Solana accumulation continues to grow, even as the token’s price trades sideways. While May has been relatively quiet for SOL, strong buying activity suggests that investors are preparing for a potential breakout.

Price Remains Flat, But Optimism Builds

Throughout May, Solana (SOL) has shown minimal price movement. This calm is largely attributed to the token’s prior rally, which may have overheated the market. Despite the current consolidation, investor sentiment remains bullish.

Investors Are Stacking SOL

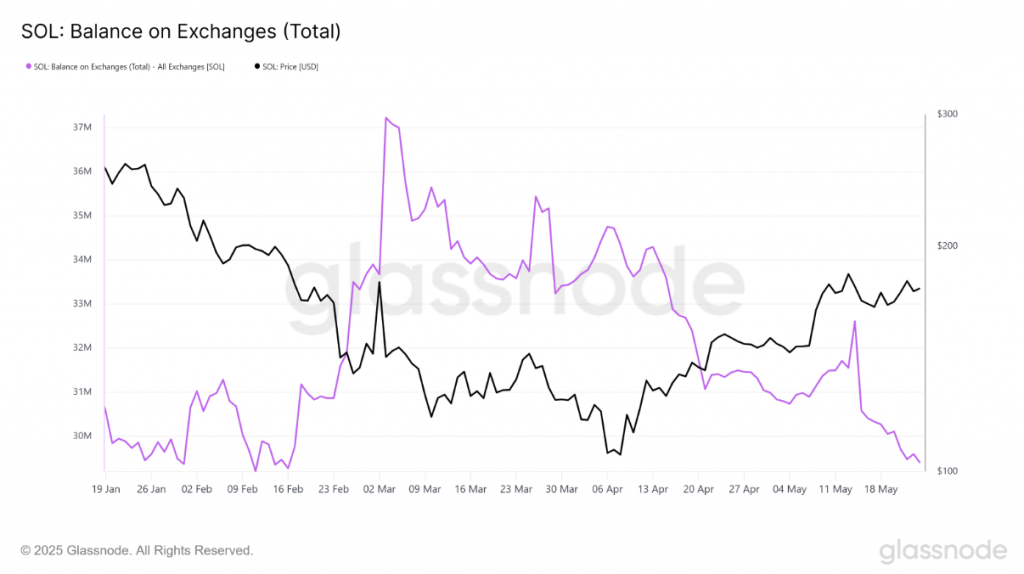

In the past 10 days, 2.2 million SOL—worth around $381 million—has been withdrawn from exchanges. This steady decline in exchange balances typically indicates accumulation.

Such moves are often driven by market optimism, fear of missing out (FOMO), and the belief that the token will appreciate in value. As fewer tokens remain on exchanges, supply tightens, setting the stage for a possible price increase.

Technical Indicators Suggest a Move

Solana’s price chart shows tightening Bollinger Bands, a classic indicator of an upcoming volatility surge. When the bands contract like this, it usually means a breakout is coming.

If momentum continues to build, a bullish breakout could follow. But it’s also possible the price will consolidate further before making a move. Either way, volatility appears to be on the horizon.

Key Levels to Watch for SOL

Currently trading at $173, Solana is testing a key support zone. For bulls to take control, SOL must:

- Hold above $178

- Break through resistance at $180

- Push past the next hurdle at $188

Successfully clearing these levels could trigger an uptrend and drive prices higher. On the flip side, failing to maintain $178 could send SOL down to $168 or even $161, negating the bullish outlook.