FTX’s native token, FTT, has been on a wild ride, struggling to regain stability even as the exchange begins payouts to creditors. However, the token saw a massive 44% surge, fueled by tweets from FTX founder Sam Bankman-Fried (SBF).

Despite this rally, market indicators suggest the price increase may not be sustainable. Weak investor commitment and low capital inflows raise concerns about whether FTT can hold onto its gains.

SBF’s Tweets Spark Speculative Buying

The sharp rise in FTT’s price was largely driven by speculation. SBF’s recent tweets, where he discussed the challenges of firing employees and the failures of leadership, resonated with his supporters. This led to increased sentiment-driven buying, despite no strong fundamental backing.

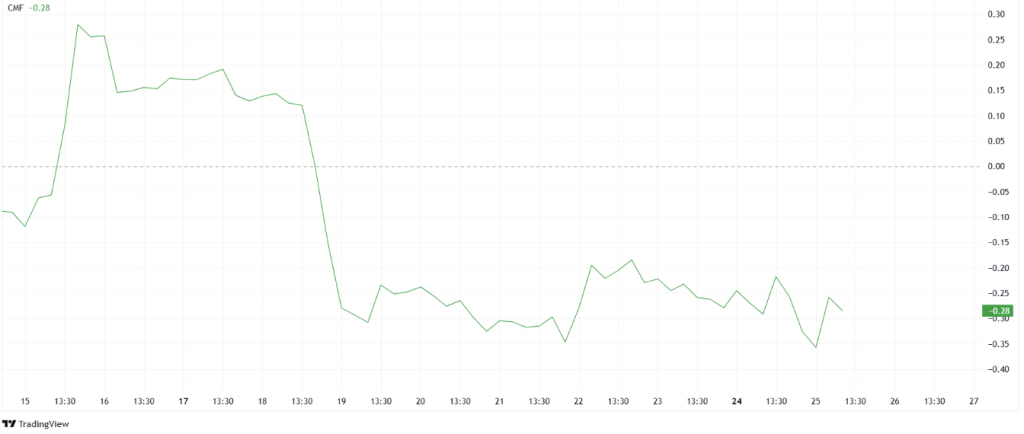

However, the Chaikin Money Flow (CMF) indicator showed that this rally lacked significant capital inflows. The buying volume remained weak, suggesting that the surge was fueled by emotion rather than actual market demand.

Whale Investors Remain Uninterested

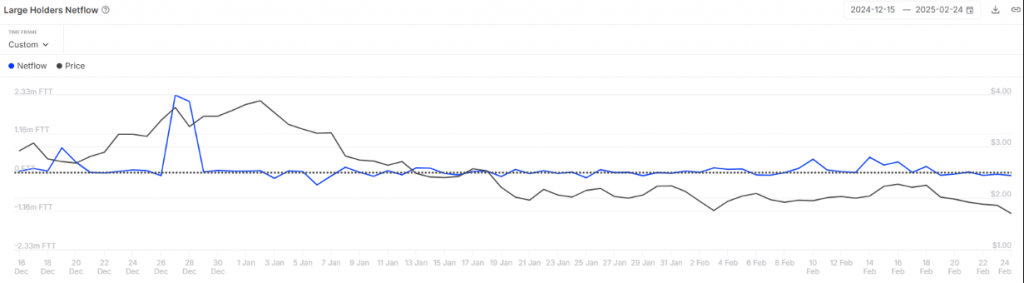

One of the strongest signals of a token’s health is whale activity, but FTT has seen little engagement from major investors. Large wallet holders have remained inactive for months, with neutral net flows indicating a lack of strong institutional interest.

Without major investors backing the rally, FTT’s price may struggle to maintain momentum.

FTT Faces Key Resistance at $1.83

After peaking at $2.31, FTT retraced to $1.75, recovering from an earlier 32% decline. However, the token is struggling to break past the $1.83 resistance.

If FTT fails to gain enough investor support, it could drop to $1.55 before attempting another breakout. For a sustained recovery, the token needs to secure $1.98 as support and push past $2.31. Without this, a continued rally remains uncertain.

Final Thoughts: Can FTT Hold Its Gains?

While FTT’s 44% jump has grabbed attention, lack of strong investor backing and minimal whale activity raise doubts about its sustainability. If the market fails to generate strong buying pressure, the token could face further declines.

Investors should watch key support and resistance levels before expecting any long-term recovery.