Wall Street Meets Solana: Ondo to Launch Tokenized US Stocks in 2026

A massive bridge between traditional finance and crypto is being built. Ondo Finance has announced plans to launch tokenized US stocks and exchange-traded funds (ETFs) on the Solana blockchain in early 2026. This strategic move aims to bring seamless, 24/7 trading of traditional equity exposure directly into the crypto wallet experience. By leveraging Solana’s speed and its native “Token Extensions” for compliance, Ondo is engineering a new paradigm where stocks and stablecoins can coexist and move freely on-chain.

How Ondo’s Tokenized US Stocks Will Work

The model is custody-backed and designed for credibility. Real US stocks and ETFs will be held by registered broker-dealers, while their economic value is represented as tokens on Solana. This means you get exposure to price movements and dividends, but the legal ownership (and shareholder rights) remain with the off-chain custodian.

Crucially, Solana’s Token Extensions allow for “transfer hooks,” meaning compliance rules (like jurisdiction checks) are embedded directly into the token itself. This ensures regulatory requirements travel with the asset, no matter where it’s traded or held in the ecosystem.

The User Experience: A Hybrid of TradFi and DeFi

For qualified non-U.S. investors, the process will begin with familiar eligibility and KYC checks. Once onboarded, users can mint tokens using stablecoins 24/5 (aligning with market hours) and then trade or transfer them 24/7 across Solana applications. Settlement is near-instant, a stark contrast to traditional T+1 settlement.

Pricing will be maintained via custom Chainlink oracles that account for both real-time prices and corporate actions like dividends, ensuring the tokens accurately track their real-world counterparts.

Why This Is a Game-Changer

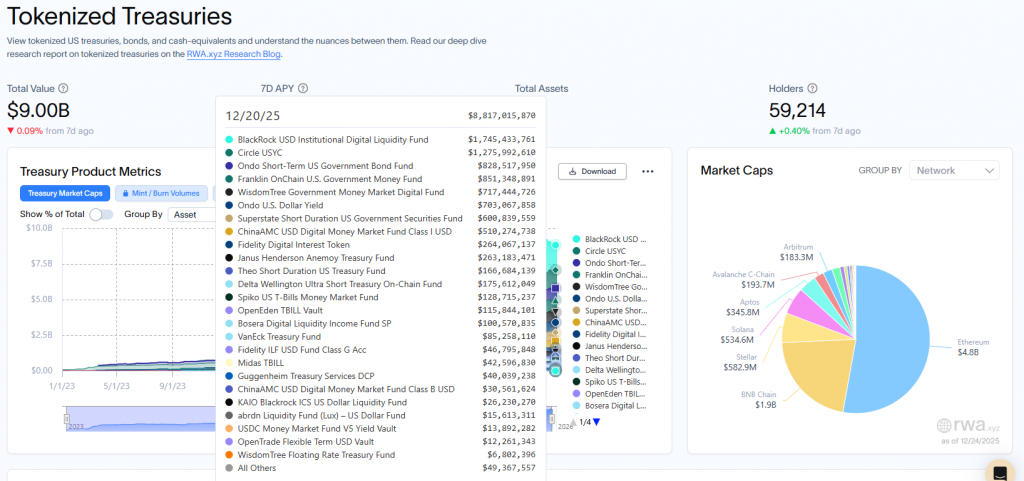

This isn’t just a novelty. It represents a foundational shift in how financial assets can be owned and transferred. Solana’s low fees, high speed, and massive retail user base make it the ideal network to give tokenized US stocks a truly native, fluid on-chain life. For institutions, it opens a new distribution channel. For crypto users, it brings trusted traditional assets into their DeFi workflows without intermediaries.

My Take

This is one of the most consequential real-world asset (RWA) announcements to date. Ondo isn’t just porting a product; it’s architecting the future of hybrid finance on the chain best suited for high-frequency activity. The use of Token Extensions for compliance is genius—it solves the regulator’s biggest headache. If executed well, this could funnel billions in traditional equity liquidity onto Solana, creating massive new use cases for SOL and setting a new standard for all RWA projects. This is alpha in infrastructure building.