Zcash Price Surge Defies Market Downtrend Amid Critical Network Upgrade

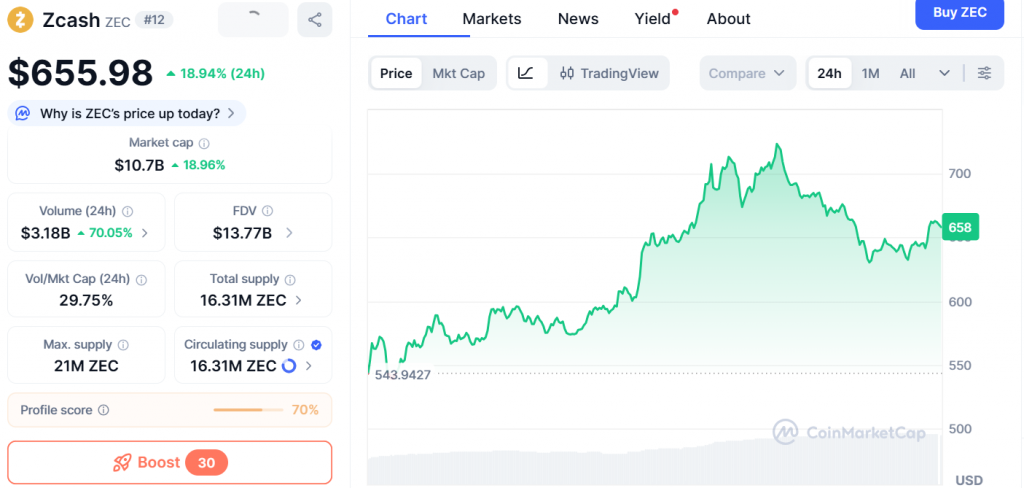

In a stunning show of strength, Zcash (ZEC) is rocketing against the grain with a 14% surge while the broader market retreats. This powerful Zcash price surge is fueled by a pivotal technical proposal to overhaul the network’s fee structure and a wave of massive institutional accumulation that signals deep, long-term conviction in the privacy-focused asset.

Catalyst #1: A Groundbreaking Dynamic Fee Proposal

The primary driver is a major network upgrade proposed by Shielded Labs. The plan would replace Zcash’s outdated static fee model with a dynamic, median-based system. This technical shift is critical: it aims to eliminate network spam, stabilize transaction costs, and improve scalability for shielded transactions—which already comprise 30% of ZEC’s supply. By addressing congestion and high fee edge cases before they become crises, developers are proactively strengthening the network’s foundation for wider adoption, directly boosting investor confidence.

Catalyst #2: Unmistakable Institutional Demand

The fundamentals are being supercharged by clear institutional action. The Winklevoss twins’ entity has acquired 200,000 ZEC (worth over $80M) since November, targeting 5% of the circulating supply. Furthermore, Reliance Global Holdings has liquidated all other crypto positions to go all-in on ZEC. This isn’t speculative trading; it’s strategic treasury allocation. Adding to this, Grayscale has filed to convert its Zcash Trust into a spot ETF, a move that would open the floodgates for regulated capital.

Regulatory and Development Momentum Converge

The momentum extends beyond markets. Zcash founder Zooko Wilcox has been invited to a key SEC roundtable on privacy and financial surveillance this December, indicating growing regulatory engagement. When combined with the aggressive institutional buying and a necessary technical upgrade, the Zcash price surge appears to be the start of a major revaluation.

My Thoughts

This is a classic “smart money” move. Institutions aren’t buying Zcash for a short-term trade; they’re positioning for a future where privacy and regulatory clarity coexist. The dynamic fee upgrade solves a real usability problem, while the ETF filing and SEC dialogue suggest a path to legitimacy. This Zcash price surge may just be the first spark. If the upgrade is implemented smoothly and ETF plans advance, ZEC could be repositioning from a niche privacy coin to a serious institutional asset.