The crypto market has cooled into neutral territory, with the Fear and Greed Index dipping to 48. But don’t let the calm fool you. While retail sentiment hesitates, a massive institutional wave is building behind Ethereum, with Wall Street giants placing historic bets on ETH’s future.

Goldman Sachs Leads a Wall Street Charge

The data reveals an unmistakable trend: smart money is flooding into Ethereum ETFs.

- Goldman Sachs: The top holder, with $721.8 million in exposure (288,294 ETH).

- Jane Street: Follows with $190.4 million.

- Millennium Management: Holds $186.9 million.

In total, institutional Ethereum ETF exposure has climbed to a massive $2.44 billion, representing 975,650 ETH. Investment advisors lead this charge with $1.35 billion, showing this is a strategic allocation, not speculative trading.

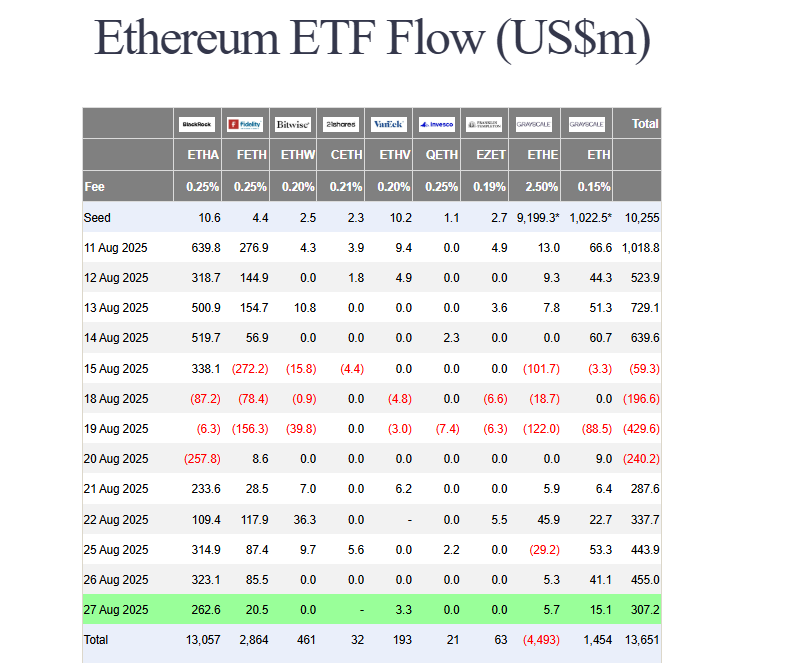

ETF Inflows Are Shattering Records

The demand is reflected in the explosive growth of ETF inflows. According to data from Bloomberg’s James Seyffart, Ethereum ETF assets have skyrocketed.

- Late June: $4.2 billion in total inflows.

- Late August: $13.3 billion in total inflows.

- August Alone: $3.7 billion in new capital.

This isn’t just a trend; it’s a tidal wave of institutional capital recognizing Ethereum’s value.

Ethereum: The “Wall Street Token”

The narrative is shifting. VanEck CEO Jan van Eck has famously called Ethereum the “Wall Street token,” arguing it will become the backbone for stablecoins and traditional finance (TradFi).

His reasoning is powerful: with the stablecoin supply surpassing $280 billion, banks will have no choice but to adopt Ethereum-based infrastructure to process transactions or risk becoming obsolete.

ARK Invest Doubles Down on Its ETH Bet

Cathie Wood’s ARK Invest is also making a huge indirect bet on Ethereum. The firm recently bought another $15.6 million of BitMine Immersion Technologies shares, lifting its total stake above $300 million.

Why does this matter? Because BitMine itself holds a colossal $7.9 billion in ETH. This investment makes BitMine ARK’s second-largest crypto-equity holding after Coinbase, signaling a profound belief in Ethereum’s long-term infrastructure role.

The Bottom Line

The message is clear: a major divergence is happening. While retail traders pause, institutions are locking in their positions through ETFs and corporate treasuries. With this level of Wall Street conviction, fueled by real-world utility in finance, Ethereum’s path to $5,000 and beyond appears stronger than ever.