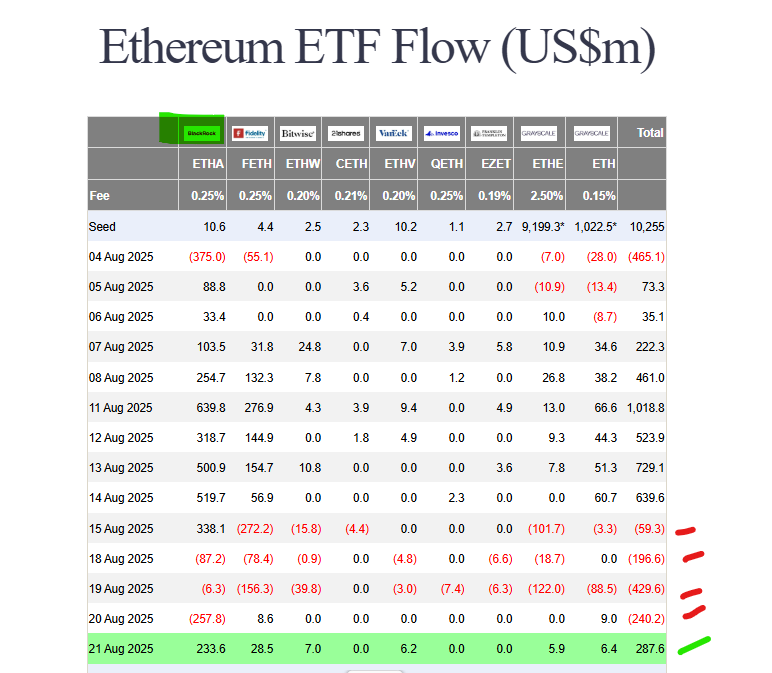

After a tough week, U.S.-listed Ethereum ETFs have finally broken their negative streak. On August 21st, the funds recorded a substantial $288 million in net inflows, putting an end to four consecutive days of outflows. This surge suggests that institutional interest may be returning, even as ETH’s price continues to struggle.

BlackRock’s iShares Ethereum Trust Leads the Charge

The inflows weren’t distributed evenly. BlackRock’s iShares Ethereum Trust (ETHA) absolutely dominated, pulling in a massive $233 million—the vast majority of the day’s total.

Other issuers saw much more modest numbers:

- Fidelity’s FETH: $29 million

- Other Issuers: Between $6-7 million each

This shows that while interest is returning, it’s heavily concentrated in the largest, most established funds.

Inflows Defy Ongoing Price Decline

What makes this inflow particularly interesting is the context: ETH’s price is still falling. At the time of writing, Ethereum trades around $4,238, down roughly 0.72% in 24 hours and about 8% for the week.

This divergence is a key signal. It suggests that institutional investors are using the price dip as a buying opportunity, potentially believing in ETH’s long-term value despite short-term weakness.

Ethereum ETFs Outperform Bitcoin ETFs

The story for Bitcoin ETFs is completely different. While Ethereum funds enjoyed inflows, Bitcoin ETFs suffered another day of outflows.

- Bitcoin ETFs: $194 million in outflows (5th consecutive day of losses)

- Total BTC ETF outflows for the streak: Nearly $1.2 billion

This highlights a notable shift in institutional preference, at least for this brief period, with capital moving toward Ethereum products despite its weaker price action.

The Bottom Line

The massive inflow into Ethereum ETFs, led by BlackRock, is a strong bullish signal. It shows that major institutions are willing to accumulate ETH even during a downturn. For investors, this could indicate that the current price weakness is a potential consolidation phase before the next leg up, rather than the start of a major bear trend.