The XRP price outlook is painting a concerning picture this week, stubbornly staying in the red despite a massively successful launch for the first-ever U.S. XRP ETF.

XRP Price Outlook Sours as Technicals Overpower ETF Hype

While the fund smashed records, the token itself is trading at $2.26, a far cry from its yearly high above $3.60. So, why is the price struggling when the news seems so bullish? The charts are telling a clear and bearish story.

A Bearish XRP Price Outlook Emerges from the Charts

A close look at the daily chart reveals a troubling technical setup. XRP has been forming a consistent pattern of lower lows and lower highs, a classic sign of a sustained downtrend. Even more alarming, several key bearish indicators have triggered. The dreaded “death cross” has appeared, where the 50-day moving average crosses below the 200-day average. Furthermore, a potential head-and-shoulders pattern is completing, which often signals a reversal. With the price now below both the 38.2% Fibonacci retracement level and the Supertrend indicator, the path of least resistance is clearly down. The next major support level to watch is the October low of $1.77; a break below this could trigger another significant leg down.

Bullish Catalysts Are Being Ignored

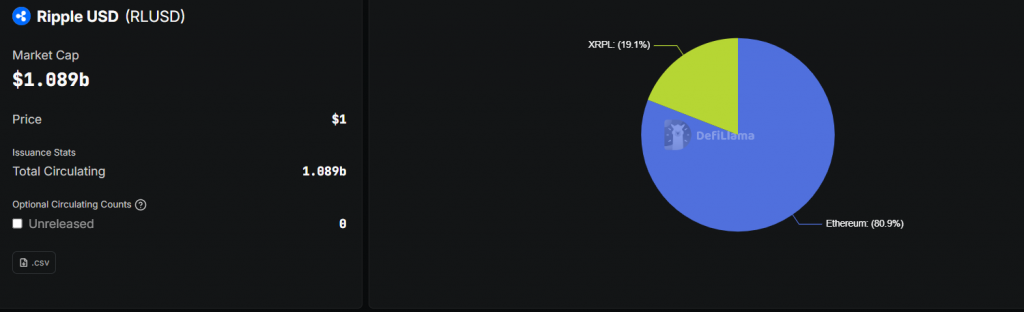

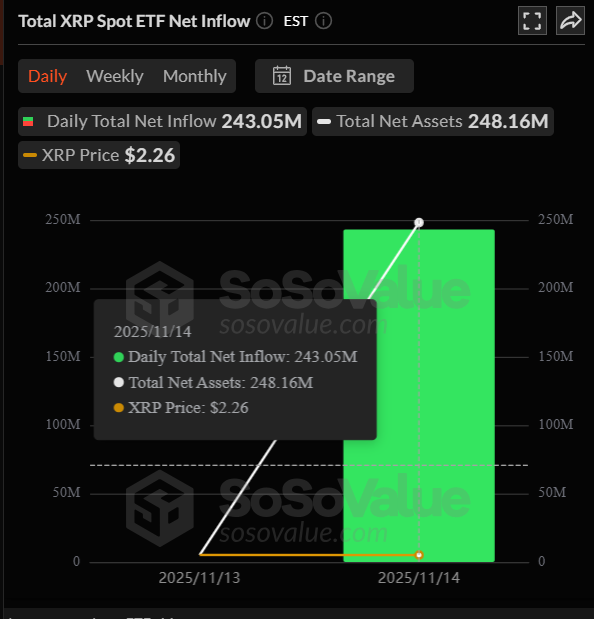

Ironically, this gloomy XRP price outlook exists alongside some incredibly strong fundamental news. The new Canary XRP ETF is a undeniable success, boasting a first-day volume of over $58 million and now holding $248 million in assets. For context, all Solana ETFs combined hold about $541 million, making the XRP fund’s launch exceptionally strong. Additionally, Ripple’s stablecoin, RLUSD, has skyrocketed past a $1 billion market cap. These are typically massive bullish signals, but they are being completely overshadowed by a brutal market-wide crash.

My Thoughts

This is a classic “sell the news” event combined with a macro-driven liquidity crunch. The strong ETF inflows are a silent bull, accumulating in the background while weak hands panic sell. Once the broader market stabilizes, this fundamental strength could fuel a violent rebound. For now, caution is key, but the long-term narrative is far from broken.