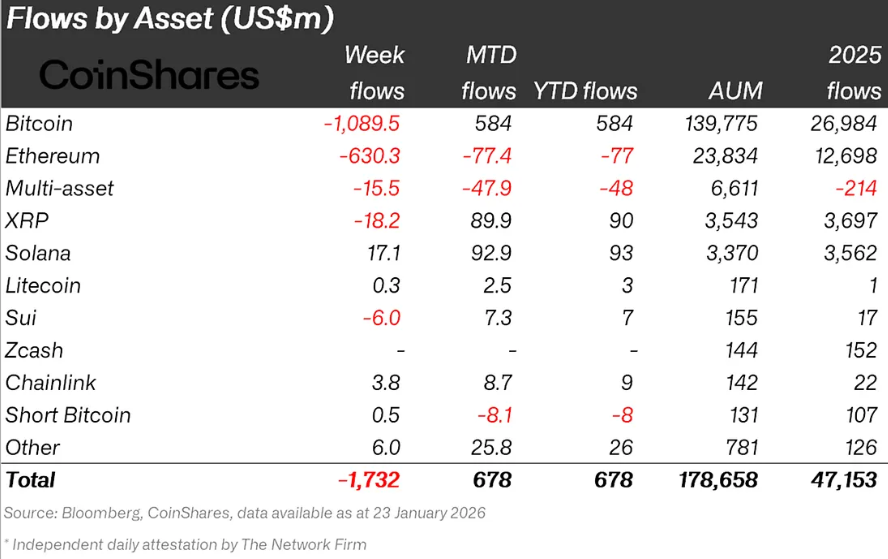

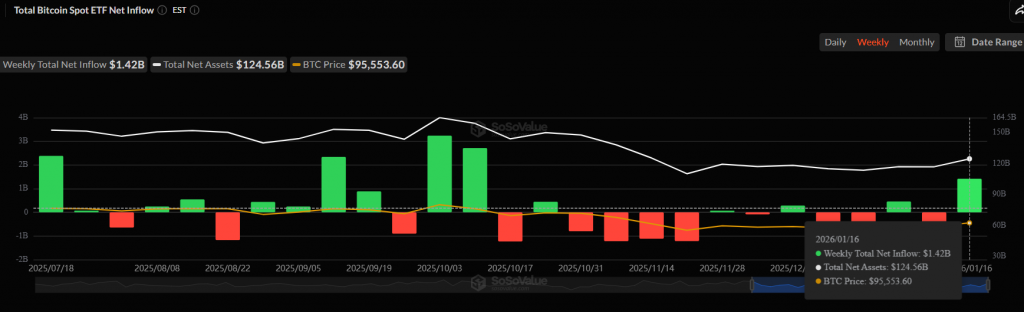

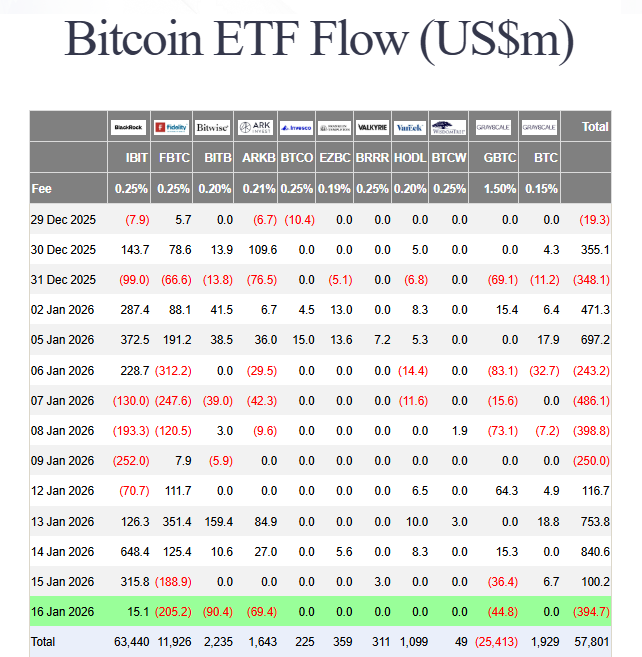

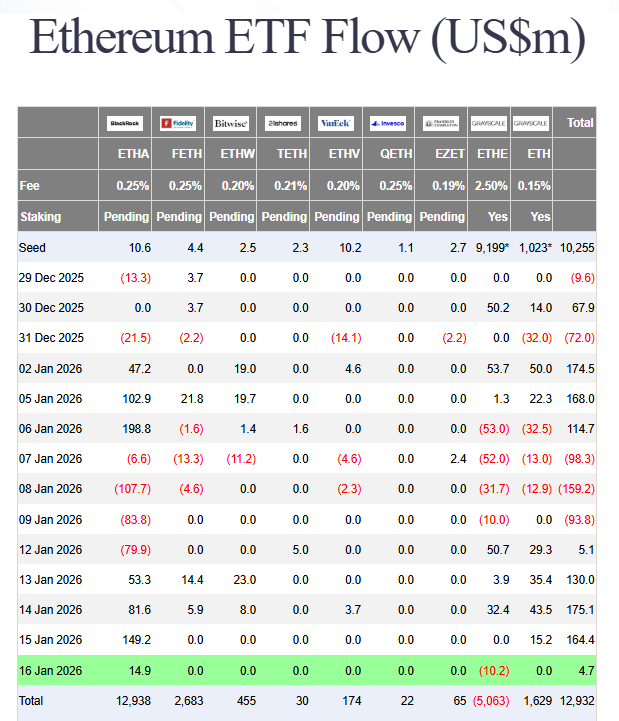

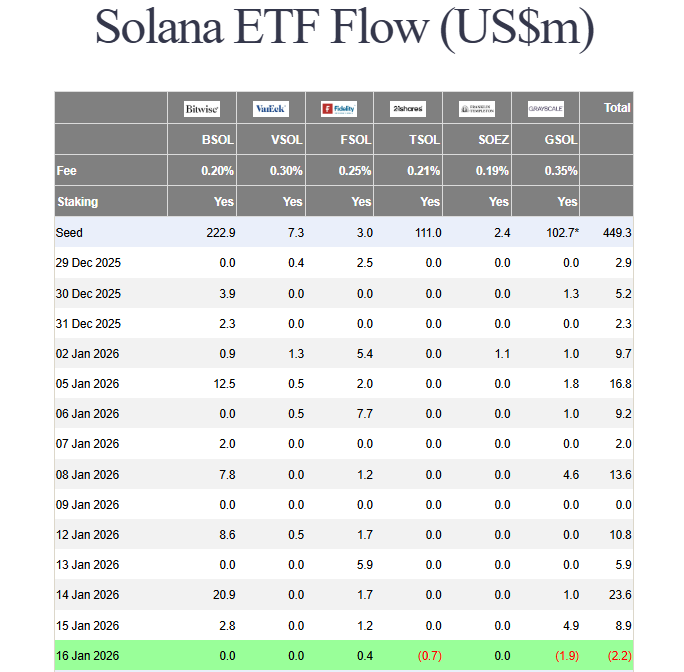

Morgan Stanley isn’t alone. Goldman Sachs recently disclosed nearly $108 million in SOL ETF exposure. This coordinated institutional accumulation signals a paradigm shift: Solana is no longer just a retail phenomenon—it’s a core TradFi portfolio asset.

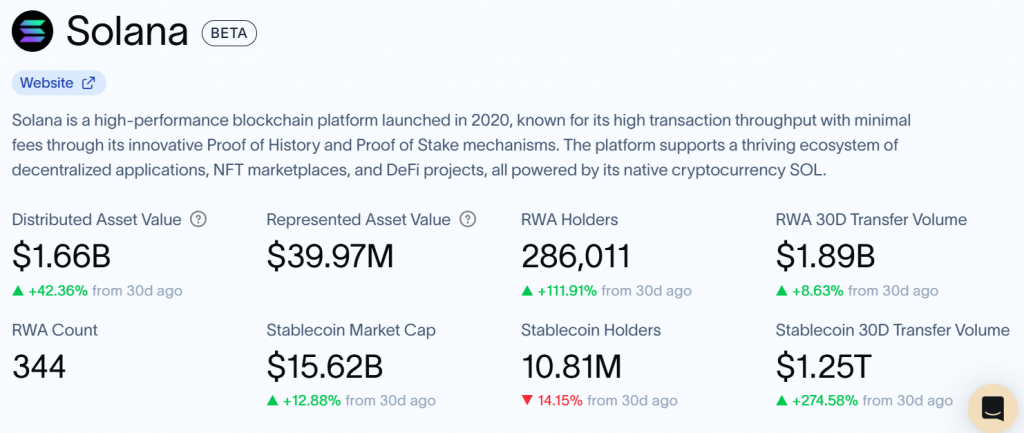

Solana’s RWA Tokenized Value Explodes to $1.66B

The institutional inflows are chasing real utility. Solana’s RWA ecosystem just hit $1.66 billion in tokenized value, driven by its low transaction costs and high scalability. For context, BlackRock’s BUIDL fund alone surged from $175M to over $552M in a week following Uniswap integration.

This isn’t speculative hype. It’s real assets migrating on-chain—treasuries, stocks, and institutional-grade products choosing Solana as their settlement layer. The infrastructure is finally matching the ambition.

SOL Price Action: Volatility Amidst Strength

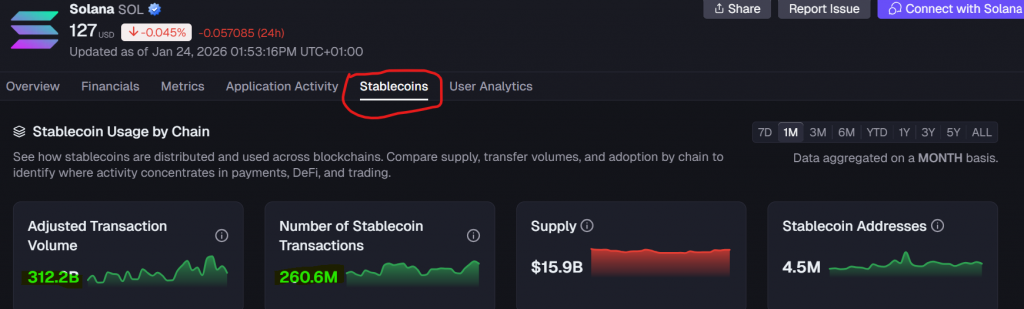

Despite the bullish fundamentals, SOL price remains volatile, dipping over 4% to $85.35 after failing to hold $90 resistance. The 24-hour range of $84.58–$90.36 reflects a market still digesting macro uncertainty. Short-term traders are skittish; long-term institutions are accumulating.

My Thoughts

This is the signal within the noise. While retail panics over sub-$90 SOL, Morgan Stanley and Goldman are building beachheads. Solana institutional adoption isn’t a narrative—it’s a line item in 13F filings.

The RWA milestone is the real story. $1.66 billion in tokenized value means real yield, real assets, real demand. Solana’s tech stack is winning the institutional mandate. Price will eventually follow flows. For patient investors, this pullback is the opportunity to accumulate alongside the world’s largest asset managers.